Crypto Moguls Compete for Huobi Majority Stake: Report

Sam Bankman-Fried, Justin Sun contend for founder’s stake in the cryptocurrency exchange

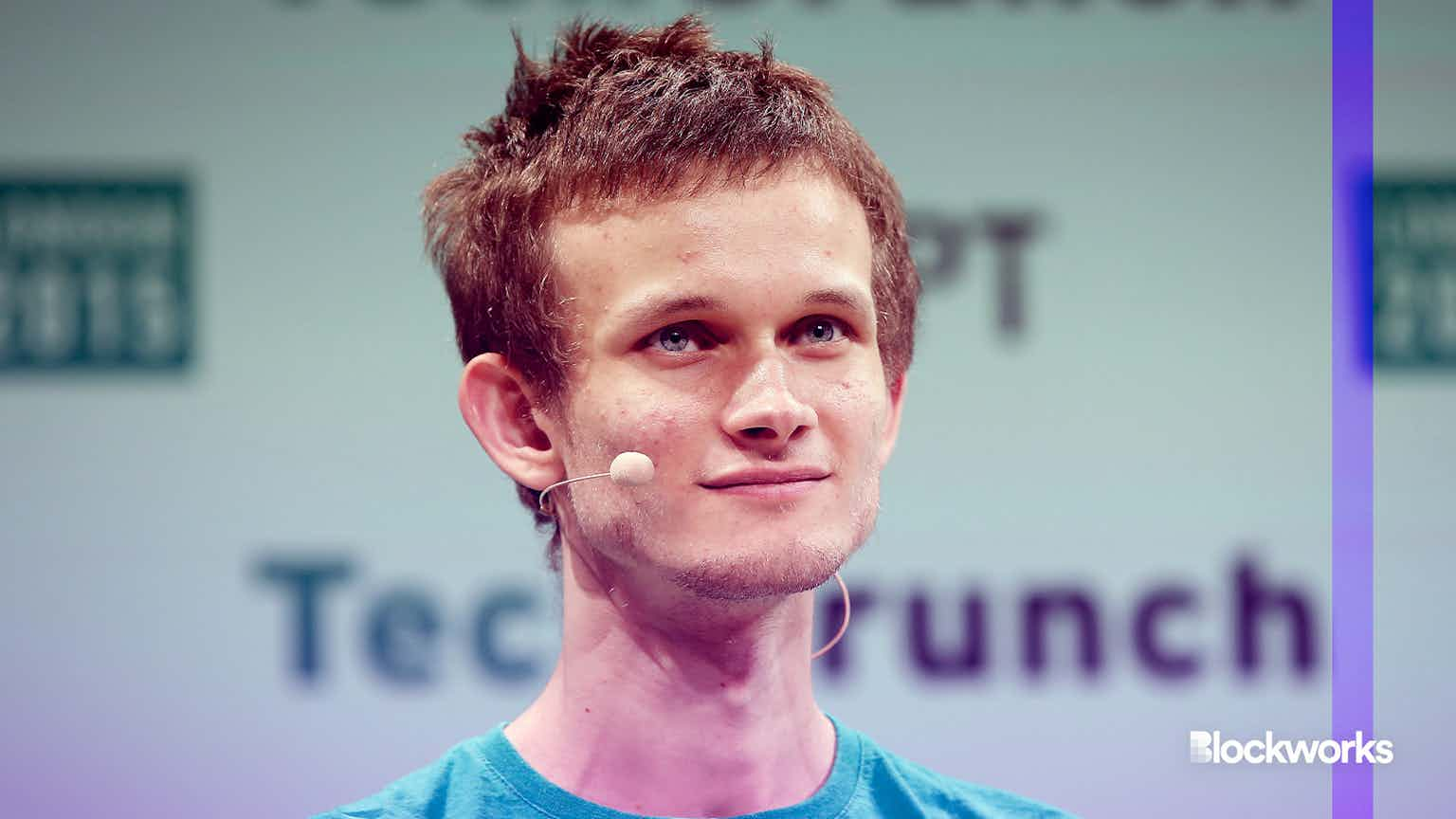

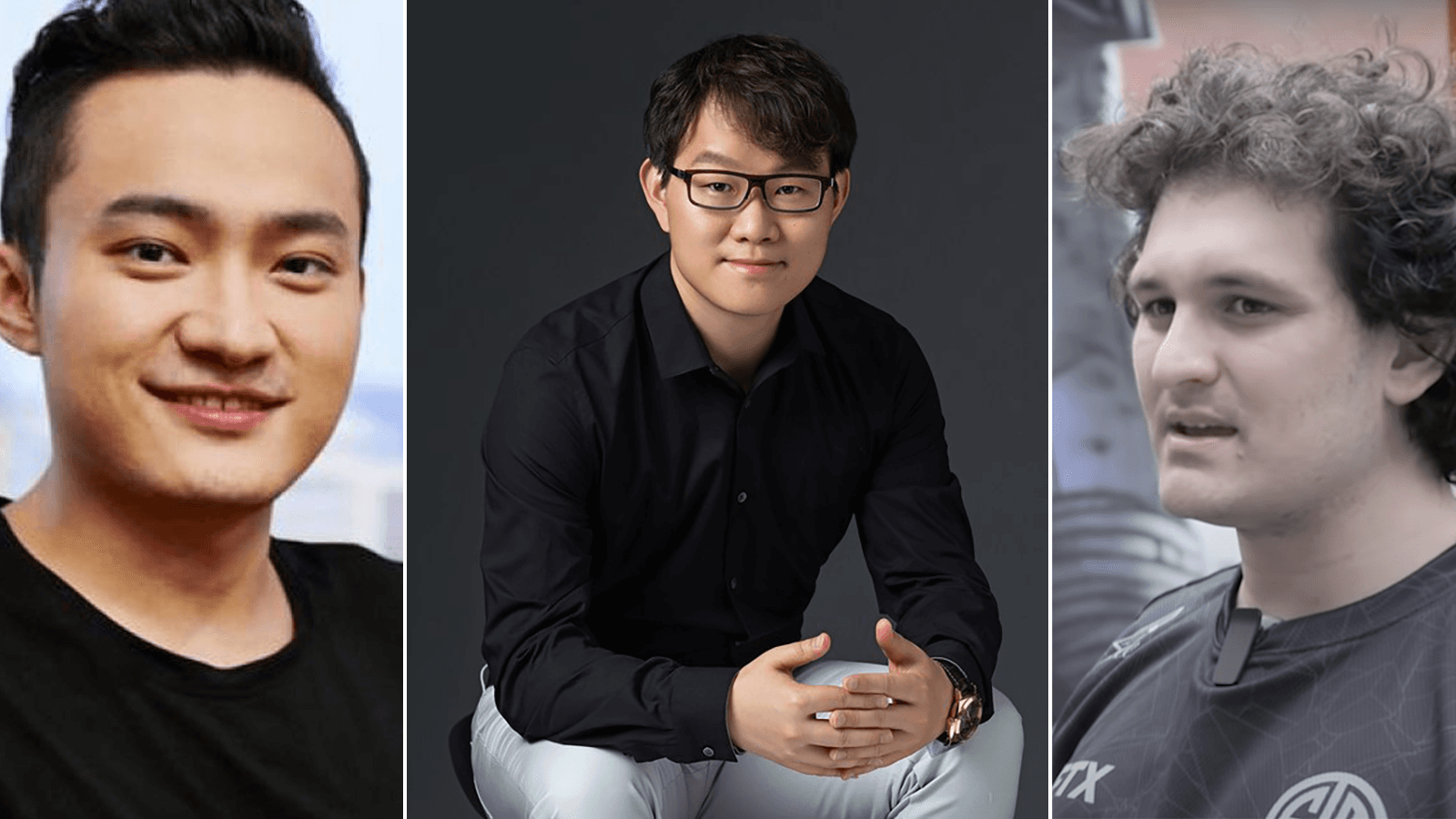

Justin Sun (Source: Piskev91, CC BY-SA 4.0 via Wikimedia Commons); Leon Li (Source: Huobi); Sam Bankman-Fried (Source: Cointelegraph, CC BY 3.0, via Wikimedia Commons

key takeaways

- Huobi founder seeks a valuation of up to $3 billion

- It’s unclear whether affiliate firm Huobi Technology is part of the stake sale

Leon Li, the founder and CEO of Huobi Global, is in talks with investors to sell his majority stake in the cryptocurrency exchange, Bloomberg reported on Friday, citing unnamed sources.

Li, who co-founded Huobi in 2013, reportedly wants to sell about 60% of his stake. He’s aiming for a valuation between $2 billion to $3 billion, implying that a sale could generate over $1 billion, the report said.

FTX founder Sam Bankman-Fried and Tron founder Justin Sun are among potential investors that have held preliminary discussions with Huobi about the stake sale, it added.

As one of the world’s largest crypto trading platforms, Huobi often sees daily volumes above $1 billion. The exchange slowly pulled out of servicing users in China — previously a hotbed of revenue and clientele — after the country declared crypto-related transactions illegal last year.

It isn’t clear whether the stake involved includes the company’s Hong Kong-listed affiliate Huobi Technology, which manages digital assets for investors. Huobi Tech’s shares are down 45% so far this year, TradingView data shows.

Huobi, FTX and the Tron Network didn’t return Blockworks’ request for comment by press time.

Some well-positioned venture capitalists and investors considered the recent meltdown in cryptocurrency markets as a buying opportunity for new projects. Periods of turmoil in the market are also seen as the best time to develop new services in the crypto sector.

Bankman-Fried took it upon himself to go on a deal frenzy, announcing agreements to buy Canadian crypto trading firm Bitvo, as well as Embed Financial and BlockFi. He also offered to bail out Voyager Digital, but the bankrupt crypto lender denied what it termed his “low-ball” bid.

Sun — who prefers to be known as His Excellency after a 2021 diplomatic appointment from the Caribbean island nation of Grenada — said last month he was prepared to join Bankman-Fried in offering financial support to companies within the crypto ecosystem, saying that he and the Tron protocol he founded were “ready to serve.” Sun previously acquired a stake in crypto exchange Poloniex and file-sharing pioneer BitTorrent, now called Rainberry, for $140 million.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.