Coinbase, Compound Labs Launch USDC High-Yield Accounts

The launches come as USDC continues to draw investor interest. USDC is the most trusted stablecoin by investors, according to University of Zurich.

Blockworks exclusive art by Axel Rangel

- Coinbase is debuting a crypto savings account where users can earn 4% annually by lending out USDC

- Compound Labs, in partnership with Fireblocks and Circle, launched a new subsidiary, Compound Treasury

It was a big week for USD Coin (USDC), the dollar-backed stablecoin that Coinbase issues in partnership with Circle, lending rates.

Coinbase is debuting a crypto savings account, the exchange announced Tuesday. Users can earn 4% annually by lending out USDC.

Decentralized finance (DeFi) firm Compound Labs, in partnership with Fireblocks and Circle, launched a new subsidiary, Compound Treasury Monday. Treasury Accounts will convert US dollars to USDC and deploy them to the Compound Protocol. Users can also earn 4% interest.

Circle revealed plans for Circle Yield, a new DeFi application that is used for Compound Treasury. The product offers returns based on the duration of the deposit.

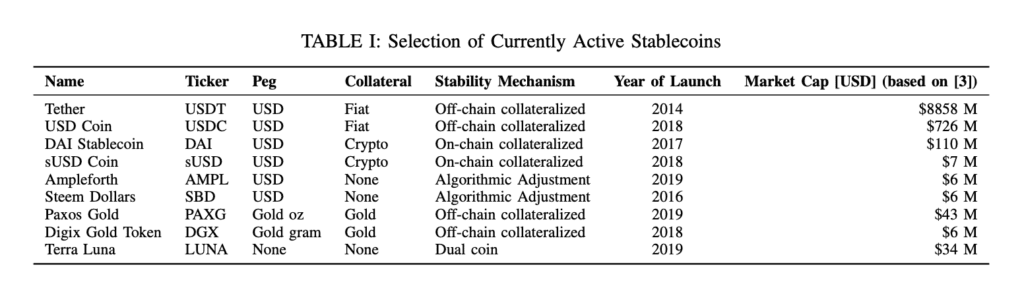

The launches come as USDC continues to draw investor interest. USDC is the most trusted stablecoin by investors, according to a new University of Zurich report. The stablecoin’s market capitalization also grew by over 50% in the weeks following the crypto market crash in March 2021.

Analysis of Stablecoins during the Global COVID-19 Pandemic, University of Zurich

Analysis of Stablecoins during the Global COVID-19 Pandemic, University of Zurich

Pre-enrollment for Coinbase’s account is now open. The exchange is betting that users will be lured with high yields.

“Everyone wants to get the best interest rate available for the assets they hold. But interest rates have decreased steadily over the past few decades, making it difficult to earn meaningful passive income on your assets,” Coinbase said in the announcement. “The national average for a traditional savings account hovers around 0.07%, with high-yield savings accounts still falling well short of even 1%.”

Coinbase’s account is not FDIC or SIPC-insured and offers less interest than many similar, competing accounts, such as Celsius and Nexo, which offer 13% and 12%, respectively. The USDC product launch comes shortly after the exchange’s bitcoin lending program. Coinbase offers users up to $20,000 in credit with an interest rate of 8% for bitcoin-backed loans for contracts that are 12 months or less.