Powell Turns to Lumber to Prove Inflation is Transitory

Amid pandemic-related spending and industrial supply chain issues, lumber surged more than 260% over the past year.

Source: Shutterstock

- Post pandemic demand, coupled with supply chain issues and bottlenecks have pushed prices up, but they will not last, Powell said, and lumber prices explain why.

- In May, lumber was $1,686 per thousand board feet, almost quadruple the pre-pandemic price of $460.

Federal Reserve Chairman Jerome Powell has admitted that Americans are facing higher prices, but he maintains his view that inflation will be transitory, and he points to lumber prices to prove it.

While testifying before a special House panel Tuesday, the central bank leader admitted that inflation is here. He pointed to airline tickets, hotel prices and lumber as examples. Post pandemic demand, coupled with supply chain issues and bottlenecks have pushed prices up, but they will not last, Powell said, and lumber prices explain why.

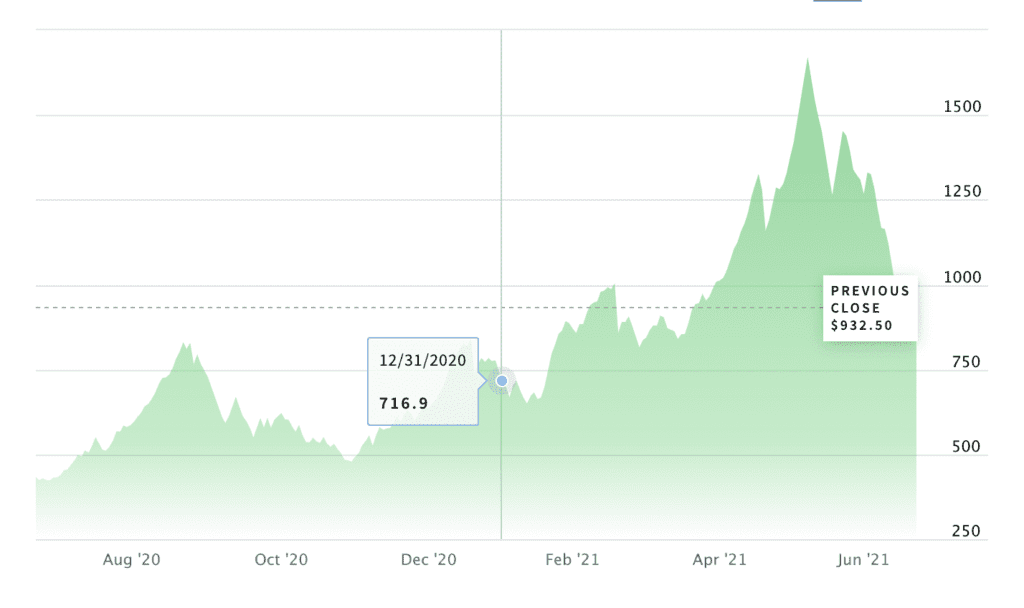

Amid pandemic-related spending and industrial supply chain issues, lumber surged more than 260% over the past year. In the past two months however, prices have crashed nearly 50%. The surge and fall pattern shows Powell and other central bankers that these temporary spurts of inflation will run their course, in time.

Lumber’s rollercoaster price chart offers proof that labor market shortages and bottlenecks are short-term issues tied to reopening efforts, Powell believes. Higher prices will be fleeting.

Lumber prices during the Covid-19 pandemic; Source: Nasdaq

Lumber prices during the Covid-19 pandemic; Source: Nasdaq

“Our expectation is that these high-inflation readings that we are seeing now will start to abate. And it’ll be like the lumber experience,” Powell said Wednesday during a press conference following June’s Federal Open Markets Committee meeting. “Prices that have moved up really quickly because of the shortages and bottlenecks and the like, they should stop going up. And at some point, they, in some cases, should actually go down. And we did see that in the case of lumber.”

Back in March 2020, sawmills cut production and furloughed workers in preparation for an economic slowdown. The surge in the housing market that followed that summer meant that lumber demand was high, but supply was limited, so prices surged. In May, lumber was $1,686 per thousand board feet, almost quadruple the pre-pandemic price of $460. As reopening continues, prices have started to level out.

Weyerhaeuser, the largest US lumber producer, reported its best first-quarter results since the housing bubble crash this year. The company raked in $681 million in profit during the first quarter of 2021.

While lumber may prove Powell’s point, other experts fear that the Fed’s easy money policy runs the risk of overheating the economy. Former treasury secretary Lawrence H. Summers has warned recently that maining near zero interest rates and bond buying at $120 billion/month may lead to a repeat of the last inflation crisis that began in the 1960s.