Most Expensive Three Arrows Capital NFTs To Be Liquidated

A court-appointed liquidator is preparing to sell more than 300 NFTs previously held by Three Arrows Capital, with many set to be devalued

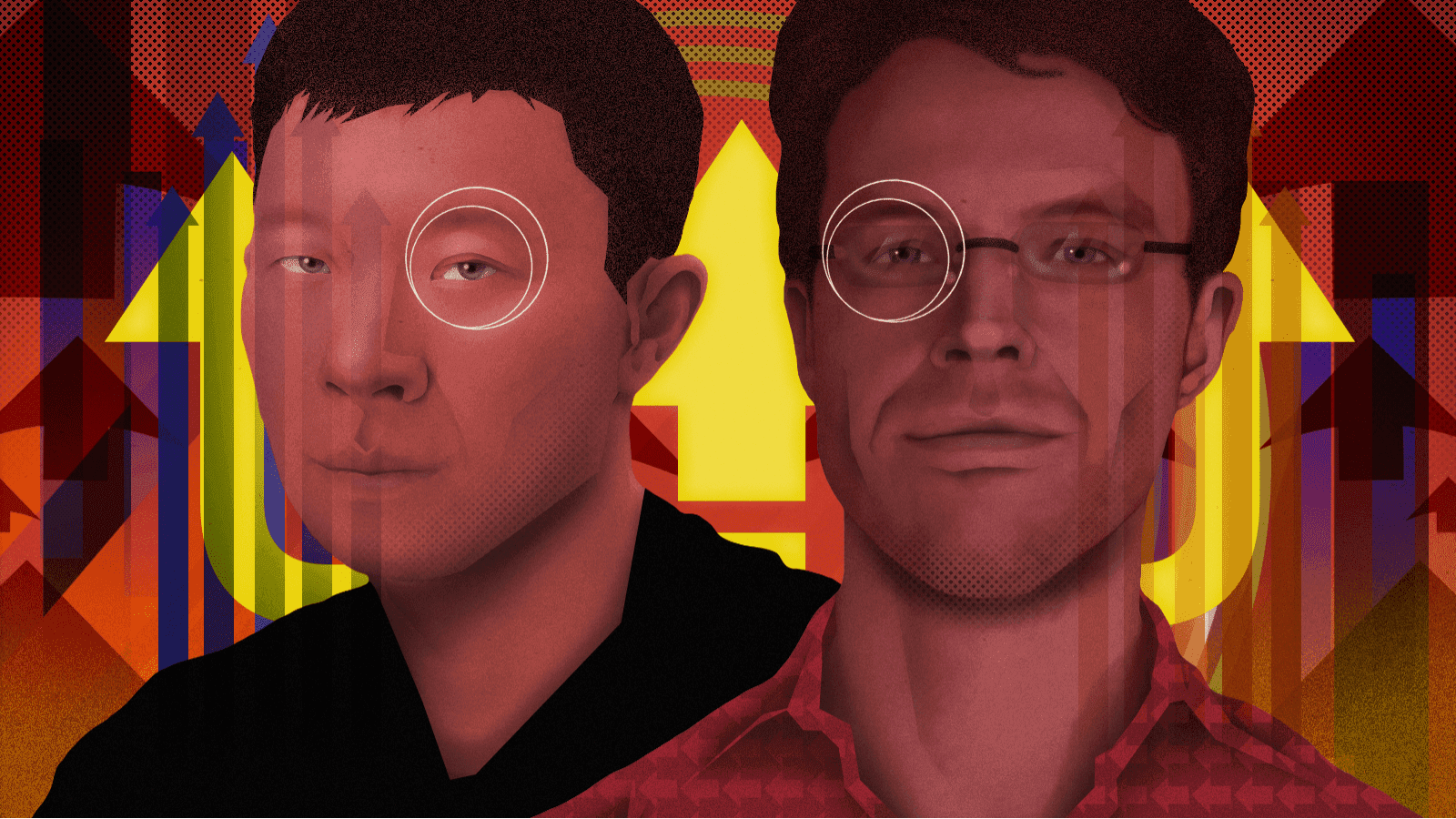

Three Arrows Capital founders Su Zhu and Kyle Davies | Blockworks exclusive art by axel rangel

- 3AC’s Starry Night Capital spent over $35 million on NFTs in 2021

- Analytics firm Nansen pegs the current portfolio value of the collectibles at some $860,000

Starry Night Capital, the investment fund focused on NFTs owned by Three Arrows Capital’s (3AC) founders, has moved more than 300 digital collectibles belonging to the now-bankrupt firm.

Teneo, the liquidator behind 3AC’s bankruptcy proceedings, said on Tuesday that all of the NFTs “have been accounted for and are in our possession or are being transferred to us.”

Starry Night was raised by 3AC and pseudonymous investor Vincent Van Dough last summer with the intention to collect premium NFTs. Data from a Dune Analytics dashboard suggests the fund spent some $35 million on NFTs last year.

