Waiting for altcoin season: Why recent rallies may just be strong bounces

Few people agree on what altcoin season really means — but this model still gives it a solid crack

ddRender/Shutterstock modified by Blockworks

Crypto markets are giving hints of altcoin season. But we’re not there yet.

The total crypto market cap has jumped almost 20% since earlier this month, swelling by over $360 billion to $2.35 trillion. Altcoins are responsible for about 40% of those gains, with the rest coming from bitcoin.

But first, let’s define altcoin season.

One sometimes-cited index says an altcoin season starts when three-quarters of the top 50 coins have performed better than bitcoin over the past 90 days.

Only 34% of the top 50 have beaten bitcoin across that period. There was a very brief period at the start of the year where those conditions were met but it didn’t pan out into a full-blown altcoin season.

As loyal Empire readers would know (subscribe to the daily newsletter here), a different way of tracking altcoin seasons includes much more of the market than just the top 50. But even that still says we’re far away.

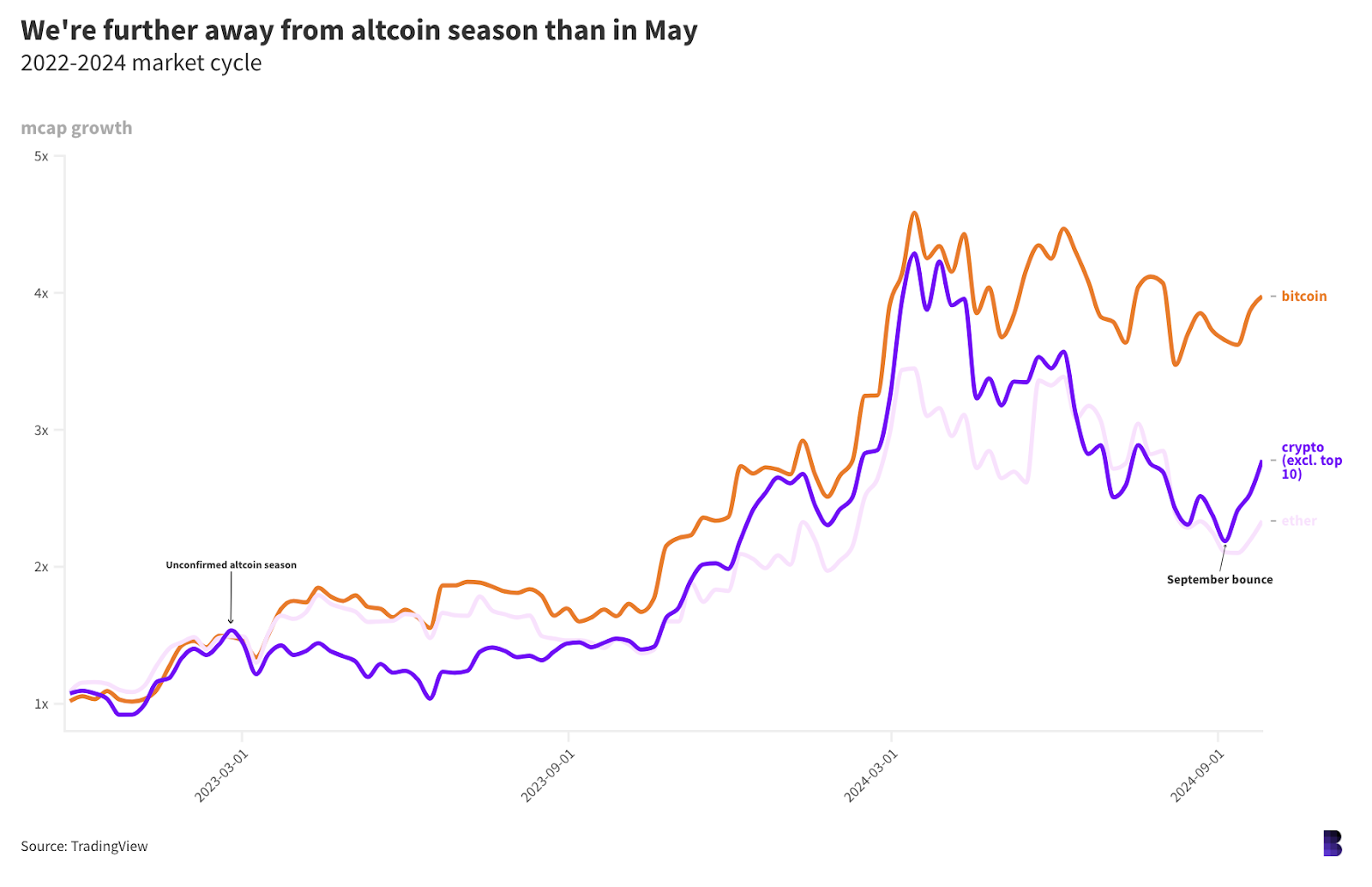

Altcoin seasons are possible when the blue line (altcoins) rises above the orange line (bitcoin).

Altcoin seasons are possible when the blue line (altcoins) rises above the orange line (bitcoin).

It goes like this: Altcoin season potentially starts when the market cap growth of the entire crypto market — minus the top 10 — eclipses that of bitcoin, starting from the cycle bottom.

A full-blown season is only confirmed if the wider crypto market grows faster than bitcoin for at least 90 days in a row.

