Ex-Symbolic principal joins Pantera to help with crypto-AI investing

Lehman becomes Pantera’s fourth junior partner

VAlex/Shutterstock and Adobe modified by Blockworks

Former Symbolic Capital principal Sam Lehman is taking on a new role as a junior partner at Pantera Capital, Blockworks has learned exclusively.

Pantera brought Lehman in for his expertise on investments at the intersection of crypto and AI, Lehman said. The crypto VC is stocking the cupboard shortly after its first closing for Pantera Fund V, which is targeting a $1 billion raise. Pantera general partner and portfolio manager Cosmo Jiang has implied a significant amount of the new fund will be earmarked for crypto-AI bets.

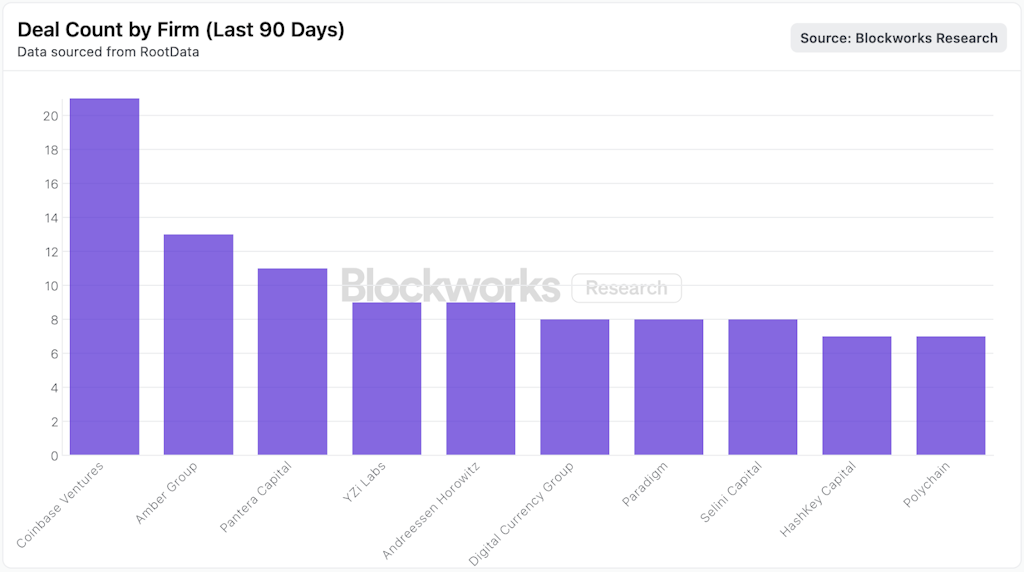

Pantera is one of the largest and oldest crypto venture firms, having grown to $4.8 billion in assets under management since its 2013 founding. It has cut the third-most deals among crypto VCs over the past 90 days, per Blockworks Research.

Pantera previously showed support for Bittensor, and Jiang told Blockworks that he’s watching other projects, such as Grass, in March. It also led a $43 million round for the blockchain-AI startup Sahara AI in 2024.

Lehman will become Pantera’s fourth junior partner. The firm also employs two managing partners, two general partners, and two partners.

While at Symbolic, Lehman made multiple investments at the intersection of crypto and AI, he said. He has also written about the sector, particularly in regards to reinforcement learning and pre-training, two processes through which AI models are developed.

Crypto and AI became popular speculative retail bets in late 2024, with several new projects tying tokens to AI agents — which, in many cases, were just chatbots. Many of these projects’ tokens have since cratered. Lehman’s interests lie outside of curiosities like the GOAT memecoin.

“If we’re using [projects] like goat, zerebro, etc, to define [the intersection of] crypto [and] AI, then, yeah, I’d definitely say there is nothing exciting to invest in there,” Lehman said in a text. “For me, however, I’m focused on more distributed, open-source AI companies where the focus is on using blockchains very intentionally / sparingly to facilitate coordination of people all over the world to collaborate on building SOTA AI.”

Lehman said he was drawn to Pantera partly due to the opportunity to work with companies “throughout their full journey, not only at the earliest stages.” He also said the move was due to the team he will be working with.

“I got to know the Pantera team during my time at Symbolic, having co-invested in several deals together. The team has a really unique mix of analytical rigor, warmth with founders, and extremely high integrity,” Lehman said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.