But the collection’s value dwindled to $4.2 million by July after the turmoil in crypto markets. Analytics firm Nansen estimates that the collection’s value now stands at 625 ETH (about $861,500 as of press time).

3AC itself was ordered into liquidation in late June. The long-serving crypto hedge fund firm had faced numerous margin calls across the crypto ecosystem following the collapse of Terra.

3AC had sizable exposure to its native algorithmic stablecoin UST as it depegged from the US dollar, costing it nearly $200 million, according to co-founder Kyle Davies.

Three Arrows Capital fund spent $10M in ether on top five NFTs

Much of Starry Night Capital’s NFT portfolio will now be valued below their last purchase price, because ether has dropped over 60%, but Teneo is still likely to recover millions from their liquidation.

All dollar values represent sale prices at the time of trade (images sourced from OpenSea).

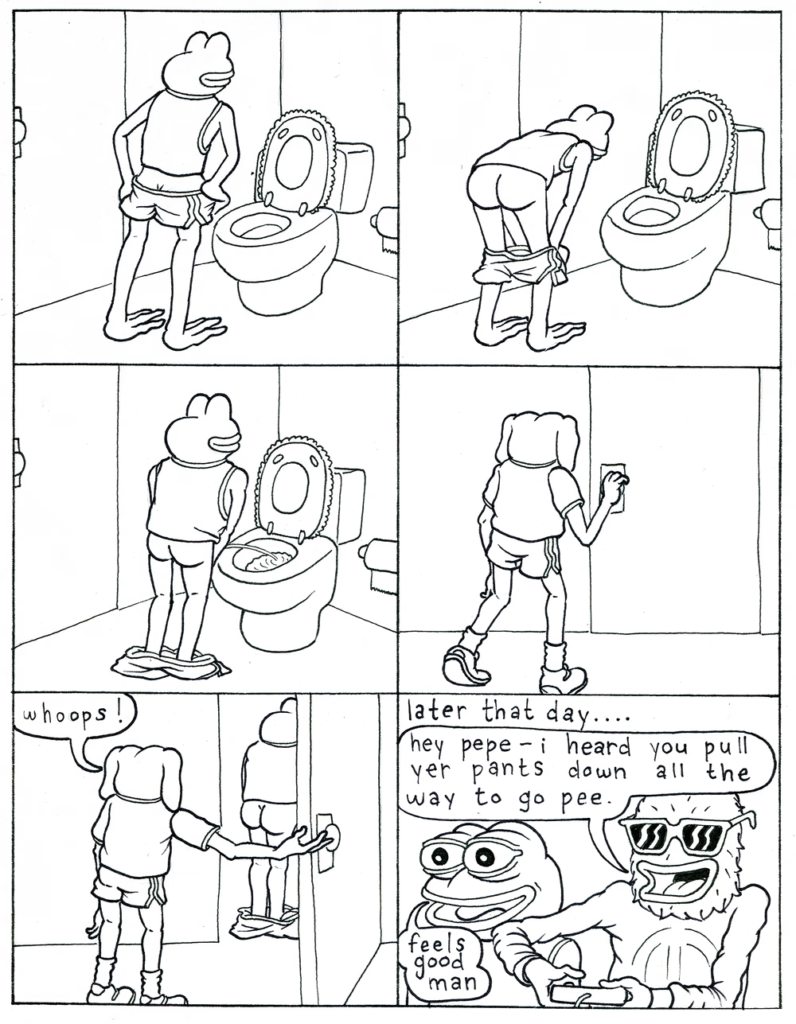

Pepe the Frog NFT Genesis

Artist: Matt Furie

Sold for: 1,001 ETH ($3.5 million) on Oct. 5, 2021

Some Other Asshole

Artist: XCOPY

Sold for: 550 ETH ($2.3 million) on Dec. 5, 2021

DANKRUPT

Artist: XCOPY

Sold for: 469 ETH ($2 million) on Oct. 24, 2021

DECAY

Artist: XCOPY

Sold for: 345.69 ETH ($1.4 million) on Dec. 5, 2021

AI Generated Nude Portrait #7 Frame #184

Artist: Robbie Barrat

Sold for: 300 ETH ($1.1 million) on Oct. 5, 2021

3AC’s Starry Night Capital had transferred all of its NFTs to a single wallet in June, prompting speculation about an upcoming fire sale. Over the last two days, the NFTs have been transferred to a new Gnosis Safe address now in Teneo’s possession.

The liquidator appreciated Van Dough’s cooperation in getting access to the NFTs and ensuring that they weren’t disposed improperly or without authorization from the bankruptcy court. Van Dough is also likely to assist with the final sale of the NFTs, it added.

It isn’t clear yet how much the NFTs will be sold for. Teneo is subsequently expected to share further details on the NFT liquidation process.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.