Binance Hires NBA Star to Warn Against Celebrity Ads

NBA’s Jimmy Butler says ‘trust yourself’ in crypto exchange’s Twitter post ahead of Super Bowl

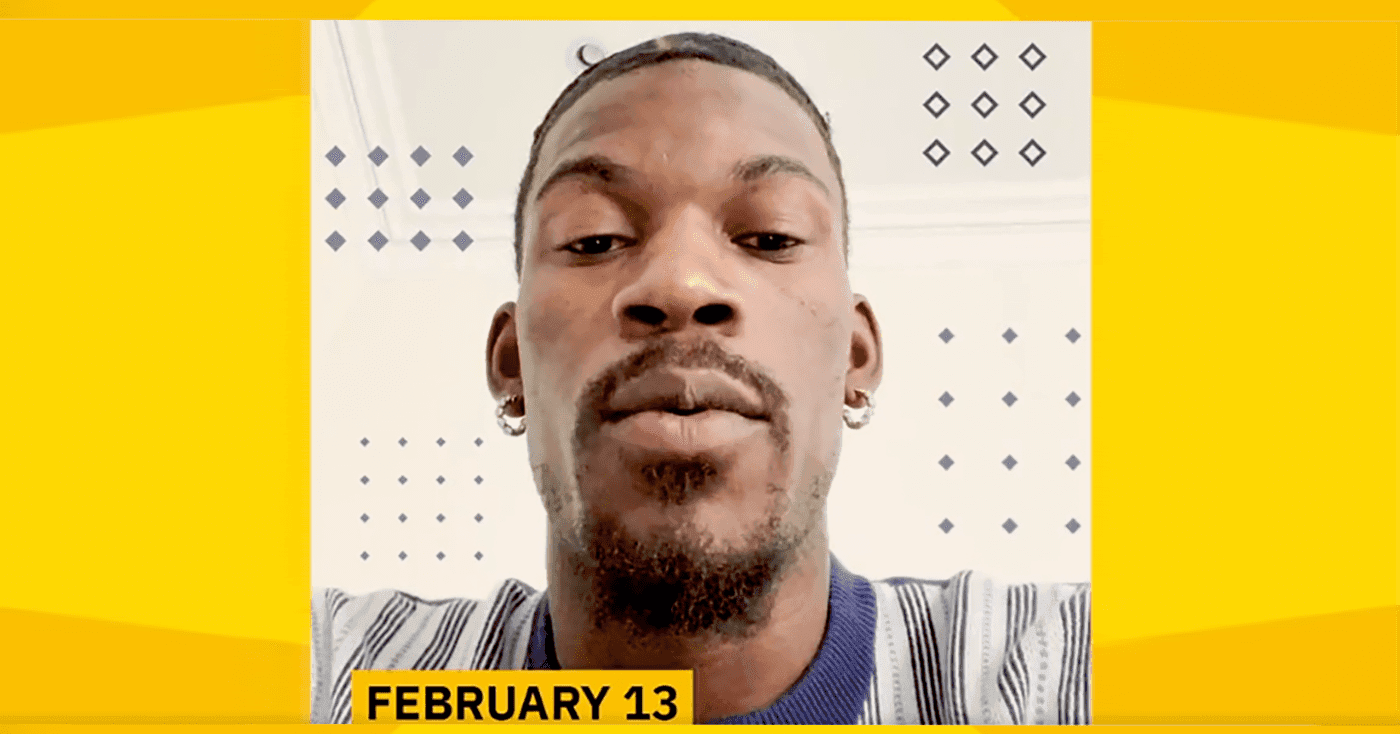

Source: twitter.com/binance

- Miami Heat Forward Jimmy Butler urges people to ‘do your own research’ about crypto

- Crypto.com and FTX will reportedly run ads during the Super Bowl on Feb. 13

Binance has used a celebrity to tell prospective crypto users not to listen to celebrities.

In a Twitter post on Wednesday, Binance shared a video with five-time NBA All-Star Jimmy Butler, who warned that people will be told by celebrities to get involved in crypto on Feb. 13, the day of the Super Bowl in the US.

The Wall Street Journal reported in December that crypto companies Crypto.com and FTX would be buying ads for the NFL championship game.

Spokespeople for the firms have declined to comment on specific marketing plans around the event.

“They don’t know you or your finances; only you do,” Butler said of celebrities in the video. “Binance and I are here to tell you, trust yourself and, of course, do your own research. Be on the lookout for more before the game.”

A Binance spokesperson told Blockworks the crypto exchange would be teaming up with Butler and other celebrities that are “known for their honesty and independence” to remind consumers of their financial freedom.

The firm is set to reveal more about the campaign next week, the representative added.

In addition to the reported Super Bowl ads, crypto firms have utilized celebrities as a way to build brand awareness over the past year.

Crypto derivatives exchange FTX partnered with Tom Brady, Kevin O’Leary, Stephen Curry and Shohei Ohtani, among others, to help build its brand in 2021.

In a year capped off by buying the naming rights to what was formerly the Staples Center in Los Angeles as part of a 20-year, $700 million deal, Crypto.com also began running a television commercial featuring actor Matt Damon.

Voyager Digital teamed up with Nascar driver Landon Cassill and NFL tight end Rob Gronkowski last year.

Not all companies in the space are looking to celebrity deals as a way to bolster brand awareness.

WisdomTree CEO Jonathan Steinberg said the asset manager would be sticking to “lean marketing principles” when discussing the firm’s upcoming digital assets consumer app during an earnings call last week.

“We’re not going to put our brand on a sports stadium,” he said. “We’re not going to hire Matt Damon to be in our TV commercials.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.