Powell: Tapering Might Begin This Year, Rate Hike Far Off

Powell said that the central bank may begin tapering its $120 billion/month asset purchases this year, although a rate hike will not be coming soon.

Jerome Powell, chair, Federal Reserve, Blockworks Exclusive Art by Axel Rangel

- Powell stays on script that inflation will be transitory

- Rate hikes are unlikely to come in the near future

Federal Reserve Chairman Jerome Powell said that the central bank may start to scale back its asset purchases this year during his virtual Jackson Hole policy forum address Friday. He also stressed that the recent inflation surge will fade in time.

During the July meeting, “I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace,” Powell said Friday, referring to the Fed’s $120 billion monthly asset purchase pace.

Powell noted that the economy has progressed since July in terms of employment numbers, but the rise of the delta variant may pose additional challenges.

“The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the delta variant,” Powell said. “We will be carefully assessing incoming data and the evolving risks.”

Stocks gained on the news. The energy, materials and communication sectors pushed the S&P 500 higher Friday after closing lower on Thursday.

“The market is taking Powell as slightly dovish, and then it seemed a bit confusing because he did say that the Fed is going to taper QE starting this year, but we always expected that,” said Tom Essaye, founder of Sevens Report Research. “That’s what everybody’s expected and priced in, instead what Powell did was spend most of his speech pushing back on the idea that inflation is a problem.”

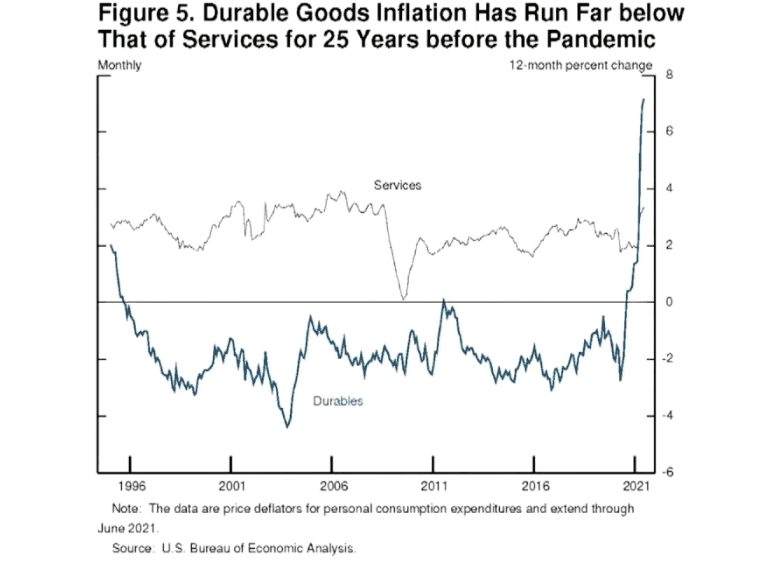

Powell continued to insist that today’s 4% inflation will not be lasting, also claiming that today’s wage increases are unlikely to impact inflation significantly.

“We will continue to monitor this carefully, policymakers and analysts generally believe that as long as longer term inflation expectations remain anchored, policy can and should look through temporary swings in inflation,” Powell said.

There will not be any interest rate changes, Powell said, until the economy reaches “conditions consistent with maximum employment,” and inflation has reached 2%.

June’s quarterly projections revealed that seven of 18 Federal Open Markets Committee participants believed raising rates next year would be appropriate. Thirteen expected rate increases would be appropriate by 2023.

“I agree that 4% Inflation is transitory, I think that some of what we are seeing is not to go away,” said Essaye. “I think that inflation is going to run between 2% and 3% now pretty consistently, which isn’t necessarily a problem, but it’s also something we’re not used to.”

Powell’s address comes as President Biden weighs whether or not to nominate the head of the central bank for a second term.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.