Raydium Token Holder Report Q3 2025

Q3 2025 marked the quarter where Raydium fully grew into its multi-product identity

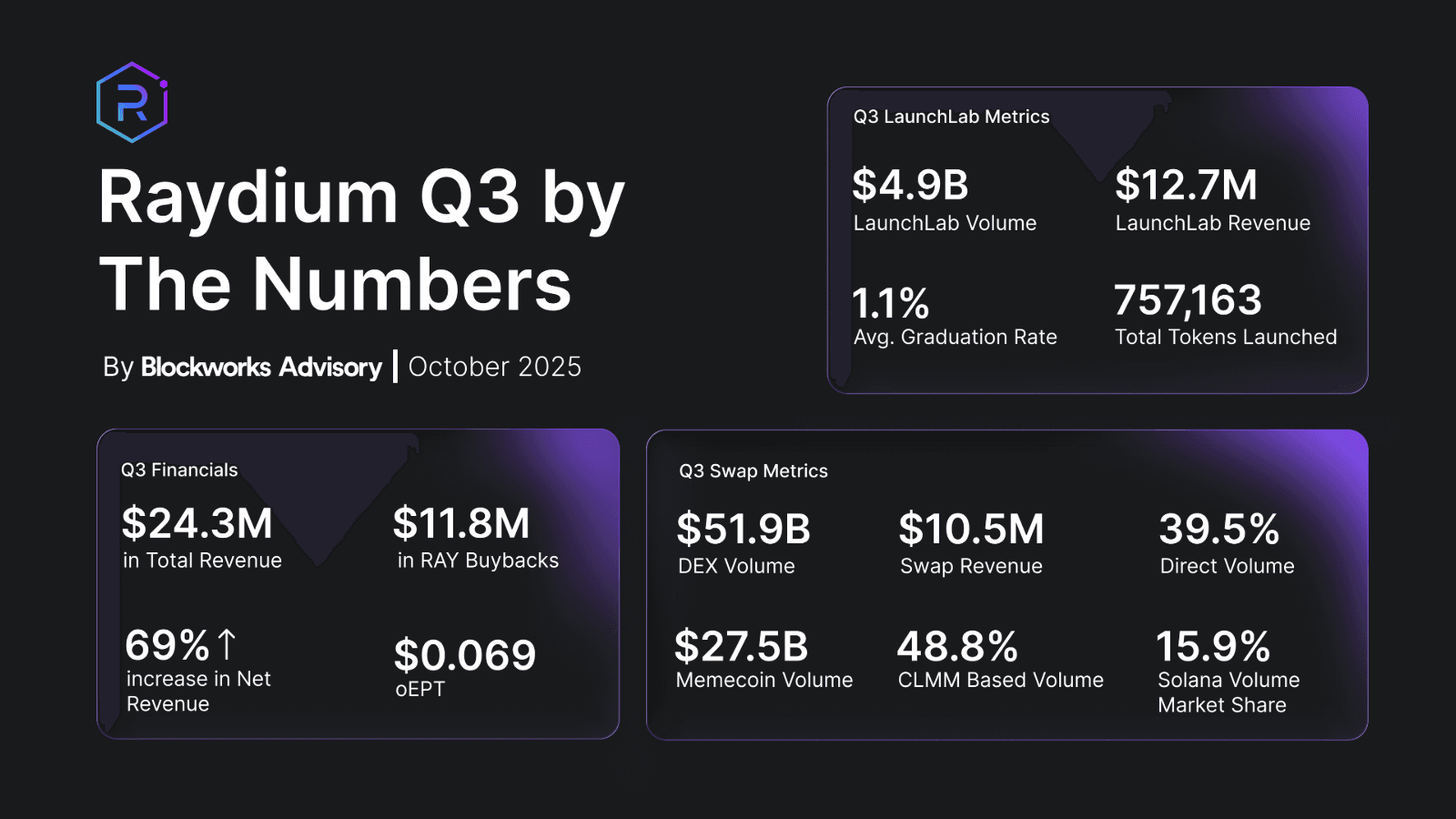

Blockworks Advisory | Raydium Q3 by the Numbers

This Token Holder Report is a product of Blockworks Advisory. Each quarterly report combines high-fidelity, proprietary data with expert commentary from our analysts and management commentary from the protocol team, providing a comprehensive view of the protocol from a fundamentals perspective.

A downloadable PDF version of this report is available for readers who prefer offline access or wish to share the report internally.

Executive Summary

Q3 2025 marked the quarter where Raydium fully grew into its multi-product identity. Following LaunchLab’s mid-April debut, the product reached operational scale, becoming the protocol’s dominant revenue driver and redefining how Raydium captures value within the Solana ecosystem. By extending from token trading to token creation, Raydium positioned itself as a core participant in Solana’s token issuance economy.

LaunchLab’s first full quarter validated the integration of issuance and secondary liquidity. The platform contributed $12.8M in revenue (+220% QoQ), equating to over half of total revenue ($24.3M, +69% QoQ), demonstrating scalability and establishing Raydium as a leading venue for token launches. Nearly half of swap revenue originated from LaunchLab tokens, illustrating how new issuance directly amplified trading across AMM, CPMM, and CLMM pools.

Beyond issuance, Raydium’s swap engine continued to adapt. Swap revenue rose 18% QoQ to $10.5M, led by CPMM and CLMM pools that now anchor a stable base in fee generation, while AMMs remained the high-beta driver tied to speculative activity and meme-token cycles. This balance of stable and cyclical liquidity gives Raydium a flexible fee structure.

