Solana and Terra Tokens Rise Amid NFT Craze: Markets Wrap

“It’s great to see some divergence among different assets as we saw Solana (SOL) and Terra (LUNA) continue to hit all-time highs, which I believe shows that this asset class [will] continue to mature,” said Founding Principal of BKCoin Capital Kevin Kang.

SHUTTERSTOCK

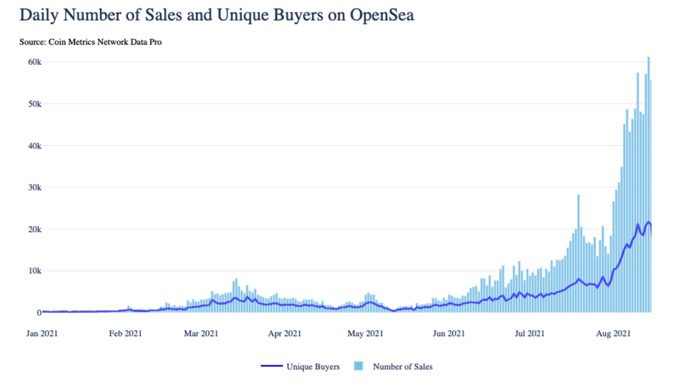

- NFT marketplace OpenSea hit over $1 billion in sales in August, benchmarking their highest number of unique daily buyers to date

- DeFi protocol Ondo raised $4 million in seed funding from big-name investors like Pantera and Genesis

Solana and Terra token prices made sizable gains on Tuesday amid the onslaught of booming non-fungible token (NFT) sales, including the increasing popularity around animal-based NFTs.

The Degenerate Ape Academy was listed on NTF platform Solanart over the weekend. Solanart, which uses the Solana blockchain to mint the digital art, sold all 10,000 cartoon apes in eight minutes on Saturday.

Following the news, Solana shot up 28% on Monday and rose 15.68% on-day. Overall, SOL is up +83.02% in the past week, according to CryptoSlate. In addition, Terra’s LUNA token was up 15.41% on Wednesday and 73.92% over the past seven days.

OpenSea, one of the largest NFT marketplaces, hit over $1 billion in sales in August, benchmarking their highest number of unique daily buyers, according to Coin Metrics Network Data.

In funding news, DeFi protocol Ondo raised $4 million from big-name investors like Pantera and Genesis. Founded by two former Goldman Sachs employees Nathan Allman and Pinku Surana, the seed funding will go toward launching further yield strategies and expanding staff. Co-founder Allman added that the company has “just scratched the surface of opportunity in DeFi with services like lending, trading, and basic derivatives.”

DeFi

- Uniswap is trading at $26.53 with a total value locked of $4,765,744,171 down -7.1% in 24 hours at 4:00 pm ET.

- Chainlink is trading at $25.67, declining -5.9% with trading volume at $1,566,624,139 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 32.8% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $44,899.04, down -0.27% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,030.10, shedding -1.40% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.067, up 0.17% at 4:00 pm ET.

- VIX advanced 9.83% to 19.67 at 4:00 pm ET.

Insight

Founding principal of BKCoin Capital Kevin Kang recapped market action from Tuesday, predicting that some divergence among different assets (i.e. SOL and LUNA) could be a sign of maturing crypto markets.

“[The] crypto market wasn’t immune to the equity market sell-off yesterday as bitcoin and ethereum both slid [and] broke below $45,000 and $3,000, respectively,” Kang said to Blockworks. “It’s great to see some divergence among different assets as we saw Solana (SOL) and Terra (LUNA) continue to hit all-time highs which I believe shows that this asset class [will] continue to mature.”

Source: Coin Metrics Network Data Pro

Source: Coin Metrics Network Data ProEquities declined following signals that the Federal Reserve may taper back bond purchases as early as this year, Federal Open Market Committee (FOMC) minutes revealed on Wednesday. However, it was not clear when exactly the tapering would begin or in what sector, Blockworks reported.

Markets opened lower on Wednesday after lower-than-expected July housing data. The monthly report by the Commerce Department indicated that US housing starts tumbled, mult-family homes fell 13.1% while single-family figures dropped 4.5%.

All major indices closed in the red.

Equities

- The Dow was down -1.08% to 34,960.

- S&P 500 fell -1.07% to 4,400.

- Nasdaq declined -0.89% to 14,525.

Insight

“I believe a lot of investors took off risk assets yesterday to see how markets will react to the Fed minutes today as they wait to see when the Fed will start tapering their $120 billion a month in bond purchases,” Kang said.

Commodities

- Brent crude fell to $67.71 per barrel, declining -1.88%.

- Gold was up 0.02% to $1,786.20.

Fixed Income

- US 10-year treasury yields 1.272% as of 4:00 pm ET.

Currencies

- The US dollar strengthened 0.03%, according to the Bloomberg Dollar Spot Index.

In other news…

Binance announced Greg Monahan as the crypto company’s new global money laundering reporting officer on Tuesday, Blockworks reported. Monahan, who was the former US Treasury criminal investigator, is set to help expand its AML detection and analytics capabilities.

We’re watching out for…

- US initial jobless claim are released on Thursday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.