Pantera Capital’s Morehead: We Are in a New Bull Cycle

Pantera, which earlier this year set its bitcoin price target to hit $115,000 by August 2021, has long looked to bitcoin halving cycles as a timeline for price movements.

Dan Morehead of Pantera Capital at Blockworks Digital Asset Summit 2021; Photo by Mike Lawrence

- Dan Morehead says the days of vast price swings may be a thing of the past

- Historically, bitcoin has seen two bear markets where the currency lost 83%, but the most recent two have been -61% and -54%, respectively

Just in time for bitcoin’s latest rally, Pantera Capital has released its investment letter and the firm is as optimistic as ever.

“My sense is that we finished the halving cycle in April,” Morehead wrote in Pantera’s October blockchain letter. “We had a period of temporary insanity — where Chinese mining bans were thought to be negative and a few people had blockchain ESG upside down — and now we’re in a new bull market.”

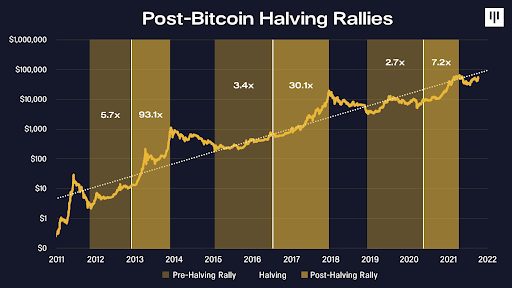

Pantera, which earlier this year set its bitcoin price target to hit $115,000 by August 2021, has long looked to bitcoin halving cycles as a timeline for price movements. The world’s largest cryptocurrency typically sinks about 15 months prior to halving, which occurs every 210,000 blocks, before rising and rallying after the halving.

The most recent halving was in May 2020, but the rally peaked early in April 2021 when bitcoin broke $64,000. Looking to halvings, Morehead said, is important when trying to understand the change in the stock-to-flow ratio across each halving.

The first halving reduced the supply of new bitcoins by 15% of the total outstanding bitcoins, he said, resulting in a major impact on new supply and pricing. The 2020 halving, by contrast, had less than a third of the impact on price.

“Each subsequent halving’s impact on price will likely taper off in importance as the ratio of reduction in the supply of new bitcoins from previous halvings to the next decreases,” Morehead wrote. “Below is a chart depicting past halvings’ supply reductions as a percentage of the outstanding bitcoin at the time of the halving.”

All this means, Morehead said, that the wildly volatile price swings bitcoin has been known for will likely start to calm.

“I long advocated that as the market becomes broader, more valuable, and more institutional the amplitude of price swings will moderate,” he wrote.

Historically, bitcoin has seen two bear markets where the currency lost 83%, but the most recent two have been -61% and -54%, respectively. This also of course means that bitcoin’s bull markets will not see such dramatic swings either.

“Unfortunately, there’s no free lunch,” Morehead said. “The flipside is we probably won’t see any more of the 100x-in-a-year rallies either.”

Even without a 100% increase, there is still room left in this rally, Morehead said, but to be clear he is still bullish.

“If it ever hits -83% again, I’m going ALL IN,” he wrote.

Pantera did not provide an updated price target in this letter.