Fort Worth Becomes First City to Mine Bitcoin

The city said the three 2017-vintage machines will mine enough bitcoin to cover electricity costs

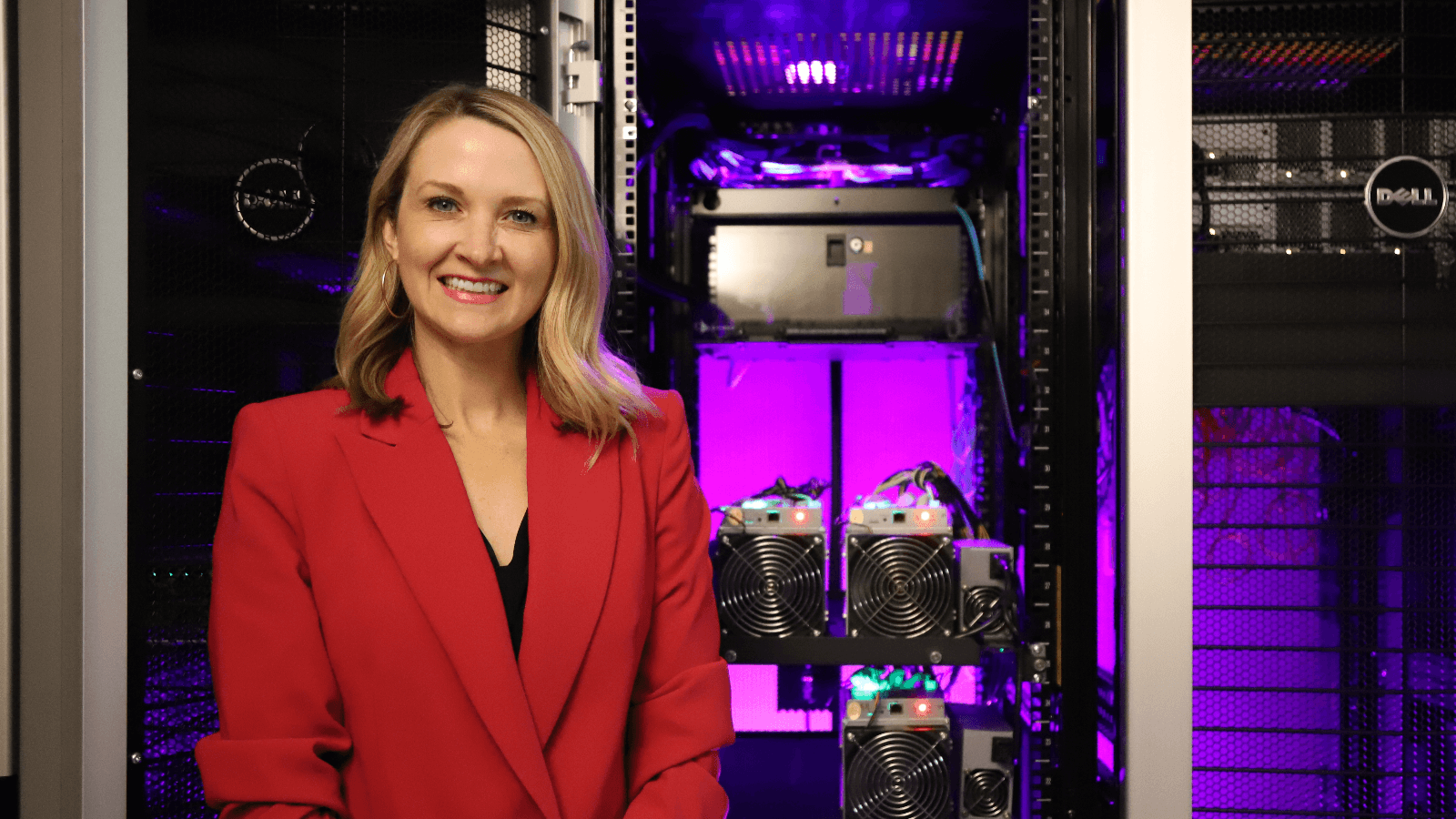

Fort Worth Mayor Mattie Parker

- The Texas Blockchain Council has donated three bitcoin mining machines to the Fort Worth City Council

- The program will run for six months before officials evaluate its impact and value

The city of Fort Worth, Texas, says it will start mining bitcoin on Tuesday, potentially becoming the first US city to do so, city authorities said.

The Texas Blockchain Council, a nonprofit association made up of companies and individuals that work in the blockchain industry, donated three Bitmain s9 bitcoin mining machines to Fort Worth, enabling the city to launch what it calls “a mining pilot program.” The Fort Worth City Council voted to formally accept the donations Tuesday.

Beginning Tuesday afternoon, machines will run 24/7 in the information technology solutions department data center located at Fort Worth City Hall. The machines will be housed on a private network to minimize security risk, city authorities said.

“With blockchain technology and cryptocurrency revolutionizing the financial landscape, we want to transform Fort Worth into a tech-friendly city,” Fort Worth Mayor Mattie Parker said. “Today, with the support and partnership of [the] Texas Blockchain Council, we’re stepping into that world on a small scale while sending a big message — Fort Worth is where the future begins.”

Starting small with three machines will allow authorities to experiment with mining on a manageable scale, Parker added. After six months, city officials will evaluate the program.

The city expects that each machine will use the same amount of energy as a household vacuum cleaner, or about 3,900 to 4,000 watts, officials said. The cost of energy is expected to be offset by the value of the bitcoin mined, officials said, but despite the energy rate in Texas being lower than the national average, this may not be the case. The s9 miners, which were released in 2017, would only break even if the city can power them for about 2.5 cents per kilowatt-hour, according to CryptoCompare.

The news comes as other local governments start to look into the crypto mining industry and energy usage as more miners move their operations to the US. New York state legislators are expected to vote on a bill that would ban proof-of-work cryptocurrency mining for at least two years as soon as this week.

Texas, with its cheap energy and favorable regulations, has become a hotspot for miners in recent months. Seven large mining companies and 20 smaller ones are currently based in the state, according to data from the Texas Blockchain Council.

“Texas is an energy state and it has too much to gain,” said Colin Harper, head of content and research at Luxor Technologies, a mining services company working with the city of Fort Worth on the project. “Many politicians in Texas are starting to see the benefits bitcoin mining can bring, be those from tax revenue, job creation, or grid stabilizing.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.