Latest in Crypto Hiring: Morgan Stanley Exec Jumps Ship to Crypto

Blockchain-based solutions provider for commercial banks adds former leaders from Bank of America Merrill Lynch, London Stock Exchange

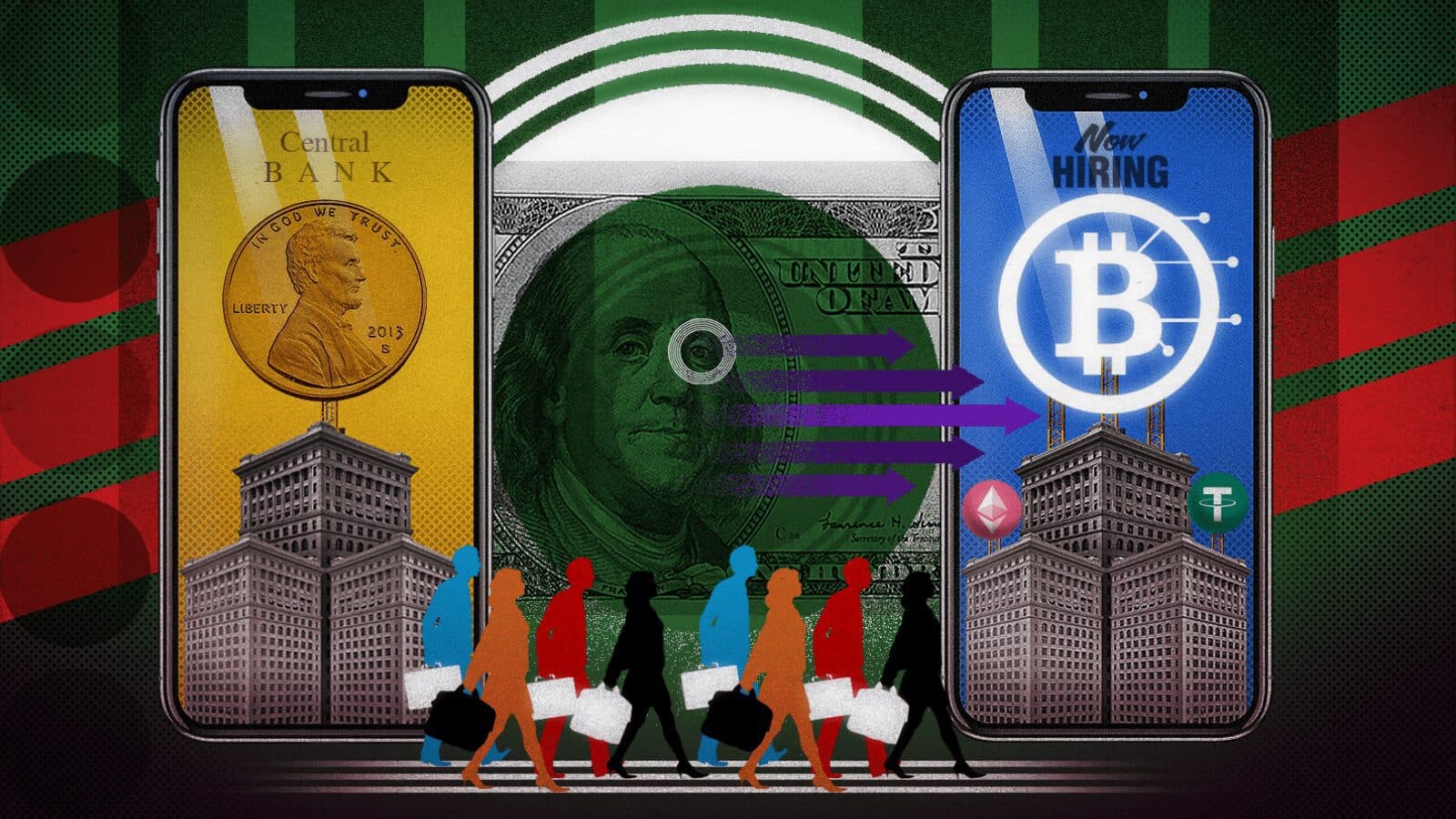

blockworks exclusive art by axel rangel

- Ex-global head of macro electronic trading at Morgan Stanley joins crypto liquidity provider B2C2

- Former Revolut and Coinbase pro jumps to Algorand Foundation

Blockchain-based payments solutions provider Tassat hired a handful of executives, some of which join from large traditional financial firms.

Andre Frank, who was appointed as managing director of the New York-based firm’s Digital Interbank Network, recently worked at the London Stock Exchange as an executive management consultant. He also previously worked as chief operating officer of Thesys Technologies, the big data and market structure technology subsidiary of Tradeworx.

Formerly Tassat’s director of product development, Glendy Kam is now its chief product officer. Prior to Tassat, which is focused on b2b payments, she launched the API pilot program that supported JPMorgan’s blockchain initiative, Onyx.

Dan Wolff, Tassat’s new managing director for customer success, spent 20 years at fintech broker-dealer Liquidnet. Carol Hartman, previously the CEO of Hartman Group Consulting, was hired as a managing director of business development.

Jack Rash and Ned Thompson are now also managing directors of business development at Tassat. Rash formerly was a national sales manager at Fiserv. Thompson, an ex-vice president of global treasury solutions at Bank of America Merrill Lynch, also previously worked at Fidelity Investments and Santander Bank.