Operating cash flow totaled $27.5M, marking a strong rebound from Q2. While buybacks and treasury allocations remained significant at $14.6M, a smaller share of operating inflows was recycled this quarter, reflecting deferred deployment of this quarter’s LaunchLab revenue.

Q3’s performance reflected strong momentum within a growing Solana DEX market. Raydium processed $51.9B in volume (+31% QoQ) and expanded its market share to 15.9%, outperforming the broader ecosystem despite greater fragmentation. The quarter affirmed Raydium’s evolution into a multi-product liquidity platform, with ongoing focus on aggregator integration and LaunchLab-driven trading depth.

Management Commentary

With Q3 revenue of $24.3M (+69% QoQ) and Solana DEX market share rising to 15.9%, Raydium continued its performance as a leading protocol driving Solana’s onchain trading ecosystem. At the same time, the quarter revealed important truths about competitive dynamics in DeFi.

The rapid migration of memecoin volume from established platforms to new entrants like BonkFun, both within Solana and across chains like BNB, suggests that user loyalty in speculative markets remains transactional. Similar patterns were seen in perpetuals trading, where entrenched leaders saw challenges to their market share. Additionally, the emergence of proprietary AMMs (pAMMs) in Q3 generated significant volumes on Solana, though these remain concentrated in a handful of low-fee tier pairs like SOL-USDC.

While headline pAMM volumes appear impressive, the operational reality is more nuanced. pAMMs currently require active inventory management and centralized oversight, which limits their deployment beyond core routes. Moreover, questions have been raised about liquidity stability during periods of heightened volatility when onchain protocols need it most for liquidations. As a non-custodial AMM, Raydium serves a fundamentally different market need: providing reliable, permissionless liquidity across the full spectrum of assets without dependency on external inputs or centralized intervention.

Equally important are the revenue implications of differing liquidity models. While pAMMs drive high volumes with tight spreads and extremely low fees, a single higher-fee AMM pool that enables genuine price discovery can deliver multiples of the revenue generated by commoditized routing on established pairs in low fee-tier environments. Raydium’s ability to serve both efficient routing for core pairs and profitable price formation for new assets creates a balanced revenue profile resistant to single-point competition. Raydium continues to research improvements to capital efficiency and is considering options in this area.

On the protocol side, Raydium made several program-level upgrades in Q3 to facilitate the trading of permissioned assets, positioning the protocol well for growth of RWA issuance onchain. Raydium has already demonstrated strong positioning within the tokenized equity space as a launch partner for xStocks, facilitating the majority of tokenized equity volume on Solana during Q3 according to Blockworks Research. Beyond RWAs, Raydium saw areas of increased volumes in non-memecoin markets, specifically from projects leveraging onchain fundraising models and then relying on Raydium pools as their primary liquidity venue during TGE, further diversifying trading activity from memecoin volumes.

Continued cooperation with RWA issuers and building out necessary onchain rails for trading puts Raydium at the intersection of traditional finance and DeFi, which could promise higher-value, stickier liquidity than longer tail asset speculation alone. As the market matures beyond memecoin cycles, our comprehensive infrastructure and proven ability to serve institutional-grade assets create sustainable advantages that extend beyond the cyclicality of speculative trading volume.

Financials

Income Statement Notables

Revenue Performance

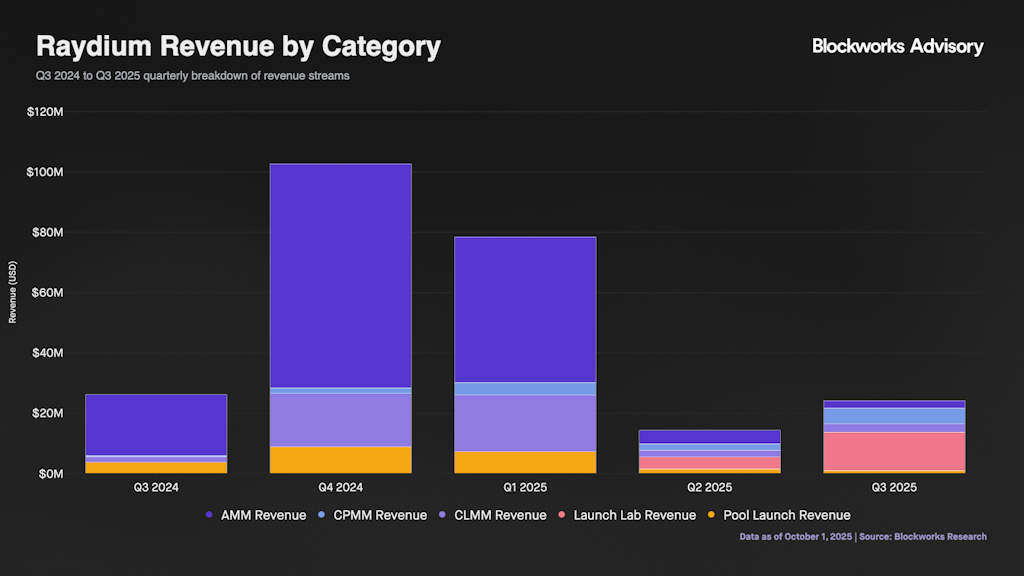

Raydium recorded $24.3M in net revenue, up 69% QoQ, reflecting strong performance across both LaunchLab and swap products.

LaunchLab Contribution

LaunchLab generated $12.8M, accounting for 53% of total revenue, up from 28% of total revenue in Q2. The shift in mix demonstrates the platform’s accelerating adoption and underscores its role as a key revenue pillar.

