North America Bitcoin Trading Week Opens to Tumbling Price on China News

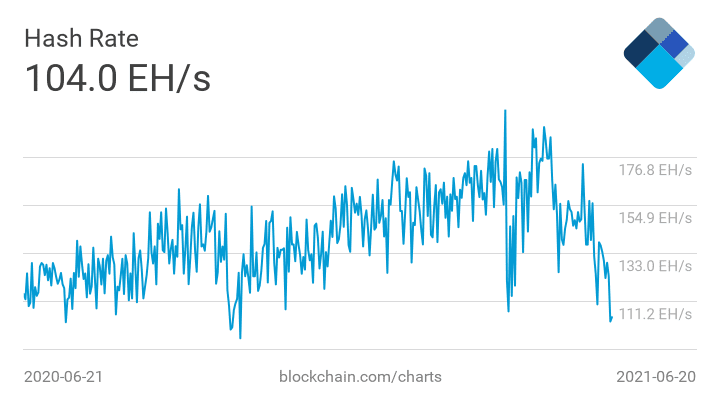

Hashrate plummeting as miners flee hostile regulatory environment, banking crackdown. But open interest on strike prices shows price recovery inbound.

Blockworks exclusive art by Axel Rangel

- Bitcoin’s global hashrate drops to year-low of 104 million Th/s as China-based miners pack up and head abroad as banks cut off service, Alipay blocks P2P trading

- While bitcoin’s price is tumbling, strike prices for bitcoin options points to possible recovery by the fall

The price of bitcoin dropped nearly 7% as the week opened in first Asia then North America, coming in to rest at just over $32,000, as authorities in China made it more difficult for the mining industry to do business.

On Monday, the People’s Bank of China issued a statement that it had banned the country’s banks from offering services such as trading, clearing and settlement for digital asset transactions This comes as the crackdown on mining intensifies in China. The provincial government of Sichuan, home to the abundant hydroelectric supply that has powered the majority of China’s mining ambitions, put the industry on notice that it was ordered to close shop.

Effectively the mining industry is about to be cut-off permanently in China: with the closure of P2P markets in the country, miners would have no way to liquidate their proceeds. Centralized exchanges are long-closed in the country, but P2P exchanges that run via WeChat groups and use Alipay as a payment rail have been an effective replacement in the time since.

As a result, the hashrate — the measure of the collective power of bitcoin’s mining capacity — dropped to a yearly low with machines being turned off and shipped abroad to destinations around the world, from the United States, to Canada and Kazakhstan.

Sources that spoke to Blockworks say there’s an active cottage industry providing bridge financing to miners making the move.

The total hash rate available at the moment is just over 104 terahashes per second, down from nearly 200 mid-April, at the height of the bull market.

Well known Chinese pools like Poolin or Huobi Pool have reported declines in hashing power of between 13-18% over the past 24 hours.

While some miners may be liquidating their equipment and getting out of the industry, most of the equipment that’s making the move to the US will be owned by the same people albeit with a different corporate shell.

Most publicly listed bitcoin and blockchain companies were down Monday, as the market treated them more as a macro bitcoin proxy tied to the currency’s price rather than on fundamentals.

Riot Blockchain, which has large US-based mining facilities, finished the trading day down 2%. Silvergate Bank, however, which offers banking and treasury services to many US-based exchanges and large traders is up 3%.

Traders seem to be optimistic about an eventual price recovery, which could be fueling Silvergate’s stock. According to ByBt, support in the form of open interest is growing on strike prices between $45,000 and $55,000 on bitcoin options that expire at the end of August.