Mailchimp Is Banning Crypto Companies Again

The email marketing service is banning crypto creators beyond what is outlined in the company’s terms of service

Source: DALL·E

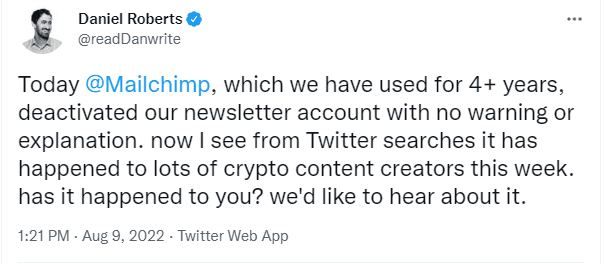

- Decrypt’s newsletter was banned by Mailchimp Tuesday after using the newsletter service for four years

- Mailchimp is owned by Intuit, the company behind TurboTax, QuickBooks and Mint

Mailchimp is once again clamping down, without warning, on cryptocurrency companies.

The email marketing company and service provider has since 2018 banned digital asset firms from using its platform for marketing, citing “higher-than-average abuse complaints.” Recently, the service seems to be applying the bans more liberally, and to creators who appear compliant with Mailchimp’s terms of service.

Crypto media publication Decrypt is the latest to be suddenly removed from the platform. The email marketing platform on Tuesday deactivated Decrypt’s newsletter, which primarily covers crypto-focused news, and would seem to meet Mailchimp’s criteria. Blockworks has previously likewise been removed from the service.

Mailchimp’s terms of service prohibit “Businesses that offer…Cryptocurrencies, virtual currencies, and any digital assets related to an Initial Coin Offering.” It’s not clear whether offending customers would receive a refund.

In cases where companies’ crypto involvement is not the focus of their branding, Mailchimp has taken a stringent stance. Last week, Jesse Friedland’s lifestyle apparel brand was booted from Mailchimp, presumably for the company’s involvement with non-fungible tokens (NFTs).

Mailchimp is owned by Intuit, the financial software company behind TurboTax and Mint. The company has stayed quiet on the thinking behind its crypto ban outside of a 2018 tweet, where Mailchimp seemed to say cryptocurrency information would be allowed within the company’s terms of service.

Mailchimp did not immediately return a request for comment.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.