Swap Segment Dynamics

Swap revenue totaled $10.5M (+18% QoQ). Within the product, CPMM and CLMM pools delivered the majority of Q3’s revenue, while AMMs, despite a lower share of activity, remains Raydium’s highest-fee product (0.25% swap fee), generating significant income during peak speculative phases. This mix reflects a balanced revenue structure where AMMs drive upside while CPMM and CLMM pools sustain baseline consistency.

Operating Leverage

Net profit reached $23M (~95% margin), supported by low infrastructure costs ($0.97M) and operating expenses ($1.3M). While margins expanded slightly quarter-over-quarter (+2.5pp), infrastructure costs continued their gradual uptrend (+20% QoQ).

Seasonal and Market Context

Q3 2025 revenue was broadly in line with Q3 2024 levels ($24.2M vs. $26.2M), but composition shifted materially, from 86% swap-driven to a model where LaunchLab contributed over half of total revenue. This change highlights a durable expansion of Raydium’s revenue stack beyond trading fees alone.

Cash Flow Notables

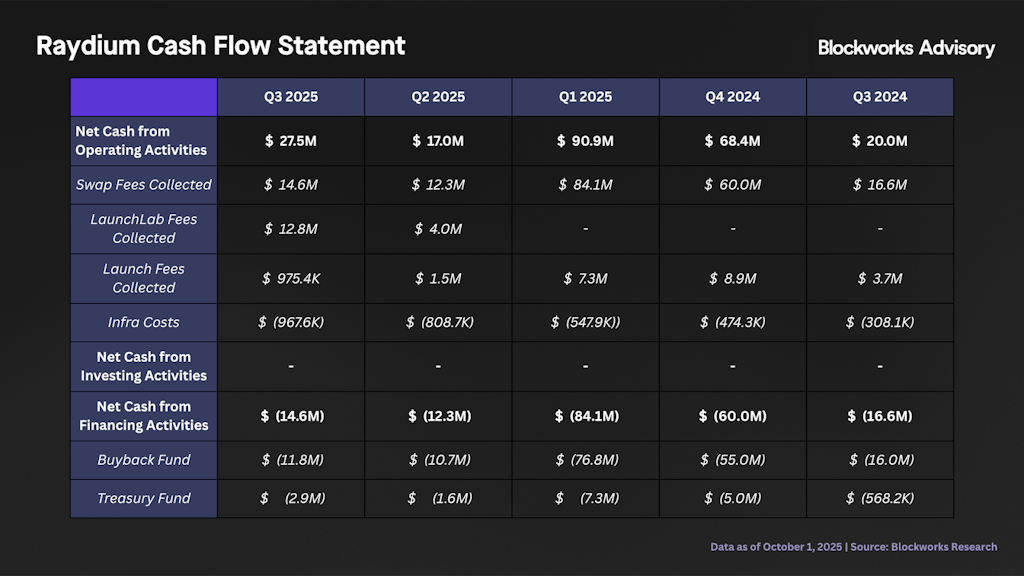

Consistent Cash Generation

Raydium produced $27.5M in operating cash flow during Q3 2025, marking a 62% increase from Q2’s $17M. The improvement was driven by higher swap and LaunchLab fee collections, which together contributed over $27M in inflows. Infrastructure costs continued their upward trend, rising to $967.6K (+20% QoQ), though they remained modest relative to total inflows. Notably, a portion of LaunchLab fees collected late in the quarter had not yet been deployed toward buybacks or treasury transfers by period end, slightly inflating reported operating cash.

Capital Allocation Discipline

Deployment of cash followed established priorities. The buyback fund received $11.8M, representing roughly 43% of quarterly operating cash flow, while $2.9M was allocated to the treasury reserve. Together, these outflows totaled $14.6M, consistent with the prior quarter; however, Q3 breaks a trend of an unusually high share of operating cash being recycled into financing activities, marking a temporary pause in the 70%+ capital recycling pattern observed in prior quarters. Following LaunchLab’s debut, a portion of LaunchLab revenue was redirected to experiment with RAY buybacks through single-sided liquidity provisioning in the RAY–SOL CLMM. Around 33,000 SOL was used to repurchase 2.06 million RAY, serving as a live test for automated buyback and treasury-recycling mechanisms.

Seasonal Context

Operating cash flow rose sharply +37% YoY from $20M in Q3 2024, reaffirming the protocol’s ability to scale fee generation despite evolving market dynamics. The balance between reinvestment, buybacks, and treasury growth positions Raydium for continued operational and capital efficiency across market cycles.

Treasury Statement Notables

Robust Treasury Expansion

Raydium’s treasury closed Q3 2025 at $239.9M, a 34% increase from Q2’s $178.6M. Growth was fueled by a combination of RAY token appreciation and steady accumulation, underscoring the protocol’s ability to compound capital alongside operational performance.

Dominance of RAY Holding

The treasury’s core position remains in RAY, which rose to $189.2M (+30% QoQ), now accounting for ~79% of assets. This reflects both price appreciation and the protocol’s strategy of maintaining strong alignment with its native token. While this concentration magnifies exposure to RAY performance, it also signals confidence in the long-term value of the ecosystem.

Diversification and Liquidity Reserves

Complementing its core RAY position, the treasury held $18M in USDC reserves (+17% QoQ), providing a liquid buffer for operational flexibility and market stability. SOL holdings expanded to $22.4M (+30% QoQ), representing ~10% of assets and giving the treasury direct exposure to the broader Solana ecosystem. Other assets remained minimal at $0.88M.

