Solana Advances Despite Broad Crypto Sell-Offs: Markets Wrap

Amid the sea of losses for major cryptos, Solana’s native token hit an all-time high of $194.82 on Tuesday morning.

Blockworks exclusive art by Axel Rangel

- Bitcoin shed more than 10% in an hour on Tuesday morning, according to Messari

- Total crypto market capitalization remains above $2 trillion, according to Messari

Bitcoin, ether and solana suffered big losses today due to whale leverage liquidations and sell-offs in the face of mixed news from Latin America.

While El Salvador officially adopted bitcoin as legal tender, a Panamanian Congressman proposed a ‘crypto law’ and outages on various crypto exchanges, bitcoin and ethereum plunged.

Bitcoin fell the most it has since May, shedding more than 10% in an hour, according to Messari. A day before its steep decline, bitcoin benchmarked a four-month high, trading over $52,000. At the height of the sell-off, bitcoin prices were down to almost $42,000. The largest crypto by market inched its way back up above $47,000, as of press time.

Ethereum experienced a similar fall, shedding over 13% on-day. Despite notching a 24-hour low of roughly $3,000, ether rose to $3,400 in the afternoon. Total crypto market capitalization remains above $2 trillion.

Although some investors were shocked by the sell-off, others referred to it as a market correction. According to Calvin Chu, council member and core builder at Impossible Finance, volatility across platforms were “bound to happen”, adding that despite El Salvador’s bitcoin adoption there are still “drawbacks after positive news.”

“With many platforms these days offering leverage, small swings can lead to larger cascades, so it’s always important for users to be careful when trading and do their own research prior to investing,” Chu said.

Also, certain investors wanted to capitalize on the dip, but major trading platforms such as Binance and Coinbase had technical difficulties and outages on Tuesday.

Despite its early loss, Solana’s native token later hit an all-time high of $194.82 on Tuesday morning following FTX’s launch of a minting platform for non-fungible tokens (NFTs). After jumping 30% in the morning, the altcoin, whose blockchain is commonly used to mint NFTs, simmered down to $173.78, as of press time. The token has been on a recent hot streak as NFT sales surge, dethroning dogecoin as the sixth largest crypto by market cap last week.

DeFi

- Uniswap (UNI) is trading at $24.05 with a total value locked of $4,714,827,167 declining -18.2% in 24 hours at 4:00 pm ET.

- Chainlink (LINK) is trading at $27.97, down -20.4% with trading volume at $3,550,267,721 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 30% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $46,737.35, declining -10.05% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,414.03, down -13.59% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.073, shedding -1.93% at 4:00 pm ET.

Insight

PARSIQ CEO Tom Tirman weighed in on price action in crypto markets following El Salvador’s adoption of bitcoin as legal tender on Tuesday.

“Seemingly, some large holder(s) [are] selling and others [are] panic selling as a result. From the perspective of fundamental analysis and macro view, markets are bullish and this looks like a stop run,” Tirman said.

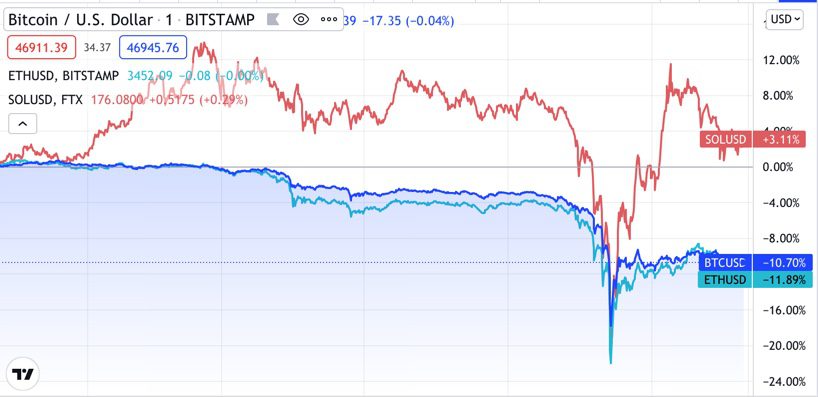

Solana (SOL), Bitcoin (BTC) and Ethereum (ETH) trading over the past day Source:TradingView

Solana (SOL), Bitcoin (BTC) and Ethereum (ETH) trading over the past day Source:TradingViewShares of crypto-related stocks such as Coinbase Global Inc. and MicroStrategy Inc. fell on Tuesday, shedding 4.18% and 9.02% by market close. Wall Street indices were mixed with small gains in the tech-heavy Nasdaq Composite.

Equities

- The Dow declined -0.76% to 35,100.

- S&P 500 is down -0.34% to 4,520.

- Nasdaq advanced 0.07% to 15,374.

Commodities

- Brent crude was down to $71.5 per barrel, declining -0.9%.

- Gold fell -2.07% to $1,795.9.

Currencies

- The US dollar strengthened 0.56%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.371% as of 4:00 pm ET.

In other news…

Three-time NBA champion Stephen Curry has entered into a long-term partnership with the crypto exchange FTX and West Realm Shires Services Inc., Blockworks reported on Tuesday. Curry, who recently purchased a Mutant Ape Yacht Club NFT, will become a global ambassador for the company and receive an equity stake in FTX Trading Limited.

We are looking out for

- European Central Bank President Christine Lagarde will hold a press conference after the central bank’s rate decision on Thursday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.