Bitcoin open interest surges as price hits two-week high

Activity across the derivative market for bitcoin is bustling as price surged to fresh local highs not seen since last month

Maxx-Studio/Shutterstock modified by Blockworks

After several consecutive weeks of muted trading, bitcoin (BTC) sprang to action Tuesday, surging 3.6% to pierce above $30,000 for the second time this month.

Beginning at roughly 5 am ET, price action propelled the asset to a 16-day-high above $30,200 by late afternoon. BTC has since retreated 1.2%, settling near $29,800, data shows.

It comes as the Federal Reserve announced plans at the end of the day seeking to introduce a “novel activities supervision program” over the crypto activities of banks regulated within the US.

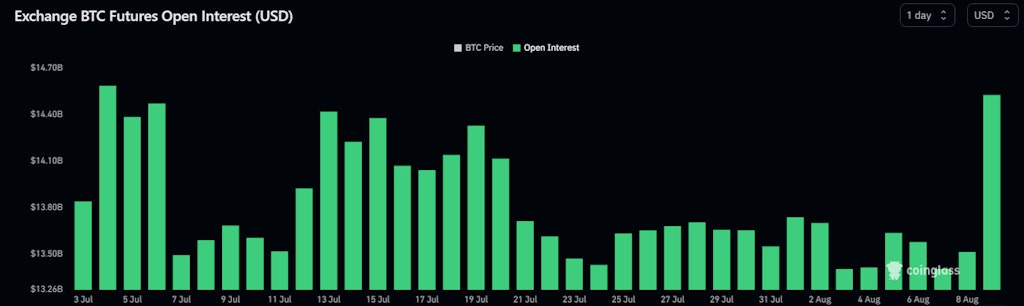

Tuesday’s total aggregate open interest (OI) for BTC futures ballooned by more than $1 billion from the day prior to $14.53 billion, marking the largest increase in more than a month, Coinglass data shows.

Exchange BTC Futures Open Interest; Source: Coinglass

Exchange BTC Futures Open Interest; Source: CoinglassDerivatives activity across CME, a barometer of institutional trading, saw little change in OI, suggesting the move was retail focused.

BTC’s upside was also marked by active spot trading, most noticeably on the Binance exchange, contrasting with relatively subdued activity on Coinbase, exchange data shows.

The robust performance was accompanied by a sharp increase in the aggregate stablecoin OI, which leaped by a considerable 12.6% to $8 billion in just under ten hours, according to Coinanalyze.

Analysts had earlier forecast a major move, in either direction, resulting from an uncharacteristically low volatility environment persisting close to a month.

Despite the recent pullback, the market is contending with a significant accumulation of OI which could come under pressure if the downward trend persists, Jason Pagoulatos, head of markets at Delphi Digital told Blockworks.

The combination of increasing funding rates and a decrease in spot activity is exerting strain on newly established positions.

Pagoulatos sees two possible scenarios stemming from the current market dynamics.

Should spot activity remain subdued, a further decrease in OI might occur, possibly leading to a decline in price, he explained. On the other hand, if spot trading returns to its previous intensity, the market might experience a continuation of the upward trend.