Strategic Context

On a year-over-year basis, treasury assets more than doubled, rising from $89.7M in Q3 2024 to $239.9M in Q3 2025. While growth has been impressive, the composition has shifted more heavily toward RAY, increasing from 75% to 79% of total assets over the past year. This concentration underscores Raydium’s bet on its own token as the cornerstone of long-term value creation, balanced by incremental growth in USDC liquidity and Solana ecosystem exposure.

Revenue Drivers

LaunchLab Revenue

Immediate Scale & Growth

LaunchLab generated $12.7M in Q3 2025, up +220% QoQ from $4.1M in Q2, its partial launch quarter. This surge lifted LaunchLab to 53% of total revenue, up from 28% in Q2, marking a decisive shift in Raydium’s revenue composition and confirming the platform’s role as the company’s new growth engine.

Strategic Rationale

LaunchLab represents Raydium’s vertical expansion beyond core DEX services into token origination, capturing value throughout the token lifecycle. By integrating issuance, liquidity provisioning, and secondary trading within a single stack, Raydium positions itself as a central infrastructure layer for Solana-based project launches. As projects are able to leverage their white label infrastructure services, Raydium deepens its moat within the ecosystem.

Adoption & Market Signal

Early adoption by the Bonk Foundation and sustained throughput from bonding-curve launches transitioning into secondary trading underpinned July’s exceptional revenue spike. These early results signal strong go-to-market traction and validate LaunchLab’s product-market fit, suggesting Raydium has successfully begun to extend its dominance from trading venue to token creation itself. However, LaunchLab’s revenue performance was notably front-loaded, with the majority of quarterly income generated in the first half as launch momentum moderated through August and September. This slowdown coincided with a rebalancing of market share toward incumbent competitors and rising competitive pressure from new token-issuance platforms in other ecosystems.

DEX Revenue

Resilient Growth Across Pool Types

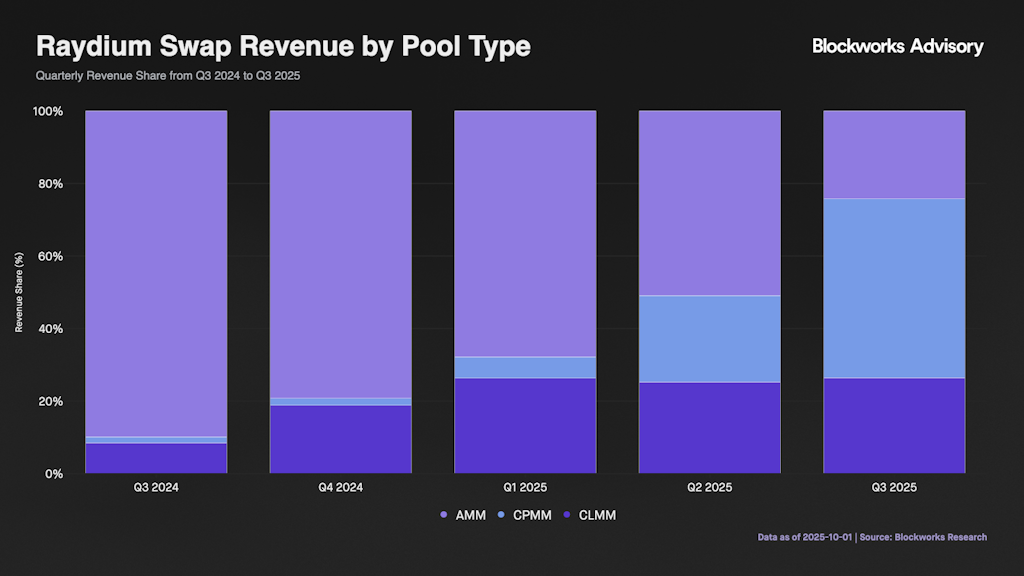

Raydium’s DEX segment generated $10.5M in swap revenue during Q3 2025, up 17.7% QoQ from $8.9M in Q2. The quarter underscored both the resilience of trading activity and the structural evolution in how liquidity is deployed across pool types.

Raydium’s pricing model differentiates by pool architecture. Standard AMM pools (v4) charge a 0.25% trading fee, with 0.03% (3 bps) directed entirely to RAY buybacks. CP-Swap (CPMM) pools operate across four fee tiers, 4%, 2%, 1%, and 0.25%, of which 84% is paid to liquidity providers, while 12% is allocated to RAY buybacks and 4% to the treasury. Concentrated Liquidity (CLMM) pools follow the same 84/12/4 split across eight fee tiers ranging from 2% to 0.01%.

Product Mix Evolution

- AMM revenue totaled $2.5M (+16.1% QoQ), declining in share from 47% to 24% of total swap revenue as users migrated to newer pool formats.

- CPMM revenue rose to $5.2M (+20% QoQ), becoming the single largest contributor at 49% of swap revenue.

- CLMM revenue reached $2.8M (+16% QoQ), steady at 27% of the mix.

While CPMM and CLMM pools collectively generated more revenue this quarter, the AMM remains Raydium’s highest-fee product and primary source of peak-period income. AMM activity is inherently seasonal, scaling sharply during meme-token surges, while CPMM and CLMM pools provide the steady base of volume and fees that anchor performance during quieter market phases. Together, the mix ensures Raydium captures both the speculative upside of Solana’s retail cycles and consistent throughput across periods of lower volatility.

In-Quarter Trading Dynamics

Swap revenue generation was heavily frontloaded in early Q3, reflecting LaunchLab’s initial surge in token issuance spilling over into trading volume before normalizing later in the quarter.