Tim Neill is now crypto infrastructure provider Copper’s new chief risk officer, a role he previously held at Mastercard.

The executive said in a statement that he seeks to help Copper “ensure institutional investors and asset managers can continue to transact and store cryptocurrencies transparently and securely.”

Neill joined Mastercard in 2018, according to his LinkedIn profile, working as chief risk officer for real-time payments and applications and head of risk for product management. He also previously held roles at London Stock Exchange Group, Standard Chartered Bank and Deutsche Bank.

Crypto trading platform Amber Group has cut as much as 10% of its workers so far this year as the bear market persists, Bloomberg reported Friday.

Another Morgan Stanley exec defects to crypto

The Algorand Foundation appointed Deirdre Halligan as its chief operating officer to help the Algorand blockchain pursue entry into new markets and work with regulators to spur its mass adoption.

Halligan joins the organization from financial app Revolut, where she led global affairs, as well as wealth and trading. Prior to that, she was a COO for Coinbase Ireland and worked in the same role at e-commerce technology company eDesk.

“I’ve always sought work with bleeding-edge technologists [and] disruptors, and Algorand is the blockchain with the requisite speed, security, and low carbon footprint to deliver financial innovation at a global scale,” Halligan said in a statement.

Liquidity provider B2C2 hired Thomas Restout as its CEO of Europe, the Middle East and Africa as the company reports more traditional finance firms committing resources to understanding and building products around digital assets.

Restout joins B2C2 from Morgan Stanley, where he was most recently global head of macro electronic trading and led crypto trading for the Wall Street giant’s fixed income division.

Crypto exchange Binance reportedly hired Henrique Meirelles, a former president of the Central Bank of Brazil and Minister of the Economy, as an advisory board member.

The hire was reported by Brazilian newspaper O Globo. Meirelles was president of Brazil’s central bank from 2003 to 2011.

Hive Blockchain Technologies hired Gabriel Ibghy as its general counsel after joining the company last year via acquisition as director of legal affairs.

A practicing attorney and a member of the Quebec Bar, Ibghy has legal experience in corporate and commercial litigation before all levels of various Canadian courts.

He was more recently the CEO of GPU.ONE, a data center owner and operator that Hive bought last year.

The announcement came the same day Hive revealed it has started analyzing mining other coins with its feet of graphics processing units (GPUs) ahead of Ethereum’s transition from proof-of-work to proof-of-stake, and is implementing beta testing this week.

Rockstar co-founder goes Web3

Laura Mercurio is set to become the CEO of Blockchain Australia on Sept. 12. She seeks to help the organization grow its membership base and work with government and regulatory agencies to shape the future of blockchain technology.

Mercurio previously spent six years at BlackRock, the world’s largest asset manager, from 2006 to 2012, and has also worked at Citigroup, Merrill Lynch and Deutsche Bank.

Meanwhile, Australia-based cryptocurrency brokerage Caleb & Brown has hired three executives to help it expand its services to include fund management.

Tommy Rogulj will lead the design, implementation and management of a crypto asset portfolio for sophisticated investors, the firm said Wednesday. Daniel Caruso and Gary Head will help strengthen the company’s industry footprint and manage risk while working with the team to develop an institutional-grade model for investment in crypto assets.

Rogulj was most recently a portfolio manager and senior investment analyst for investment firm Spaceship, and also formerly worked at State Street, Russell Investments and AtlasTrend.

Caruso, who steps into the role of director of financial risk, previously led equity and securities finance solutions at Société Générale, Deutsche Bank and Morgan Stanley. Head, Caleb & Brown’s strategic committee chair, is a partner at MST Financial and was formerly a senior adviser at Gresham Partners.

Dan Houser, the co-founder of Rockstar Games and the creative director behind the Grand Theft Auto series, joined the advisory board of blockchain game company Revolving Games.

The Web3 startup raised $25 million in a funding round led by Houser, along with Pantera Capital, Animoca Brands, Polygon, Dapper Labs, Permanens Capital Partners, Kenetic Capital, Sarmayacar and DWeb3 Capital.

Founded in 2020, Revolving Games is developing a Battlestar Galactica game and has a cooperative adventure game — called Skyborne Legacy — set to be released in October.

Back in the finance world: digital asset management consultant Sabre56 added Antoine Farris as its new head of corporate development and ventures.

Farris joins Sabre56 from family office Golden Vision Capital, where he worked as a managing director focused on venture stage and growth equity investments in the healthcare, consumer and technology segments.

He began his career in the technology, media and telecom group at Bear Stearns & Co. and later held senior investment banking roles at Lazard and Rothschild.

In case you missed it

Digital bank ING’s former head of digital assets Hervé François joined Investcorp to lead the alternative investment giant’s first blockchain-focused fund, Blockworks reported Tuesday.

Based in Abu Dhabi, François is set to work with early-stage startups involved in segments such as decentralized finance (DeFi), non-fungible tokens (NFTs) and blockchain infrastructure.

Mysten Labs raised $300 million as part of a Series B funding round that will help power more Web3 applications and speed up the adoption of its new blockchain.

The Web3 infrastructure company intends to hire dozens of professionals across engineering, marketing, partnerships, developer relations and product roles over the coming months, a spokesperson told Blockworks.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.