Coinbase $2.23B Q2 Earnings Exceeds Estimates

Coinbase reports higher-than-expected Q2 earnings with more ethereum trades than bitcoin for the first time ever.

Blockworks exclusive art by axel rangel

- Coinbase reports revenue more than 1,000% higher than this time last year

- Citing increased trading volume and new users, Coinbase revenue totaled $2.2 billion for the second quarter of 2021

Despite a widespread selloff in the cryptocurrency market, Coinbase Global (ticker COIN) reported higher-than-expected second quarter earnings Tuesday, bolstered by trading volumes and an increase in users.

Shares of the digital asset exchange rose as much as 2.1% in the extended trading session Tuesday following the earnings report release.

Coinbase reported $2.23 billion in revenue, exceeding the $1.85 billion expected from analysts surveyed by Bloomberg.

Profit for the second quarter was $1.6 billion, compared with $32 million in 2020.

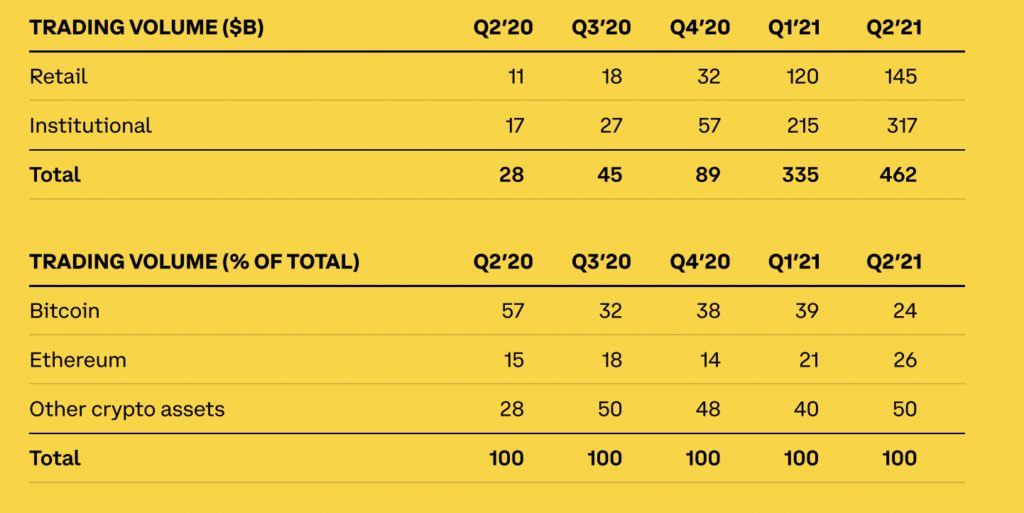

For the first time in its history, Coinbase reported a higher trading volume of ethereum than bitcoin with 26% of trades being in ETH. Twenty-four percent of trades were in bitcoin, the exchange reported.

Source: Coinbase

Source: Coinbase

Coinbase also reported an increase in institutional trading volume, after the exchange emphasized this as a growth area in its first quarter earnings.

In its shareholder letter, Coinbase revealed that 13% of Americans have traded cryptocurrencies in the last year. The exchange cited that 24% of Americans have traded stocks.

“These adoption trends paired with recent government attention on crypto as a revenue source suggests we have reached an inflection point,” Coinbase said in the letter. “Crypto has arrived.”

Share price performance

The results follow disappointing share price performance. After nearly hitting $430 shortly after its initial public offering, COIN fell as much as 51.5% to $208.

“With shares down by such a large percentage, there is a chance we could see some re-engagement, according to analysts at Goldman Sachs,” said Fiona Cincotta, senior financial markets analyst at City Index.

At the time of publication, COIN was trading at $269.67.