Stocks Rally After Tumultuous Week While Cryptos Extend Drop Amid Intensifying China Crackdown: Markets Wrap

Stocks rebound after a disordered week where looming interest rate hikes curbed investors’ appetite for inflation-sensitive assets.

Blockworks exclusive art by Axel Rangel

key takeaways

- 90% of China’s bitcoin mining is estimated to be shut down, according to a report on Sunday from the Global Times.

- PCE price index will be released on Friday

China’s crackdown on crypto continues… and intensifies. Kicking off the week with a note from the central bank, The People’s Bank of China (PBOC) told the country’s key financial institutions to block all cryptocurrency transactions, one of several anti-crypto efforts the country’s governing body has taken to curb trading of the digital currency.

The central bank said that crypto “spawns the risks of criminal activities such as illegal asset transfers and money laundering, and endangers people’s wealth.”

Following the news, bitcoin dropped again, benchmarking a new two-week low of $31,714 for the largest digital currency.

Insight

Executive Director of ARK36, a crypto hedge fund, Ulrik K. Lykke remains optimistic about the cryptocurrency despite the regulatory crackdowns. “What we think is noteworthy is that worldwide, miners continue to generate on average 30M USD daily, which shows the industry is still highly profitable,” he wrote in an email to Blockworks. “In the short-term, these conditions are naturally causing a negative market reaction, but in the long-term, they can be net-positive. As miners spread to other locations, they will likely choose places with secure access to cheap energy sources.”

Crypto

90% of China’s bitcoin mining is estimated to be shut down, according to a report on Sunday from the Global Times. Bitcoin fell -8.06% after the slew of news.

- Bitcoin extended its losses to $32,638.53 as of 4:00 pm ET.

- Ether is trading at around $1,944.58 falling -13.64% over the past 24 hours respectively.

- ETH:BTC is at 0.06 as of 4:00 pm ET.

- VIX is down -13.57% to 17.89 as of 4:00 pm ET.

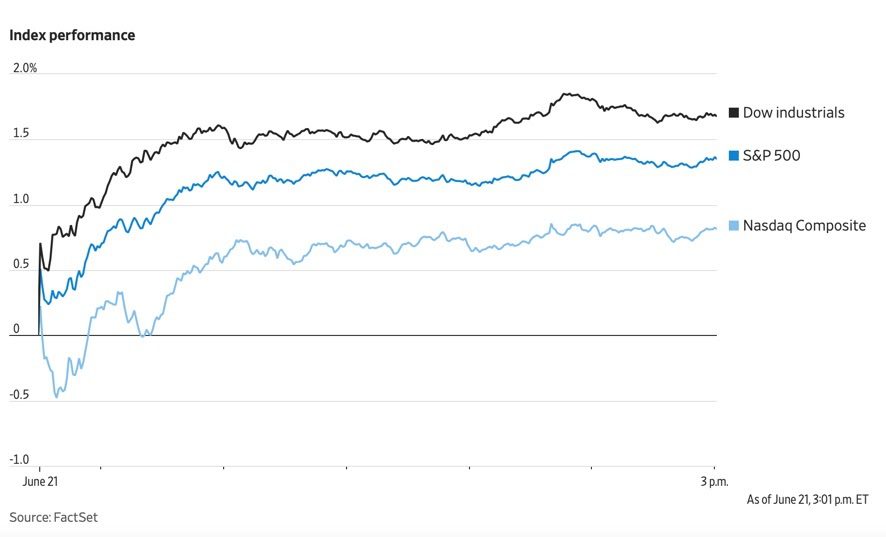

Stocks rebound after a tumultuous week where looming interest rate hikes curbed investors’ appetite for inflation-sensitive assets. Following the Federal Reserve announcement, The Dow Jones Industrial Average benchmarked its worst week in over six months, falling over 500 points in a day. There was a change of tune for equities on Monday as the market stabilized in the morning, recovering from last week’s losses.

Equities

- The Dow was up 1.7% to 33,876.

- The S&P 500 rose 1.4% to 4,224.

- Nasdaq Composite increased 0.79% to 14,141.

- Meanwhile in global markets, the Japan Topix index fell 2.4% while MSCI Asia Pacific Index tumbled 1.5%.

Insight

Ray Dalio, founder of Bridgewater Associates, weighs in on inflation concerns, adding that the road to economic recovery may be rocky with tightening monetary policies. “It’s easy to say that the Fed should tighten, and I think that they should,” the billionaire investor said in an interview with Bloomberg. “But I think you’ll see a very sensitive market, and a very sensitive economy because the duration of assets has gone very, very long. Just the slightest touching on those brakes has the effect of hurting markets because of where they’re priced, and also passing through to the economy.”

Fixed income

- The US 10-year yields 1.501% as of 4:00 pm ET.

Commodities

- Crude Oil opened at $71.15 per barrel and ticked up 2.62% to $73.52 as of 4:00 pm ET.

- Gold is up 0.81% at $1,783.30 as of 4:00 pm ET.

Currencies

- The US dollar is down -.40%, according to Bloomberg Dollar Spot Index.

In other news

Liquidity provider Amber Group closed a $100 million Series B round led by China Renaissance, Blockworks reported Monday. This values the Hong Kong-based company at $1 billion.

We’re watching out for …

- Federal Reserve Chair Jerome Powell testifies at a House Subcommittee hearing on Tuesday.

- Bank of England interest rate decision will take place on Thursday.

- PCE price index will be released on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.