Crypto Markets Bet Big on What’s Next For Ethereum Miners

Ethereum classic and bitcoin gold were the best performing top-100 crypto assets in July, with both tokens doubling in value

Source: Shutterstock

- Tokens powering GPU-mineable blockchains saw major price surges last month

- Blue-chip DeFi assets also saw a resurgence as sentiment turns on centralized entities

Crypto traders are betting on the next blockchain to attract out-of-work Ethereum miners after the network’s pending scheduled switch to proof-of-stake.

The hoards of high-performance graphics chips that once secured the Ethereum network will be practically useless for mining its blockchain after “the merge,” which is set to ditch the energy-intensive proof-of-work in favor of its own brand of collateral-powered consensus.

Digital asset markets — speculative beasts — have largely gambled on two potential new homes for all those mining rigs: Ethereum Classic (ETC) and Bitcoin Gold (BTG).

The native tokens for both blockchains, which were hard-forked away from Ethereum and Bitcoin in 2016 and 2017, respectively, were easily the best performing top-100 digital assets in July.

Hard forks occur when network participants seek substantial changes to a protocol’s rules, splitting the network into two versions. In Ethereum Classic’s case, some sought to protect its immutable nature following The Dao hack, after which lost funds were rolled back.

Bitcoin Gold, on the other hand, forked to adopt a new mining algorithm which made high-performance ASIC rigs obsolete to prioritize mining with standard graphics processing unit (GPU) chipsets.

ETC skyrocketed 143% in the past month, from $15 to $36.50, nearly triple the returns of ether (ETH), which jumped 56%. ETC’s is now about flat year-to-date.

BTG, meanwhile, more than doubled in July, from $15 to nearly $31, outperforming bitcoin (BTC), which rose a comparatively meager 16%. BTG is still down about 30% in 2022.

For scale, the top-100 tokens (sans stablecoins and crypto-backed assets) on average climbed 26% throughout the month.

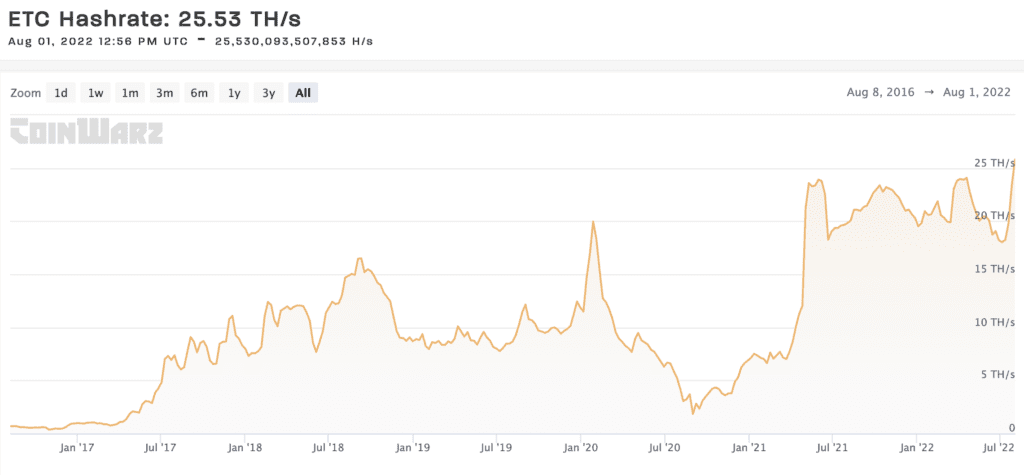

Ethereum Classic hash rate hits all-time high

Both ETC and BTG are mineable with the same GPUs on which Ethereum miners rely. ETC is the second-biggest cryptocurrency mineable with graphics cards.

So, the market is betting that Ethereum miners will increasingly support the ETC ecosystem in their attempts to strengthen the coin, Jaran Mellerud, Arcane research analyst, told Blockworks in an email.

“At current price levels, other GPU mineable coins don’t provide nearly enough mining revenue to support a significant share of the current Ethereum hashrate,” Mellerud said. “Miners’ only option to avoid dumping their GPUs and crashing the GPU market is to pump the prices of other GPU mineable coins like Ethereum Classic.”

For what it’s worth, Ethereum Classic has attracted more miners lately. Its hash rate (which measures overall computing power on the network) jumped 40% last month, now at its highest point ever at 25.34 terahashes per second, per mining portal CoinWarz.

Bitcoin Gold’s hash rate, which is far smaller than Ethereum Classic, also rose, but only by 9% — and it’s still a tiny fraction of its initial hash rate from 2017.

Ethereum’s hash rate has remained relatively steady all month. At 996 terahashes per second, the network boasts almost 38 times the processing power than both Bitcoin Gold and Ethereum Classic combined.

Pent-up Polygon price action leads to overperformance

Ethereum scaling platform Polygon’s native asset MATIC was the next-best performer of the month, booking 93% gains.

Positive sentiment was in part fueled by pent-up demand for MATIC following a string of high-profile partnerships secured throughout the year — including deals with Meta and Stripe — said Vivek Raman, head of Proof of Stake at crypto financial services firm BitOoda.

Raman noted Polygon has also delivered new products in Polygon Avail and Supernets, and has also been fostering a strong DeFi ecosystem with a push into NFTs and media via Polygon Studios.

“Despite all the business development wins, Polygon’s token suffered through the crypto crash,” Raman told Blockworks. “The 93% gain in July was likely sparked by the announcement of Polygon’s zkEVM, or a zero-knowledge based L2 solution that will scale Ethereum.

Raman dubbed ZK rollups the “holy grail of scaling solutions,” with Polygon being one of the first to market with a scalable product.

“This, coupled with a renewed focus on the Ethereum ecosystem in July, likely drove Polygon’s outperformance,” Raman said.

DeFi sentiment usurps centralized crypto exchange tokens

Over the past few months, traders have sought shelter in native tokens for centralized crypto exchanges, which are perceived to be relatively insulated from the broader market’s ups and downs.

Many of these assets, including Bitfinex’s LEO and KuCoin’s KCS, have burn mechanisms tied to trade volumes, which — combined with buy-back schemes — reduce overall supply as trades are executed.

But sentiment has shifted. LEO, which was the only top-100 digital asset to increase in value throughout June, was the worst performing last month, having sunk nearly 14%. Similarly, Huobi’s offering, HT, fell 7%, while KCS fared slightly better, having risen about 1.5%.

Instead, investors flocked to blue-chip DeFi tokens tied to protocols Curve Finance (CRV), Aave (AAVE), and Convex (CVX) — those assets pumped 92%, 71% and 70%, respectively. Aave’s DAO recently approved the launch of a new overcollateralized stablecoin, while Curve has its own in the works, both geared towards competing with MakerDAO’s stablecoin DAI.

Convex’s native asset is heavily intertwined with Curve, leading to correlation between the two assets, Katie Talati, director of research at digital asset management firm Arca, told Blockworks.

Lenders such as Celsius and Voyager blew up over the past two months, while Singaporean exchange Zipmex halted withdrawals. “This really shakes consumer confidence. Are you going to hold a token for an exchange that won’t let you get your money out? Probably not,” she reasoned.

Talati highlighted that DeFi protocols make it possible to see digital assets inside asset pools, how much lend and borrow activity there is, and what their capital efficiency ratios look like, and even at what levels liquidations occur.

“There’s a lot more transparency. From a narrative standpoint, I would say that’s why blue chip DeFi has outperformed,” Talati said, having noted that Ethereum Classic’s recent returns were likely to be short-lived.

This article was updated on August 2, 12:30am ET, to clarify year of Ethereum Classic’s hard fork.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.