Activity during the quarter followed a two-phase pattern:

- Early Q3 (July) saw strong AMM-driven volumes as LaunchLab tokens entered secondary trading, producing Raydium’s best monthly revenue performance of the period. As issuance momentum slowed and competing launchpads absorbed more asset issuance flow in August and September, activity shifted toward CPMM and CLMM pools.

- Late Q3 (August–September) marked a transition toward CPMM and CLMM pools, as liquidity providers optimized toward higher-efficiency pools amid market conditions.

Category Composition

Trading category trends remained broadly consistent quarter-over-quarter. Memecoins dominated swap revenue, amplified by LaunchLab token launches, while SOL-Stablecoin and Project token pairs gained share later in the quarter. Other categories, including LSTs and tokenized assets, remained smaller but stable contributors.

LaunchLab-Linked Activity

Nearly 50% of total swap revenue in Q3 originated from post-bonding curve LaunchLab tokens. This highlights LaunchLab’s broader ecosystem impact: beyond its own $12.8 million in direct revenue, it catalyzed secondary market activity across CPMM pools, effectively linking token origination and exchange liquidity into a unified revenue flywheel.

Protocol Analysis

Volume Growth from Q2 2025

Raydium processed $51.9B in total trading volume during Q3 2025, a 30% increase from Q2’s $39.6 billion. The growth was broad-based across trading sources and categories, reflecting renewed market activity and Raydium’s deep integration within Solana’s liquidity infrastructure.

Volume by Source

Resurgent Direct Trading

Direct trading volumes nearly doubled quarter-over-quarter to $20.5B, representing 40% of total activity. This sharp rebound signals improving user confidence and greater engagement through Raydium’s native interface; supported by UX enhancements, product consistency, and the visibility generated by LaunchLab launches.

Aggregator Stability, Platform Acceleration

Volumes routed through DEX aggregators totaled $14B (+4% QoQ), accounting for 27% of total volume. Stability here highlights Raydium’s ongoing role as a liquidity endpoint within Solana’s broader DeFi routing stack.

Meanwhile, trading platforms contributed $8.8B (+128% QoQ), emerging as the fastest-growing source of order flow. Platform-driven adoption accelerated during July, coinciding with LaunchLab’s peak activity, demonstrating how new issuance events can amplify trading participation.

Quarterly Dynamics

- July 2025: $23.8B total volume; trading platform share peaked at 27% as new LaunchLab tokens hit the market.

- August 2025: $16.7B; direct trading surged to 50% of share as users transitioned from LaunchLab launches into native trading.

- September 2025: $11.4B; a seasonal slowdown saw aggregator share recover to 34%, while trading platforms eased to 7%.

Overall, the shift toward direct and aggregator-based activity points to healthier organic usage and a more distributed flow of liquidity sources heading into Q4.

Volume by Trade Category

Speculative Energy with Signs of Maturity

Trading activity remained dominated by speculative assets but showed early signs of diversification as institutional and stablecoin flows rebalanced the mix.

- Meme Tokens: $27.5B (53% of total, +40% QoQ). Memes sustained the quarter’s momentum, reinforcing Raydium’s status as one of Solana’s primary venues for high-velocity retail flow.

- SOL–Stablecoin Pairs: $15.4B (29% of total, +28% QoQ). Continued growth in this category anchored liquidity and provided the key bridge between retail-driven volatility and stable market depth.

- Project Tokens: $4.4B (8% of total, +55% QoQ). Expanding engagement with core Solana ecosystem projects signals some increasing fundamental trading demand beyond speculative activity.

Quarterly Dynamics

- July: $23.8B volume, with meme tokens peaking at 70% share.

- August: $16.7B, distribution more balanced (memes 48%, SOL-Stablecoin 37%).

- September: $11.4B, SOL-Stablecoin took the lead at 43%, while memes moderated to 24%.

Market Structure Implications

Despite the gradual moderation of meme activity, these tokens still accounted for over half of quarterly volumes, emphasizing the retail-driven nature of Raydium’s market. However, the rising participation in SOL-Stablecoin and project-token pairs suggests a maturing liquidity base, capable of sustaining throughput and a strong revenue base even as speculative intensity cycles down.

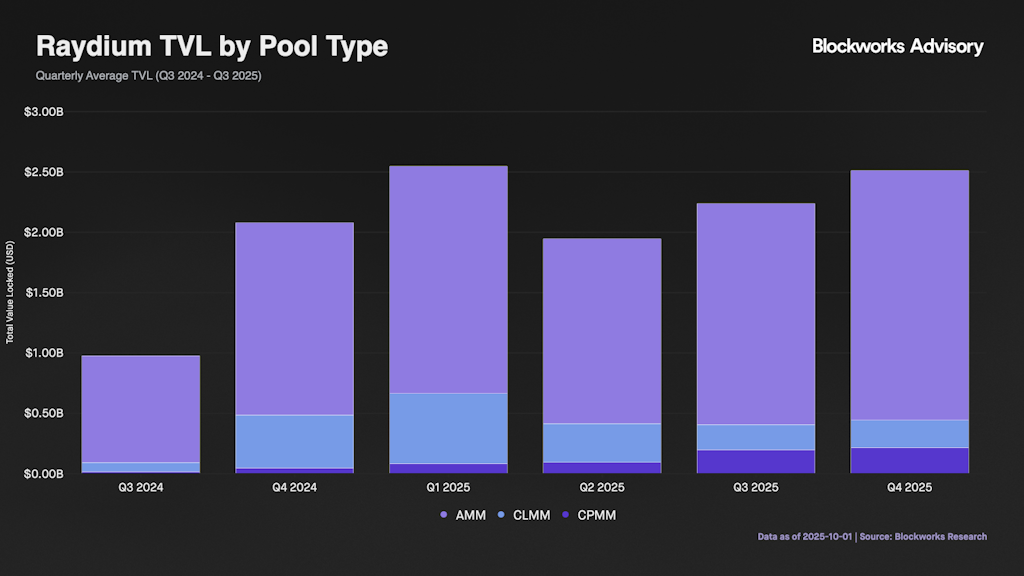

Total Value Locked (TVL)

Sustained Expansion and Market Leadership

Raydium closed Q3 2025 with $2.5B in total value locked (TVL), up 35% quarter-over-quarter from $1.8B at the start of July. This marks a second consecutive quarter of >30% sequential growth, reinforcing Raydium’s position as the largest liquidity hub on Solana and validating continued user confidence in its pool architecture.