It’s not a perfect model, but it holds up during backtesting. It’s also generous to altcoins. In many cases, market cap growth merely reflects the rate at which tokens are unlocked and added to circulating supplies — not price appreciation.

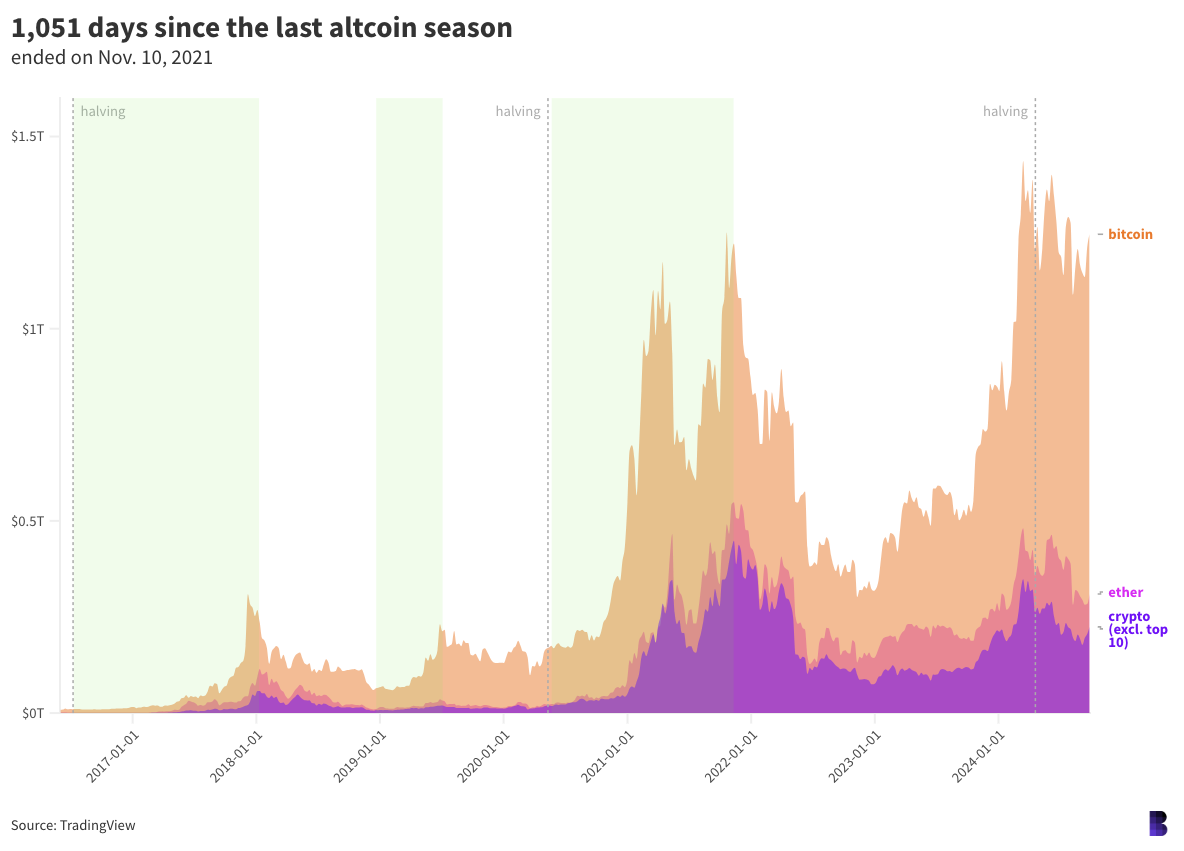

Based on these rules, crypto has seen three distinct altcoin seasons in the past eight years, as shown by the green shaded areas on the chart below.

- 18 months between July 2016 and January 2018 — litecoin, monero, ethereum classic, dash and proto-prediction market token augur were in the top 10.

- Six-and-a-half months between December 2018 and July 2019 — bitcoin cash, EOS, stellar and bitcoin sv were close to blue-chip status.

- Nearly 18 months between May 2020 and November 2021 — polkadot and chainlink sat at the top end.

Altcoin seasons have arrived directly after bitcoin halvings, but not always.

Altcoin seasons have arrived directly after bitcoin halvings, but not always.

The current market cycle started on Nov. 21, 2022, when crypto’s total market cap slipped to $727.58 billion following the FTX debacle, its lowest point since December 2020.

Bitcoin’s market cap has grown by almost four times from that cycle bottom — from $313.4 billion to $1.27 trillion ($15,500 to $64,400).

Altcoins, meanwhile, have grown by less than 2.8x over the same period, which means we’re over a whole order of magnitude away from altcoin season.

That gap had increased dramatically between April and the start of this month, when altcoin season was the furthest away it’s been all cycle. It was at its closest when bitcoin peaked in March.

All that implies that most recent altcoin rallies are really just solid bounces. Altcoin prices corrected hard after bitcoin’s recent all-time high and have only now broadly returned to where they were at the end of July.

Bears would say that altcoin season won’t arrive before the bull market runs its course.

Bulls, however, might reason that we’re in for what could be the most powerful altcoin season on record — considering how far they still have to run.

A modified version of this article first appeared in the daily Empire newsletter. Subscribe here so you don’t miss tomorrow’s edition.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.