Bitcoin Extends Sell-Off, Falls Over 10%

Bitcoin has fallen roughly $30,000 since hitting an all-time high of more than $63,000 in April.

Source: Shutterstock

- Bitcoin extended its sell-off and fell more than 10% to a two-week low Tuesday

- Alternative coins were also down Tuesday with ethereum and XRP each crashing nearly 12%

Bitcoin extended losses Tuesday as the price crashed more than 10% to a two-week low.

Bitcoin has fallen roughly $30,000 since hitting an all-time high of more than $63,000 in April. Alternative coins were also down Tuesday with ethereum and XRP each crashing nearly 12%.

“It’s hard to know who is selling and where the pressure is coming from,” said Roshun Patel, vice president at Genesis. “There’s been news about prominent hedge funds taking quite a bit of profits from crypto in this recent cycle, and that has me thinking about what the average cost basis in this market looks like.”

When looking at the long-term macro cycle, Patel said, there were a lot of institutional allocations that occurred that were able to push bitcoin to previous all-time highs into the $20,000 and $30,000 ranges.

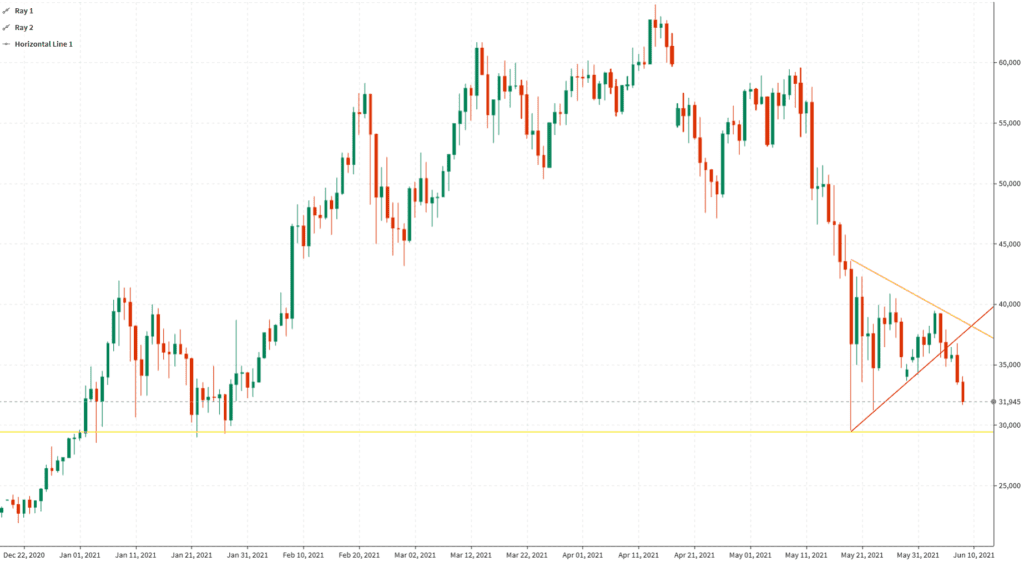

The price of bitcoin since December 22, 2020, through June 8, 2021. Source: Forexlive

The price of bitcoin since December 22, 2020, through June 8, 2021. Source: Forexlive

“If there are some macro headwinds coming up, institutions are inclined to say, ‘we made a little bit of money on bitcoin, it could make sense to de-risk a little bit there,’” he said.

While retail investors tend to think more in the short-term when it comes to allocations, institutions are more likely to play the long game.

“Retail tends to pile into the market, whereas the institutional side is a little bit more patient,” said Patel. “Retail is exhausted, and now institutions could carry the next leg of this market. They’re not going to be recklessly lifting the order books, especially on random coins, going into this sort of crash.”

Other coins also fall

The volatility in the bitcoin market is playing into other coins’ sell-offs, Patel said. When bitcoin was about $50,000, prior to the current sell-off, there was a lot of investor allocation moving into alternative coins. If bitcoin had stayed around the $50,000 level, we would have likely seen a rise in other coins.

“But what happened was the polar opposite,” said Patel. “Bitcoin went down significantly, so all that inventory that was scraping into alternative coins at those levels kind of came back into bitcoin, or even cash then to buy bitcoin, because bitcoin now became cheap and attractive again.”

Narratives like the recent news that US officials recovered most of the ransom paid to hackers that targeted Colonial Pipeline can play into broader price movements, Patel said. But the institutions and investors that understand the space are not likely to be influenced.

“This could be a pretty good time for the institutions that are actually reading underneath the headlines to get some pretty good fills in and be able to achieve the same allocation thesis that they’ve always had,” said Patel. “Fundamentally, nothing has really changed there. What has changed is the surface level headlines, which do drive narratives and flows.

The largest digital currency was trading at $32,058 at time of publication, according to data from CoinGecko.