Pool-Type Performance

- CPMM Pools: $211M TVL (+82% QoQ), representing 9% of total liquidity but contributing 51% of protocol revenue ($5.1 million). This outsized efficiency underscores CPMMs’ superior capital productivity relative to traditional pools.

- CLMM Pools: $216.8M (+6% QoQ), maintaining stable efficiency near 121 bps. While absolute growth was modest, CLMMs delivered consistent returns and predictable execution quality for professional liquidity providers.

- AMM Pools: $2B (+36% QoQ), anchoring 83% of aggregate liquidity. Depth increased materially, though revenue efficiency declined as pool scale broadened.

The mix illustrates Raydium’s balanced liquidity model: AMMs scale with speculative inflows, while CPMMs and CLMMs sustain consistent utilization and revenue efficiency through quieter market phases.

LP Participation & Fee Generation

High-Velocity Liquidity Provisioning

Liquidity providers earned $87M in fees during Q3 2025, averaging $946K daily across 92 days. The quarter was dominated by meme-token activity, which generated $77.9M (90%) of LP fees, led by Pump.fun memes ($12.1M) and other meme pairs ($65.9M). Core SOL-Stablecoin pools contributed $5.1M (6%), while AI-agent tokens added $2M (2%).

Daily fee volatility remained elevated: the protocol recorded a $10.2M peak on September 8, roughly 10.8x the daily average, reflecting Raydium’s ability to capture episodic bursts of speculative trading while maintaining baseline liquidity from core Solana pairs.

LaunchLab Deep Dive

Throughput and Market Selectivity

LaunchLab processed roughly 8,500 token launches per day on average during Q3 2025, with activity ranging from 40 to 26,823 launches daily across 91 operational days. Peak activity occurred on July 18 (26,823 launches), tapering toward quarter-end as seasonal volumes normalized.

Graduation rates, the share of tokens achieving post-launch liquidity, remained within 0.2-3.3%, consistent with industry norms. The data demonstrates exceptional scalability in handling extreme throughput while preserving selective market acceptance, reinforcing LaunchLab’s role as one of Solana’s primary issuance and early-liquidity venues.

Platform Concentration

Activity through LaunchLab was heavily concentrated in LetsBonk, which accounted for 735K tokens (98% of launches). Raydium’s native LaunchLab contributed 11K tokens (1.5%), while other external platforms (Robinhood, Cook, miscellaneous) added ~5.5K (<1%).

This concentration extended into secondary trading, where LetsBonk-originated meme tokens dominated swap volume and LP fee generation. The outcome underscores both Raydium’s capacity to absorb large inflows and the ecosystem’s reliance on a single external launch funnel, a potential concentration risk for future quarters.

Revenue Concentration & Seasonality

LaunchLab generated $12.8M in Q3 2025 (+220% QoQ), averaging $139K daily revenue. Performance was highly concentrated in LetsBonk ($12.3M, 96% share, +493% QoQ), which drove all top-revenue days in July.

Raydium’s native platform declined to $0.4M (3% share, -74% QoQ), while other sources contributed marginally. Monthly performance was front-loaded; July ($9.5 million, 74% of total) followed by steep declines in August (-77.3%) and September (-47.0%).

Interpretation

Q3 validated LaunchLab’s scalability and market adoption, proving its centrality to Raydium’s revenue engine. However, the quarter also highlighted concentration risk: sustainability will depend on diversifying issuance pipelines beyond LetsBonk and continuing product innovation to capture future cohorts of token creators.

Ecosystem Market Share

Renewed Momentum

Raydium processed $51.9B in trading volume during Q3 2025, a 31% increase QoQ from $39.6B in Q2. This growth outpaced the broader Solana DEX market, which expanded 22% over the same period to reach $326.3B in total volume. As a result, Raydium’s market share rose from 14.8% to 15.9% (+1.1pp), reaffirming its position as one of the largest DEXs on Solana by trading activity.

Monthly Performance Trends

July: $23.8B (24% Solana DEX share), driven by LaunchLab token launches and peak speculative trading activity.

August: $16.7B (14% share), as market activity normalized and trading flows diversified across platforms.

September: $11.4B (11% share), marking the quarter’s low point and a 52% decline from July’s peak as retail momentum faded and liquidity rotated toward established pools.

Market-Share Dynamics

Across Q3, Raydium’s market share peaked at 24% in July before settling at 15.9% for the quarter. This compression is largely due to new AMM entrants temporarily diverting flows. Despite this, Raydium maintained the third-largest share of total Solana DEX volume and remained a key source of on-chain liquidity depth.

Tokenized Assets: A Quarter of Emergence

Q3 2025 marked the breakout quarter for tokenized assets on Solana, as trading volume surged from $1.36 million in Q2 to $262.1 million in Q3, a 192x increase quarter-over-quarter. The category’s explosive growth reflects rising institutional and retail engagement with onchain representations of real-world assets.

