Kyle Roche Moves To Withdraw From Multiple Lawsuits

Ava Labs’ CEO denied relationship with Roche is anything out of the ordinary, despite leaked video

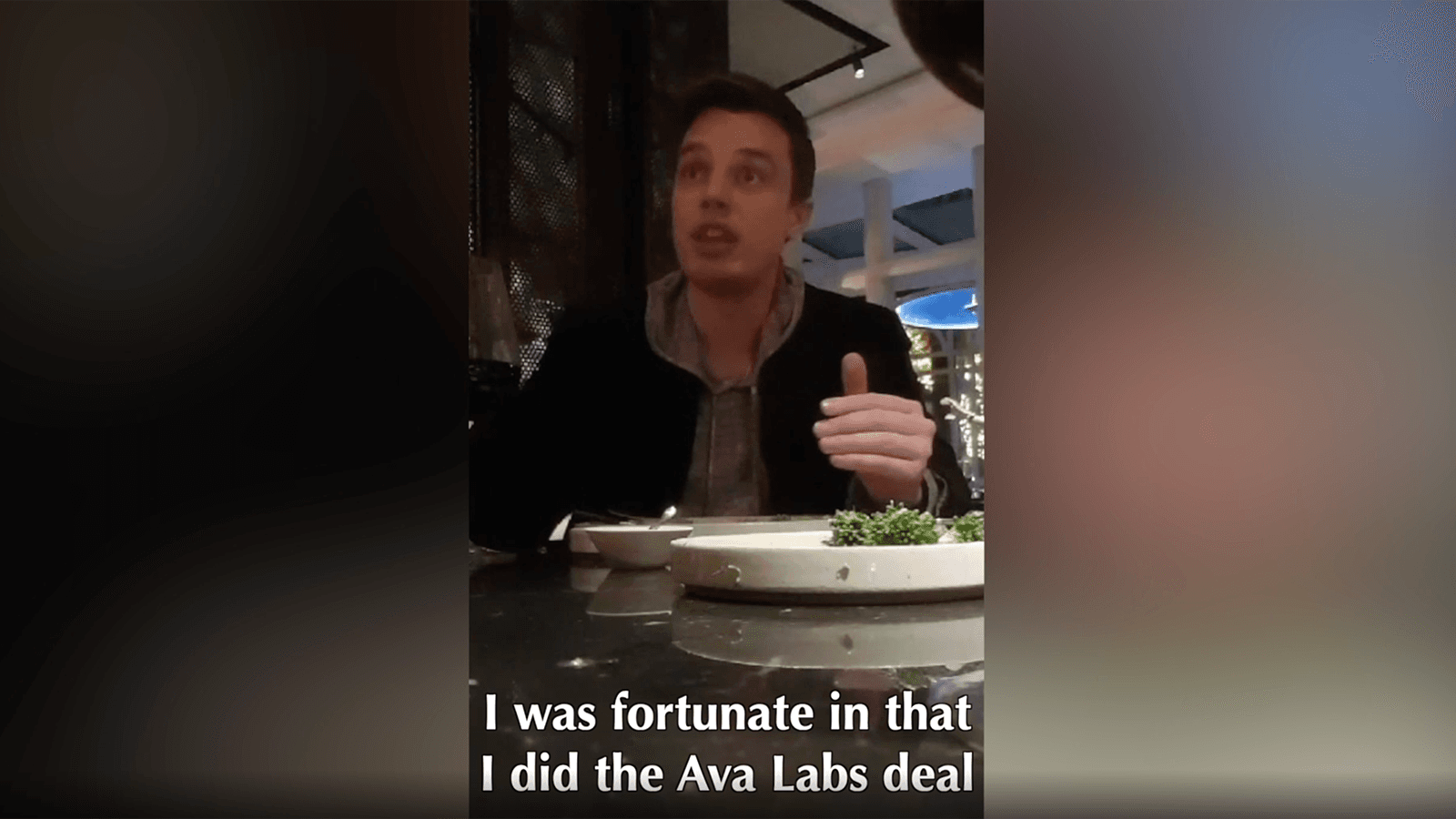

Source: CryptoLeaks

- Kyle Roche filed to withdraw as an attorney in cases against Bitfinex, Tether

- Both Kyle and Ava Labs’ CEO have denied allegations they took part in a secret pact

Kyle Roche, the lawyer recently outed for allegedly engaging in a secret pact to harm players in the crypto industry, is dropping out of multiple class action lawsuits he set up.

