Report Says Apple Won’t Join the Metaverse With its MR Headset

The tech giant is steering clear of the concept for now, calling it completely “off limits,” according to Bloomberg’s Mark Gurman

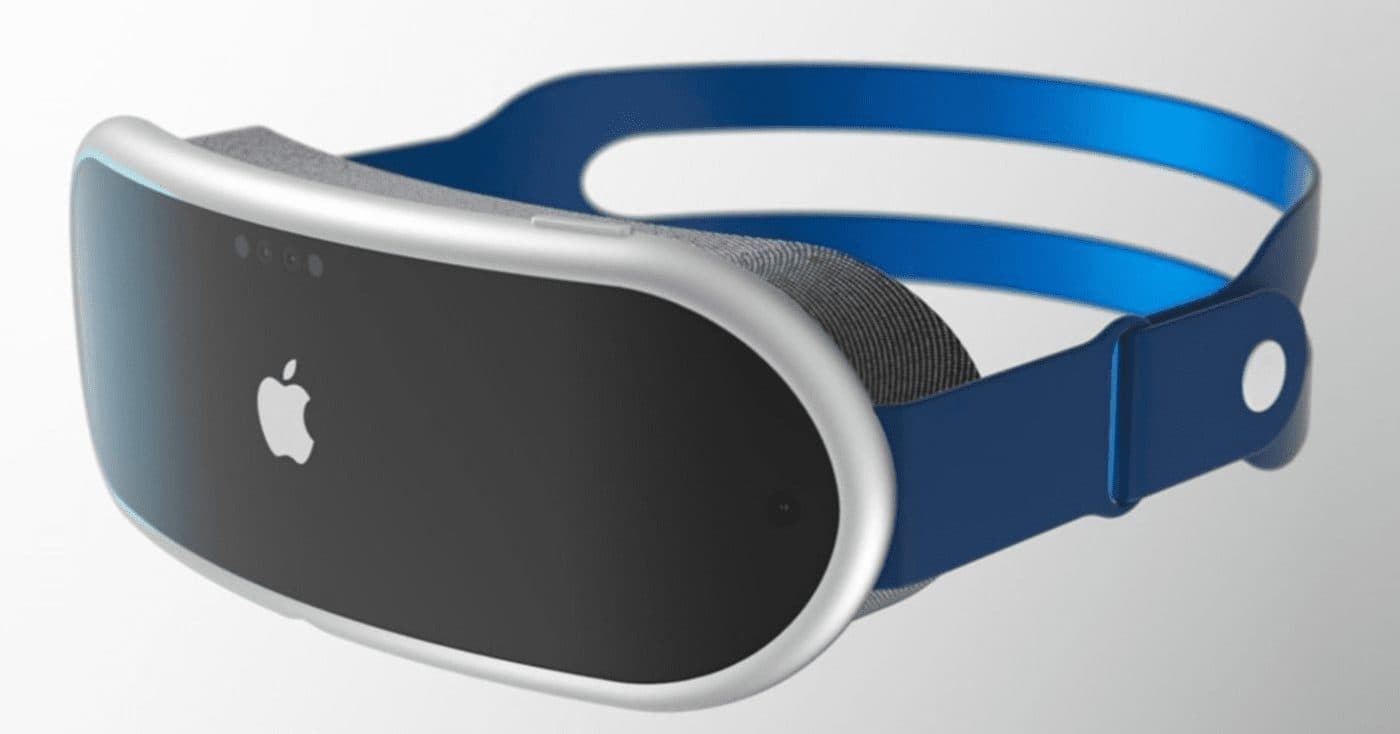

Rendering of a possible Apple headset

- The mixed reality headset is set to launch later this year

- The rumored Apple approach contrasts with the more metaverse-friendly strategy of Facebook after its Meta rebrand

Apple Inc. is not venturing into the metaverse with their mixed reality headset just yet, according to a recent report from Bloomberg’s Mark Gurman. The tech giant is steering clear of the metaverse with its yet-to-be released product, calling it completely “off limits.”

“Here’s one word I’d be shocked to hear on stage when Apple announces its headset: metaverse,” Gurman said.

“I’ve been told pretty directly that the idea of a completely virtual world where users can escape to — like they can in Meta Platforms/Facebook’s vision of the future — is off limits from Apple.”

The headset will reportedly be a mixed augmented and virtual reality headset, designed for “bursts of gaming, communication, and content consumption.” The headset will include two displays, more than a dozen cameras for hand-tracking and will cost a whopping $3,000, The Information previously reported.

The mixed reality headset is set to launch later this year, according to Bloomberg sources. However, the details have not been publicly announced by the trillion-dollar company.

Apple analyst Ming-Chi Kuo predicts that Apple will follow up a headset launch, with a more glasses-like product, in 2025.

By that time, it will be much clearer whether Facebook’s new strategy, as Meta, is paying off. Meta CEO Mark Zuckerberg has called the metaverse the “holy grail of social experiences,” and the company’s Global Business Group Vice President, Nicola Mendelsohn, said in October that “openness and interoperability” would be a “key feature.”

Apple shares were slightly higher at 11:55 am ET, and up about 40% over the past 12 months.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.