Within this rapidly forming market, Raydium captured 76.5% of total tokenized-asset volume, handling $200.5 million of the $262.1 million ecosystem total. Raydium’s partnerships and integrated liquidity architecture positioned it to dominate initial flow. The protocol’s CLMM allowList framework, built to enable permissioned trading for compliant tokenized assets, is proving instrumental in anchoring liquidity and routing efficiency across these emerging markets.

Interpretation

At the same time, Raydium’s early capture of tokenized-asset trading flow introduces a new growth vector that complements its core swap business. Together, these dynamics suggest an evolving market posture, where cyclical retail activity and structural on-chain finance converge under Raydium’s liquidity framework.

The path forward centers on stabilizing share across cycles through deeper liquidity concentration, enhanced aggregator integration, and the continued fusion of LaunchLab issuance, secondary trading, and tokenized-asset liquidity into a unified ecosystem flywheel.

Product & Ecosystem Updates

Raydium’s third quarter featured targeted technical and product advancements across its swap infrastructure, LaunchLab platform, and broader integrations. These updates refined routing efficiency, improved compliance flexibility, and expanded composability within the Solana ecosystem.

Product Updates

AMM: Raydium deployed the Swap V2 interface, eliminating OpenBook market dependencies and reducing required account inputs from 18 to 8, streamlining routing performance and user interaction.

CPMM: Introduced a pool-creator fee-share mechanism, allowing LaunchLab pool creators to claim 5 bps of swap fees denominated in the quote asset. The feature aligns incentives between liquidity originators and sustained market activity.

CLMM: Added an allowList module, SuperState, to enable trading of permissioned assets (RWAs) requiring KYC. Built on Solana’s Token-2022 standard, the system integrates directly with Raydium’s CLMM program via a thaw instruction, permitting whitelisted accounts to transact.

LaunchLab: Expanded functionality with creator-fee support prior to graduation and full compatibility for Token-2022 (t22) assets, broadening project flexibility and fee accrual mechanics.

Added support for USD1 as an additional quote asset and introduced a launch-parameter locking feature, allowing platforms to fix configuration settings pre-deployment for greater integrity and auditability.

UI/UX: Raydium became the first Solana application to release a fully functional Devnet UI, enabling developers and users to test all platform features in a mirrored environment and improving the overall product development lifecycle.

Incentives/emissions: Liquidity-mining incentives remained modest in Q3 2025 at approximately 450,000 RAY, with roughly 90% allocated to single-sided RAY staking and the remainder to CLMM liquidity incentives.

Institutional Interest

Custody / Compliance: In September 2025, 21Shares launched the RAY ETP (ARAY), granting institutional investors regulated exposure to Raydium’s native token.

Development & Growth

Integrations:

- Multiplier integrated Raydium as a liquidity venue for its Gamified Capital Markets product.

- Quanto integrated Raydium to enable collateralization of LP tokens, expanding DeFi composability.

Partnerships:

- World Liberty Financial selected Raydium as the core liquidity venue for USD1, a new 1:1 USD-backed stablecoin on Solana.

- StockX partnered with Raydium to deploy tokenized equity products.

- Metaplex Genesis utilized Raydium to provide ICO-era liquidity and support for its genesis launch ecosystem and related assets.

Closing Summary & Outlook

Raydium’s Q3 performance underscored both strength and transition. Net revenue reached $24.3 million, up 69% quarter-over-quarter, with profitability holding near 95% margins. The business model expansion into LaunchLab was decisive, as token launches, and their downstream trading impact, drove the majority of financial outcomes.

Swap activity remained healthy, though its internal composition evolved. CPMM and CLMM pools expanded as the main engines of growth, while AMM pools continued to anchor the protocol’s liquidity breadth and remained the core high-fee driver during speculative cycles. The two product sets together now form a balanced structure: AMMs capture the upside of retail-driven volume in surges, while CPMMs and CLMMs stabilize throughput during quieter market phases.

Trading volume rose to $51.9 billion, yet Raydium’s market share contracted month-over-month within the quarter from 23.5% in July to 10.5% by September, reflecting intensifying competition despite strong absolute growth. This dynamic underscores a maturing Solana DEX landscape, where liquidity fragmentation and differentiated fee models are reshaping share distribution.

Liquidity trends reflected the same duality. TVL expanded 35% QoQ to $2.46 billion, reaffirming Raydium’s position as one of Solana’s largest liquidity hubs. However, LaunchLab’s heavy concentration in LetsBonk and meme-token launches amplified both opportunity and risk, leaving the sustainability of recent performance tied to broader platform diversification.

Looking ahead to Q4, Raydium enters the next phase of its evolution with a solid foundation and clear priorities:

- Defend market share through continued infrastructure development.

- Diversify LaunchLab issuance beyond a single dominant platform to broaden participation and stabilize revenue.

- Balance speculative momentum with core liquidity depth, ensuring that AMM-driven peaks translate into sustained growth across the full trading stack.

In sum, Q3 2025 validated Raydium’s multi-pool architecture and vertical expansion strategy, proving its ability to scale through high-velocity market cycles. The challenge now lies in converting that momentum into durable market share and recurring launch activity, positioning Raydium as not just as one of Solana’s liquidity hubs, but the go-to full-stack infrastructure for token origination, trading, and growth.

Appendix

Primer: What is Raydium?

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain. Launched in February 2021, it provides liquidity and token swaps through multiple pool types, serving as one of the core liquidity hubs in the Solana ecosystem.

Core Differentiators

- Multi-pool architecture — Supports CPMM, CLMM, and AMM pools for diverse liquidity strategies.