Roche has moved to withdraw as one of the attorneys for proposed cases brought against multiple companies including Bitfinex, Tether, DigFinex and Global Trade Solutions, a court document filed in the Southern District of New York on Wednesday showed. The suits claim that the crypto companies were involved in manipulating the digital asset market.

His motion was filed under a rule that states an attorney for a party may be relieved or displaced solely by order of the court.

He has not filed to withdraw in other cases brought against Solana, Dfinity, Celsius, Binance.US and Block.one. But the document stated he is no longer involved in the law firm’s class action practice.

The withdrawal move follows allegations by new website CryptoLeaks that Kyle and Ava Labs, the core developer of the Avalanche blockchain, secretly struck a deal in September 2019. Under the deal, Kyle was directed to sue Ava Labs’ competitors, distract regulators and pursue CEO Emin Gün Sirer’s personal vendettas against individuals, the site’s authors claimed.

CryptoLeaks published a series of 25 videos, totaling about 12 minutes of footage, that showed Roche describing himself as Ava Labs’ in-house crypto expert and admitting to ensuring the Securities and Exchange Commission remains occupied with other targets to chase.

Roche said his crypto expertise was directly attributable to his pursuit of lawsuits against “half the companies in this space.”

Blockworks confirmed with digital media forensics expert Siwei Lyu that the videos were real and there were no traces of alteration.

Roche’s Ava Labs relationship

Following publication of the leaked videos, Sirer sought to distance his company from Roche. In a statement, he said Roche’s claims in the videos were made up and designed to impress a potential business partner, and that Roche was “a lawyer at a firm we retained in the early days of our company…one of more than a dozen law firms we employ for matters relating to tax, corporate, regulatory, and human resources.”

Kyle Roche

Kyle RocheThe close relationship between Roche and Ava Labs executives is clearly ongoing and personal, however. In one video, Roche stated that his equity stake in Ava Labs amounted to “a third” of that of Kevin Sekniqi, Ava Labs’ COO, and that he was temporarily living with Sekniqi in Miami at the time of the video recording.

“Gün and Kevin I trust like brothers,” Roche said.

Roche published a statement in which he identified the meeting shown in the video as being with Christen Ager-Hanssen, a Norwegian venture capitalist, who intended “to deceive and entrap” him due to a business relationship with Dfinity founder Dominic Williams.

Ager-Hanssen — who confirmed on Twitter he was the hidden individual in the videos — denied that he worked for Williams, whom he said he has never met, and called on CryptoLeaks to release the full footage with Roche.

He can be heard in most of the videos, speaking with a pronounced Norwegian accent to Roche’s left. He identified Mauricio Andres Villavicencio de Aguilar, a business consultant, as the third voice, Forbes reported, implying that Villavicencio de Aguilar was responsible for the recording.

Ager-Hanssen published what appears to be an email from Ava Labs’ former director of business development for enterprise and institutional, Sam Wang, dated Dec. 28, 2021, in which Roche is described as “spearheading [Ava Labs’] litigation financing initiatives.”

Sam Wang, Kyle Roche and Roche Freedman didn’t return Blockworks’ request for comment by press time.

After publication, Roche moved to pull out of additional cases against Nexo, BAM Trading Services (the registered name for Binance.US), Solana and Dfinity.

This story was updated on Sept. 1 at 8:37 am ET and Sept. 2 at 3:30 am ET.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.