Initial Jobless Claims Fall for Third Straight Week, Producer Prices Surge

Investors look for direction following producer price data and initial jobless claims as they continue watching the Fed for signals that tapering may start soon.

BLOCKWORKS EXCLUSIVE ART BY AXEL RANGEL

key takeaways

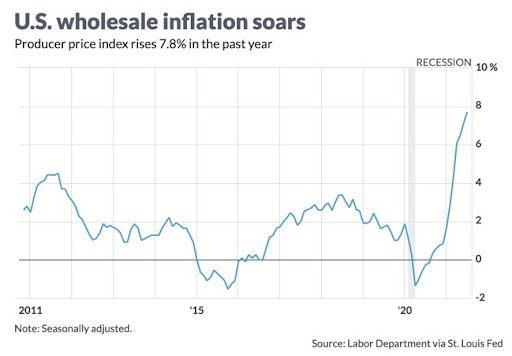

- PPI hiked 7.8% year over year, according to a report by the US Bureau of Labor Statistics on Thursday.

- Initial jobless claims fell to 375,000

Initial jobless claims fell for a third week in a row as producer prices jumped to the highest they have been in over a decade.

The overall producer price index (PPI) hiked 7.8% year over year, according to a report by the US Bureau of Labor Statistics on Thursday. Minus energy and food, the index advanced 6.2% from July 2020.

PPI, used by some investors as a broad inflation gauge, may continue an upward trend as the US economy lifts Covid restrictions.

“[PPI data] underscores that commodity inflation is still quite high. It’s not really declining as much as people had hoped for. A lot of that is supply chain-related and a lot of it is related to Covid resurfacing in China,” President of Sevens Report Research, Tom Essaye said. “That’s going to keep overall inflation elevated. There’s no question about it, but at the time it is still likely temporary. I think that’s why the market is still taking it in stride.”

Elsewhere, initial jobless claims fell 12,000 to 375,000, according to the US Labor Department on Thursday.

The seasonally adjusted insured unemployment rate fell 0.1% to 2.1% for the week ending on July 31.

The unadjusted level of insured unemployment state programs was 2,817,487 overall from the previous week. In August 2020, it was 15,254,654, 10.4% lower than the same time last year.

These two reports follow consumer price index (CPI) data on Tuesday, a measure of how much Americans pay for goods and services the month before.

Consumer prices rose 5.4% in July from a year earlier, benchmarking the fastest inflation rise in over a decade. However, CPI rose 0.5%, in line with economists’ expectations.

Investors looked for direction following the slew of economic data and as they continue watching the Federal Reserve for signals that tapering may start soon.

“I don’t think this will change the Fed calculus at all. The Fed is not concerned about what each month’s data is. They are more concerned about whether or not they can continue to believe that things will return to normal. I think they still do think that,” Essaye said. “If I am sitting in the Fed, I would look at this [data] and think ‘This stinks but ultimately, it is still temporary.’”

US equities were mixed following the news. S&P 500 and the tech-heavy Nasdaq Composite traded sideways with small gains intraday. The Dow Jones Industrial average was little changed, down 0.24% as of press time.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.