Bitcoin and Ether Maintain Upward Trend: Markets Wrap

Altcoins like Cardano and XRP made significant gains on Wednesday, hiking 16.71% and 18.85% as of 4:00 pm ET.

Source: shutterstock

- Neuberger Berman, a $400 billion investment manager, is expanding its fund strategy to include exposure to bitcoin.

- Venmo credit cardholders can now use their monthly cashback to automatically purchase cryptocurrencies with no transaction fee, the company announced.

Bitcoin and ether prices rose on Wednesday, continuing the cryptos’ multi-week upward trend.

Bitcoin hiked 1.84% on-day while ether hiked 3.06% in the afternoon.

Bitcoin faces resistance at $48,000 after trading above its 200-day moving-average earlier this week. Ether faces resistance at $3,400 according to Messari.

Neuberger Berman, a $400 billion investment manager, is expanding its fund strategy to include exposure to bitcoin and other cryptocurrencies without directly holding the assets, according to a Wednesday SEC filing. The fund group’s Neuberger Berman Commodity Strategy Fund can now invest in bitcoin and ether futures contracts, as well as bitcoin trusts and ETFs, Blockworks reported.

Venmo credit cardholders can now use their monthly cashback to automatically purchase cryptocurrencies with no transaction fee, the company announced. PayPal, Venmo’s parent company, launched a business division dedicated to cryptocurrencies in February, one of many efforts to further invest in the industry.

CEO of PayPal Dan Schulman said earlier this year that “with high initial expectations, the volume of crypto trading on our platform greatly exceeded our projections.”

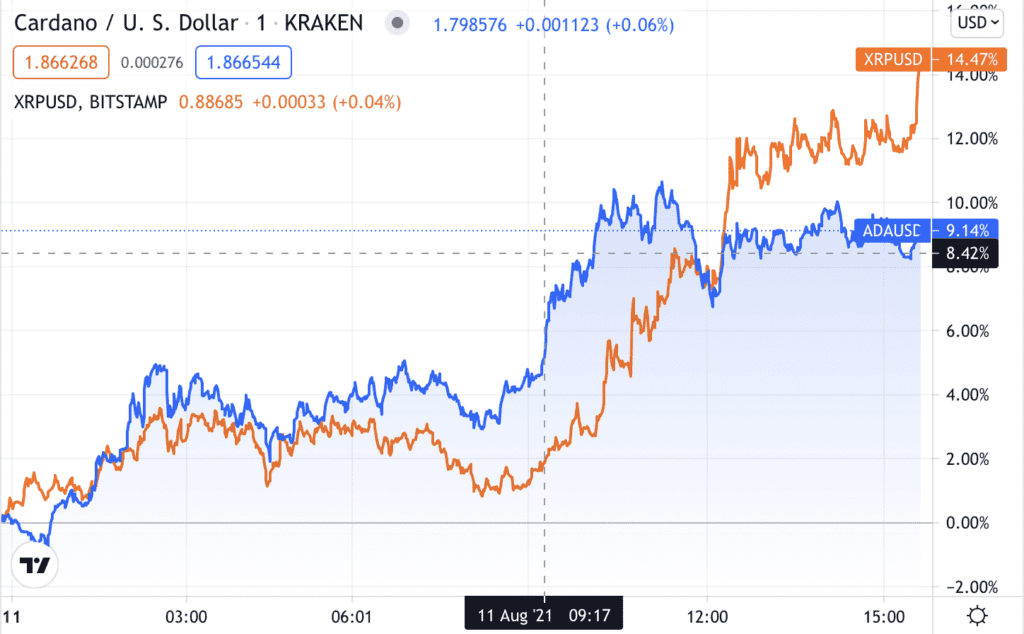

Big winners for the day were altcoins. Cardano and XRP made significant gains on Wednesday, hiking 16.71% and 18.85% as of 4:00 pm ET.

DeFi

- Uniswap is trading at $30.10 with a total value locked of $5,080,305,430 up 2.8% in 24 hours at 4:00 pm ET.

- Chainlink is trading at $27.02, advancing 1.1% with trading volume at $1,295,616,306 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 30.2% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $46,602.37, up 2.14% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,256.92, advancing 3.15% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.069, up 1.37% at 4:00 pm ET.

- VIX fell -4.47% to 16.04 at 4:00 pm ET.

Insight

“There is no putting the crypto genie back in the bottle. Reaching a $1.9T market cap through 8/9/21, crypto has reached the ‘…then they fight you’ stage of adoption,” Alkemi Co-founder Brian Mahoney said to Blockworks. “The market’s continued expansion despite increasing regulatory headwinds is a testament to the mainstay strength of this asset class.”

Cardano and XRP trading over the past day. Source: TradingView

Cardano and XRP trading over the past day. Source: TradingView

US stocks were mixed following July CPI data, which indicated consumer prices rose 5.4% last month. However, investors’ eyes are on the Federal Reserve for tapering signals in the near future, Blockworks reported.

Coinbase Global (COIN) shares were up 5.4% following higher-than-expected Q2 earnings on Tuesday.

Equities

- The Dow was up 0.62% to 35,484.

- S&P 500 advanced 0.1% to 4,436.

- Nasdaq fell -0.16% to 14,765.

Insight

“No big surprises with July’s CPI print at 5.4% yoy – it appears the spike has stalled for now,” Head of Product R&D at Bybit Shane Ai said to Blockworks. “Treasury yields have dipped slightly on short unwinds, reflecting overdone Fed tightening concerns and is supportive of risk assets like crypto and equities.”

Commodities

- Brent crude rose to $71.55 per barrel, advancing 1.30%.

- Gold advanced 1.29% to $1,754.

Fixed Income

- US 10-year treasury yields 1.33% as of 4:00 pm ET.

Currencies

- The US dollar fell 0.18%, according to the Bloomberg Dollar Spot Index.

In other news…

- Cryptocurrency exchange CoinDCX secured its place as the first crypto unicorn in India, following a $90 million Series C funding round. Facebook co-founder Eduardo Saverin’s B Capital Group helped lead the equity round, Blockworked reported.

We’re watching out for…

- OPEC: Oil Market Report is due on Thursday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.