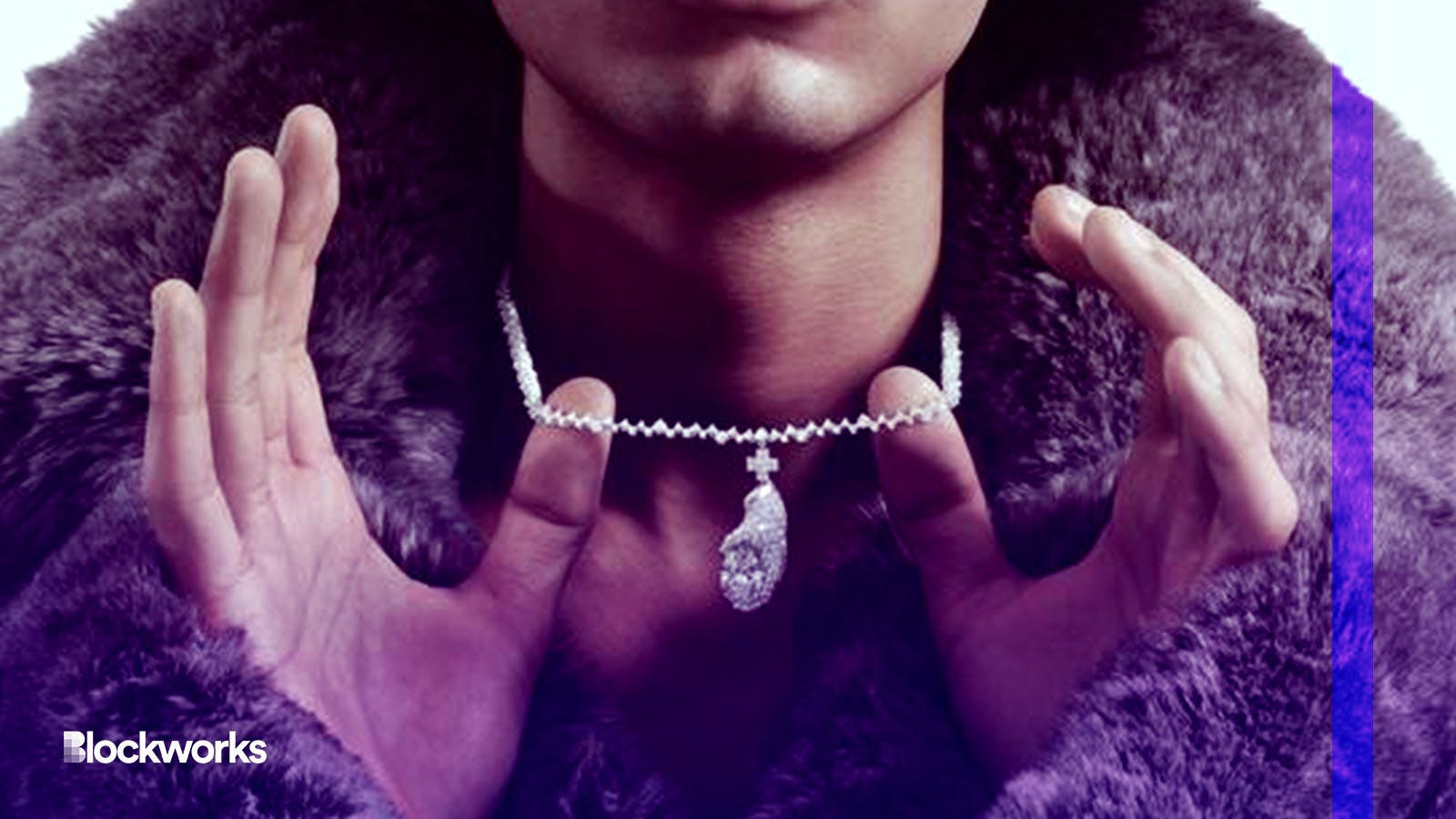

DeFi auction platform puts ‘diamond hand’ necklace under gavel

Bounce Finance will test its “mutant English auction” format with NFT-paired diamond necklace

Bounce Finance modified by Blockworks

Bounce Finance, which is pioneering new DeFi auction mechanics, debuted the proof of concept for its “mutant English auction” format at 10 am ET Friday.

The item on offer is a “Diamond Hand” necklace paired with two NFTs which Bounce calls an “homage to the ‘Hodl’ philosophy” — a reference to the oft used meme of crypto holders through thick and thin having “diamond hands.”

The auction system is not intended to compete with auction houses, CEO Jack Lu told Blockworks.

“For a long time we wanted to work with Christie’s and Sotheby’s,” Lu said, adding they proved to be very conservative. “But I think it’s a good opportunity for us to experiment.”

Read more: Not just for the highest bidder: ‘Mutant’ auction seeks to ensure everyone benefits

The necklace features a lab-created 5.5 carat diamond at its center, cradled by a hand on a 14-carat diamond chain.

From a floor price of 5 ether (about $8,300), bids will increase in 3% intervals until no higher bid is placed within a 24 hours period.

The auction mechanics reward early bidders as subsequent bids not only refund the unsuccessful bidders’ gas fees on the Ethereum mainnet, but also generate a small bonus.

The necklace is designed by artist Nahiya Su and produced by FOUNDO, which describes itself as a Web3-native jewelry brand.

The final winner will receive a pair of NFTs — one embedded in the necklace using a Near-Field Communication chip — and a second commemorative NFT designed by a Sotheby’s featured surrealist artist called 1dontknows.

Bounce’s aim is to apply its research on auction formats to a variety of DeFi use cases including NFTs, tokens and advertising space. Currently, four standardized auction formats, which have been audited by Salus Security, are available to developers via an SDK.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.