JPMorgan Says Bitcoin is 13% Overvalued

Despite estimating that bitcoin is currently overvalued by 13%, JPMorgan analysts say the digital currency could reach $150,000

Blockworks exclusive art by axel rangel

key takeaways

- Bitcoin’s fair value is $38,000, according to strategists from JPMorgan

- Crypto advocates say that bitcoin’s volatility is an advantage

Based on bitcoin’s volatility ratio to gold, the digital currency is currently overvalued by about 13%, according to a group of JPMorgan strategists.

Bitcoin today is roughly four times as volatile as gold, putting its fair value at $38,000, the strategists, led by Nikolaos Panigirtzoglou, said in a report released Tuesday.

“The biggest challenge for bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption,” the report said.

“In an upside scenario where there is more normalization in vol to around 3x, the fair value would be around $50k.”

Strategists maintain a higher long term projection for bitcoin, estimating the digital currency will hit $150,000. This is up from analysts’ previous estimate of $146,000 a year ago.

Crypto advocates argue that JPMorgan strategists are misconstruing bitcoin’s volatility as a weakness.

“The major flaw in JPMorgan’s argument against bitcoin’s resilience is that volatility will hinder broader adoption,” Leah Wald, CEO at digital asset manager Valkyrie Investments, said.

“This stance shows a failure to understand what brings many people and institutions to digital assets and cryptocurrencies in the first place.”

The report comes as the correlation between cryptocurrencies and equities continues to tighten, a trend that threatens bitcoin’s historic status as an uncorrelated asset.

Bitcoin’s investment case is that it is a hedge against other asset classes, Greg Foss, executive director of strategic initiatives at Validus Power Corp, said. The correlation to equities will not last, he added.

“Bitcoin eventually will be viewed as insurance and, therefore, will de-correlate from the rest of the assets,” Foss said.

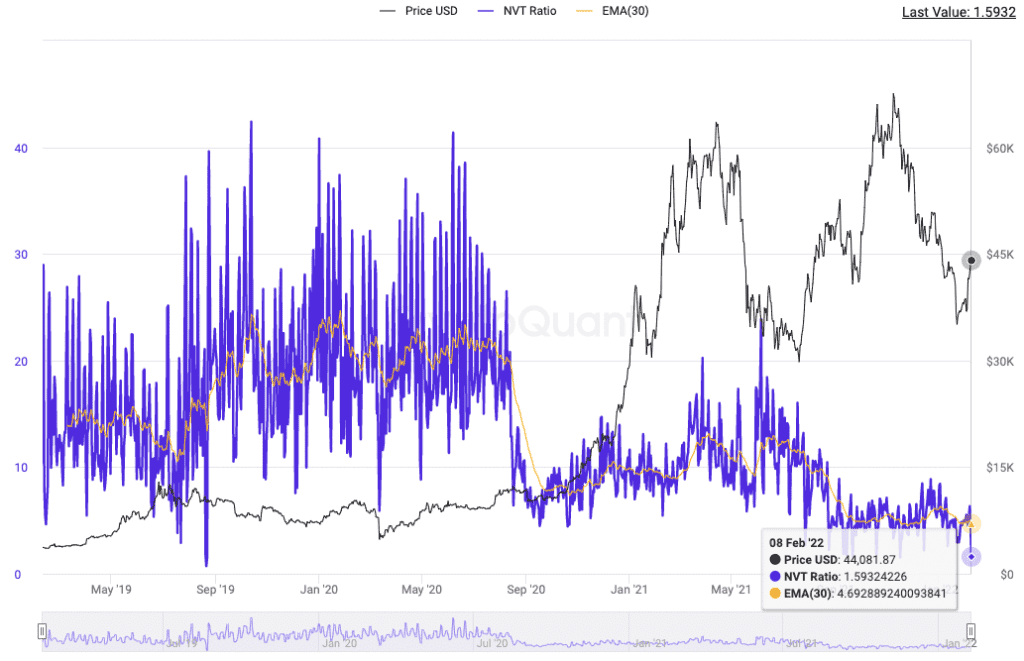

Data from CryptoQuant suggests bitcoin is currently undervalued. As of Wednesday, bitcoin’s network-value-to-transactions (NVT) ratio — a commonly-used fundamental metric — reached a 10-year low on a 30-day exponential moving average basis.

Although the market is still reeling from the recent sell-off, Wald is confident bitcoin will rally soon.

“When looking at metrics, including active wallet addresses, which are still well above where they were during crypto winter, the amount of bitcoin moving off exchanges, which continues to rise and is often an indicator that savvy traders believe the market will move higher, and the seemingly endless parade of venture investments being announced into the space — we remain firmly bullish,” she said.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.