Bitcoin Hovers Below $50K as DeFi Token $SUSHI Topples: Markets Wrap

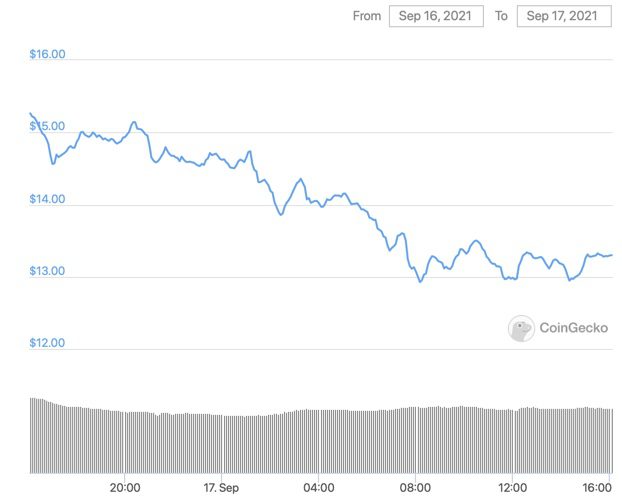

$SUSHI is trading at $13.28, 43.2% lower than the token’s all-time high, according to CoinGecko.

Blockworks exclusive art by Axel Rangel

- Total crypto market capitalization remains above $2 trillion

- Amid an insider trading scandal, OpenSea’s former product head Nate Chastain, updated his Twitter bio to say “Past: @opensea” on Thursday

DeFi token $SUSHI fell Friday on a string of news, shedding 14% in the past 24 hours.

SushiSwap, a decentralized automated market maker which created the token, had a roughly $3 million breach on its token launchpad platform. In addition, one of SushiSwap’s lead developers reportedly relinquished his leadership role to another. $SUSHI is trading at $13.28, as of press time. This is 43.2% lower than the token’s all-time high (ATH), according to CoinGecko. However, in the past week the blue chip token is up 20.7%.

$AVAX, the native token behind Avalanche, continued to rise following the company’s funding news on Thursday. $AVAX hiked 2.46% to $64.78, as of press time. The altcoin has made gains of 114.73% in the past month and is 4.91% away from its ATH. The token is dubbed the twelfth largest digital asset with a market cap of $14.23 billion, according to Messari.

Major cryptos like bitcoin and ethereum were mixed. BTC was little changed up 0.3% and ETH shed roughly 2.5%, respectively. Despite its Friday decline, ether is still up 6.07% in the past week. Total crypto market capitalization remains above $2 trillion.

DeFi

- Terra ($LUNA) is trading at $35.07, declining 7.1% and trading volume at $1,065,496,649 in 24 hours.

- Uniswap ($UNI) is trading at $26.38, advancing 0.8% with a total value locked at $4,897,757,636 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 32.1% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $47,301.79, up 0.32% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,406.51, down -2.62% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.071, rising 0.06% at 4:00 pm ET.

$SUSHI trading over the past day. Source:CoinGecko

$SUSHI trading over the past day. Source:CoinGeckoEquities

- The Dow was down -0.48% to 34,584.

- S&P 500 fell -0.91% to 4,432.

- Nasdaq declined -0.91% to 15,043.

Commodities

- Brent crude was down to $75.33 per barrel, declining -0.45%.

- Gold declined -0.23% to $1,752.6.

Currencies

- The US dollar strengthened 0.33%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.363% as of 4:00 pm ET.

In other news…

OpenSea, one of the largest NFT marketplaces, is at the center of an alleged insider trading scandal. Nate Chastain, former product head of OpenSea, updated his Twitter bio to say “Past: @opensea” on Thursday, Blockworks reported. Devin Finzer, co-founder of OpenSea, admitted in a blog post that someone at the company was involved in insider trading, but didn’t explicitly name Chastain.

That’s it for today’s markets wrap. I’ll see you back here on Monday.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.