Kanye West’s YZY memecoin is the last thing crypto needs

The token has crashed over 65% and been marked as dangerous due to its contract’s permissions

Doloves/Tinseltown/Shutterstock and Adobe modified by Blockworks

This is a segment from The Drop newsletter. To read full editions, subscribe.

Did Shopify dropping Ye push him to promote his own crypto payments processor — and memecoin?

The rapper formerly known as Kanye West’s X account, which has been frequently purged after bizarre bouts of antisemitic and incoherent tweets for years, is now promoting “YZY Money.”

Earlier this year, Shopify stopped powering payments for Ye’s Yeezy apparel website after the rapper began selling swastika t-shirts, resulting in the website’s temporary disappearance.

A Shopify spokesperson said at the time back in February that the Yeezy site “did not engage in authentic commerce practices and violated our terms.”

Shopify’s legal counsel ultimately clarified that the Yeezy Shopify site was taken down due to a risk of fraud to consumers, not because of the Nazi swastika itself.

Details of an internal Slack memo from Shopify legal counsel described the t-shirt as a “vile, disgusting, and inexcusable” stunt. They also said it “was not a good faith attempt to make money” and “brought with it the real risk of fraud.”

Now there’s a YZY memecoin, Ye Pay, and the YZY Card.

Let’s all take a moment and ask ourselves: What could go wrong?

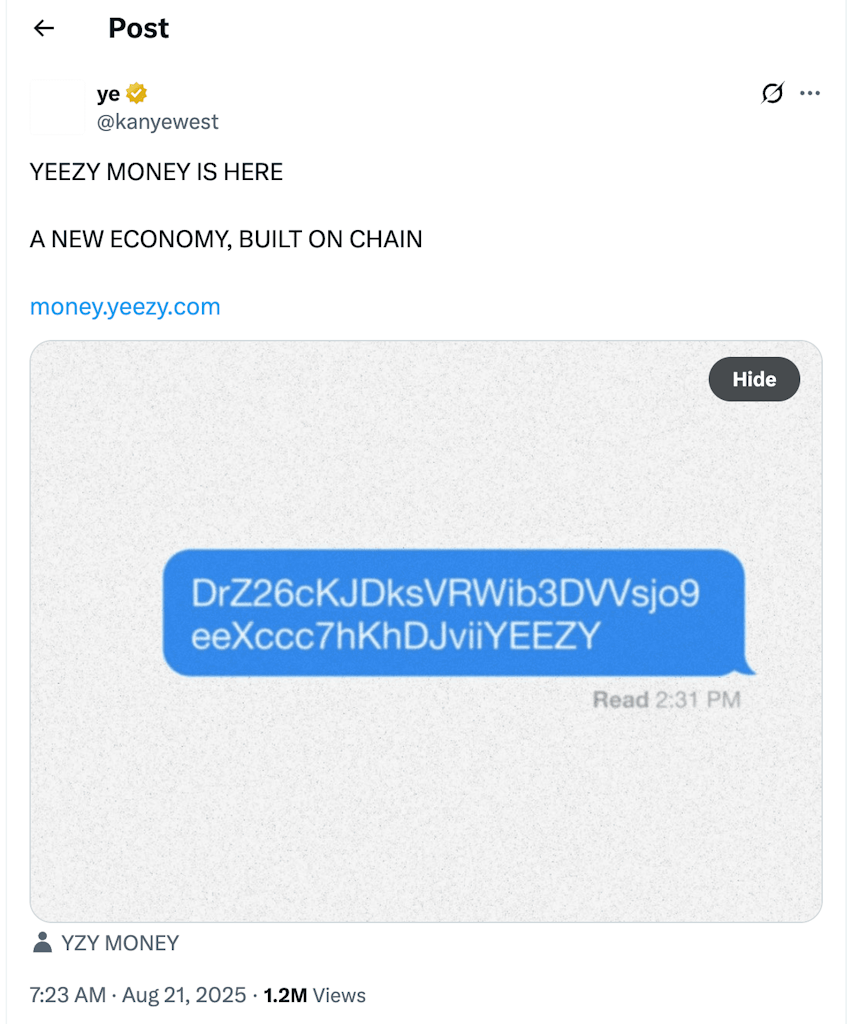

The memecoin is live and a contract address is visible on the Yeezy website and the rapper’s X account.

But RugCheck’s analysis of the token cautions: DANGER.

“The contract creator can make changes to the token contract such as contract metadata, disabling sells, changing fees, unrestrictive minting of more tokens, transferring tokens etc.,” a warning from RugCheck that appears on CoinGecko reads.

The YZY Money website claims the whole point here is to “put you in control, free from centralized authority.”

But of course, if you buy in, it’s helping Ye free you of some of your cash.

Here’s a look at the “YZYNOMICS” of this token:

The YZY Money website suggests Ye Pay is a “payments processor” that will be available to other online merchants.

The non-custodial Yzy Card is not currently available, but a waitlist has seemingly been opened for it. It’s envisioned as a way to spend YZY and Solana-based USDC.

The Yeezy site currently accepts credit card and debit card payments, as well as USDC on Solana. It promises that payments in the YZY token are “coming soon.”

Symbolically, all of this is the last thing crypto needs. Crypto does not need more Nazis, self-described or otherwise.

Do we really want figures like Ye being the spokespeople of our industry? Do we want this to be the thing your Average Joe thinks about when he thinks about crypto?

Crypto still has a bad PR problem — and moves like this will only make that worse.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.