- Permissionless pool creation — Any project can launch liquidity pools without approval.

- LaunchLab — Token issuance and liquidity bootstrapping platform, central to Raydium’s Q3 revenue profile.

- Liquidity incentives — Rewards distributed in RAY to encourage liquidity provision.

Ecosystem Role

Raydium underpins much of Solana DeFi by powering token swaps, initial liquidity for new tokens, and yield opportunities for liquidity providers.

Founding & Development

Launched in 2021 by a pseudonymous team with trading/infrastructure backgrounds, Raydium has grown into Solana’s leading DEX, continually expanding product design and LaunchLab services.

Revenue

Swap Revenue — Total revenue earned from swap fees on AMM, CPMM, and CLMM pools.

Pool Launch Revenue — Revenue collected from the creation of new pools. Each new AMM or CPMM pool pays a 0.15 SOL launch fee, which is earmarked for infrastructure costs.

LaunchLab Revenue — Revenue earned from trading activity on LaunchLab-powered platforms.

Raydium collects 0.25% of swap value on every LaunchLab trade (e.g., letsbonk.fun). Trades occurring on Raydium’s own LaunchLab incur an additional 0.75% platform fee.

Cash Flow

Raydium uses accrued revenue for two primary purposes:

- RAY Buybacks– repurchasing RAY from the open market.

- Treasury Fund Accumulation– retaining USDC in protocol reserves.

Cash Flow Breakdown by Pool Type

- AMM: 0.03% of all trades collected and used entirely for RAY buybacks.

- CPMM: 16% of total trading fees collected as protocol revenue — 12% allocated to RAY buybacks and 4% to the treasury.

- CLMM: 16% of total trading fees collected as protocol revenue — 12% allocated to RAY buybacks and 4% to the treasury.

- Pool Launch Fees: Collected from new AMM/CPMM pools; portions earmarked for infrastructure costs. Related outflows are categorized as expenses.

Treasury Statement

RAY appearing on the balance sheet is exclusively from buybacks funded by economic activity. Unvested or unissued RAY, equivalent to authorized shares in traditional finance, are non-balance sheet items and therefore not counted as assets.

4% of total trading fees from CPMM and CLMM pools are collected into the treasury as USDC. This fund represents Raydium’s retained earnings and reserves for future protocol operations.

LaunchLab

Revenue generated from LaunchLab tokens is split by trade location:

- Bonding Curve: Revenue from bonding curve trades on LaunchLab.

- Post-Bonding Curve: Revenue from AMM/CPMM pools involving graduated LaunchLab tokens.

External platforms (e.g., letsbonk.fun) can utilize Raydium’s LaunchLab infrastructure and liquidity to launch tokens. LaunchLab supports multiple token supply configurations currently 100 M, 1 B, and 10 B tokens minted. The amount of SOL required for a bonding curve to “graduate.” Thresholds are set by token creators.

LaunchLab trades incur two distinct fees:

- Protocol Fee: 0.25% flat fee collected by Raydium (applies to all LaunchLab platforms).

- Platform Fee: Variable fee set by each platform.

Total Raydium fees = Protocol Fee (0.25% of all launches) + Platform Fee (0.75% only via tokens launched directly on LaunchLab).

Pool Types

AMM (Automated Market Maker) — Raydium’s legacy constant-product pools and one of Solana’s most distributed contracts. Known as the hybrid AMM, these pools previously shared idle liquidity with a central limit order book (Serum → OpenBook).

CPMM (Constant Product Market Maker) — Raydium’s latest generation of constant-product pools are anchor-compatible and token22-supported. This offers flexible fee configurations.

CLMM (Concentrated Liquidity Market Maker) — Pools that allow asymmetric liquidity provision. LPs can allocate liquidity within specific price ranges, offering higher capital efficiency and strategic depth.

Liquidity Provider (LP) Fees and Protocol Fees

LP Fees

- AMM Pools: 0.22% of swap volume goes to LPs.

- CPMM & CLMM Pools: 84% of total trading fees (variable by pool) go to LPs.

Protocol Fees

- AMM Pools: 0.03% of swap volume.

- CPMM & CLMM Pools: 16% of total trading fees.

Methodology

Volume — All DEXs on Solana volumes have wash trading filtered out. We define wash trading based on the tokens that are traded in a pool. We currently curate a database of tokens launched on Solana with key characteristics about them. These include the category of token (stablecoin, memecoin, project token, etc.) and the launchpad it was created on. Tokens that don’t come from a reputable launchpad or are not tagged in this database are flagged as unknown tokens. Pools with unknown tokens are removed from our DEX volume dataset.

Outstanding Earnings per Token (oEPT) — A profitability metric that measures net income divided by the total outstanding token supply during the reporting period. It represents the amount of earnings attributable to each circulating Raydium token, providing a per-token view of protocol performance and value accrual.

This research report has been funded by Reactor Labs.

By providing this disclosure, we aim to ensure that the information reported in this document is conducted with objectivity and transparency. Blockworks Advisory makes the following disclosures:

- Report Funding: The information reported in this document has been funded by Reactor Labs. The sponsor may have input on the content of the report, but Blockworks Advisory maintains editorial control over the final report to retain data accuracy and objectivity. All published token holder reports by Blockworks Advisory are reviewed by internal independent parties to prevent bias.

- Researcher Disclosures: Researchers submit financial conflict of interest (FCOI) disclosures on a monthly basis that are reviewed by appropriate internal parties.

Readers are advised to conduct their own independent research and seek advice of qualified financial advisor before making investment decisions.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.