Buybacks get pushback, and markets rebound

Hyperliquid’s HIP-5 proposal ignites debate, while DePIN and DeFi bounce back

Champ008/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Markets caught a much needed bid yesterday, snapping a multi-day losing streak. The rebound stretched across both equities and crypto, fueled by optimism that Trump-era tariffs could be rolled back. We look at which sectors led the charge, how subnet tokens continue to defy gravity post-crash, and the debate heating up over Hyperliquid’s HIP-5 proposal.

Indices

After several days in the red, markets found relief yesterday as all major benchmarks posted gains. The rebound was led by BTC and the tech-heavy Nasdaq, which rose 2.36% and 1.15%, respectively.

Optimism was partly fueled by the Supreme Court hearing on the legality of Trump’s tariffs, which raised expectations that some may be rolled back. Odds of the court upholding the tariffs fell from 45% to 29% on Kalshi, lifting sentiment across risk assets.

Within crypto, DePIN and DeFi led the recovery, climbing 6.7% and 6.1%, on the day. The DePIN index was boosted by HNT and Render, up 11.1% and 8.7%, respectively, together accounting for roughly a quarter of the index.

In DeFi, AERO, PUMP, and ASTER all advanced more than 10%. Aerodrome’s strength comes on the back of the launch of Slipstream v2 this week that aims to optimize efficiency and build on its dynamic fees design.

The AI sector was the weakest performer, declining 4% despite strong gains over the past month. The pullback likely reflects a rotation toward sectors that had become oversold during the recent correction. Within the AI index, performance was mixed. ICP surged 14.6% on the day, while IP and TAO were the only constituents in negative territory, each down around -4%.

Market Update

In just a few days, we will hit the one-month mark since the brutal Oct. 10 crypto crash that wiped out nearly $390 billion from the market. While most of us would rather forget that day, it is worth looking back to see which sectors and tokens have bounced back stronger. That is often where the next wave of strength begins.

One clear standout has been the AI sector, which is up 7.3% — not just since the Oct. 10 correction but through the recent market weakness as well. Gains from tokens like ICP, up 31.8%, and VIRTUALS, up 18.5%, have helped, but much of the sector’s momentum continues to come from TAO, which makes up a third of the index and is up 10.8% this month.

When scanning the top 500 tokens by MC, it’s worth noting that subnet tokens are among the few still trading above their pre-crash levels. These include Chutes (SN-64), Ridges (SN-62), lium.io (SN-51) and Targon (SN-4). These are four out of the top five Bittensor subnets by MC.

The amount of TAO staked in Alpha continues to climb, signaling rising demand for subnet tokens.

The stake split between Alpha and Root subnets continues to grow as well, from 13.2% in July to 21.1% today, showing growing interest in Bittensor Subnets.

Despite their low float and inflationary early stages, many subnets are beginning to generate real revenue, a sign of genuine utility rather than hype. Targon, Lium and Chutes are estimated to have a combined $20 million in annual recurring revenue, a notable milestone for such young networks.

With the TAO halving approaching in December, the recent emission structure changes and a wave of potential catalysts ahead, the Bittensor ecosystem looks well-positioned to capture the next wave of market flows when sentiment turns.

HIP-5: Assistance Fund 2

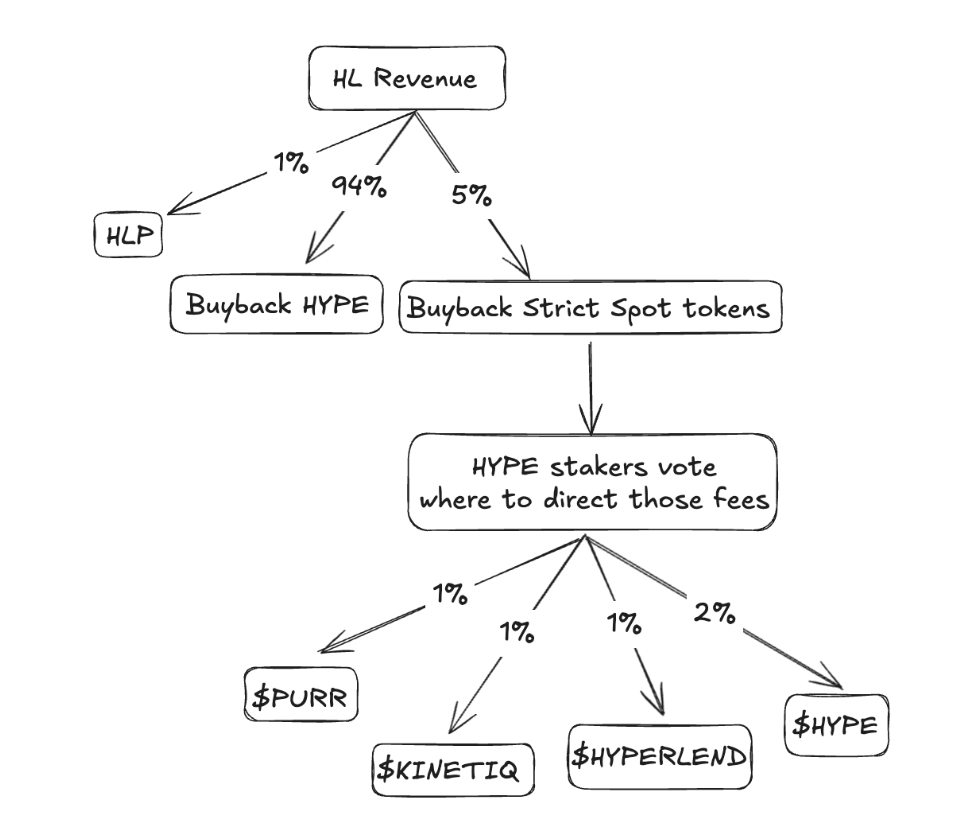

HIP-5: Staker-Governed Assistance Fund 2, authored by Hyperliquid community members, proposes to divert 1% of Hyperliquid fees (ramping to 5%) into a staker-voted buyback fund for Strict List tokens such as PURR and HFUN.

Under this system, fees would accrue in USDC to AF-2, with HYPE stakers setting weights through real-time gauge voting. Execution would occur via continuous TWAP, votes would persist until changed, and a seven-day initialization window would precede any flow. Eligibility would be limited to the Strict List, with LSDs excluded from voting unless they implement verifiable holder-level passthrough. At September 2025’s run rate of $91 million/month, a full 5% allocation would equate to $55 million/year in targeted buybacks, while AF-1 would retain 94% of total fees.

There are multiple reasons behind this decision, and I strongly encourage people to read the full proposal here. Below, I will walk through these reasons cited in the proposal and provide both sides of the argument.

- “Bootstrap ecosystem projects: Provide buy-pressure to existing strict spot Hypercore tokens, giving teams already staking HYPE more incentive to deploy their tokens in Hypercore. At the same time, new projects launching on Hypercore are encouraged to stake HYPE (or incentivize stakers) in order to compete for votes and buybacks.”

This is the primary case for implementing this proposal, reminiscent of when the Hyperliquid Foundation did a buyback of PURR with AF-1. $55 million would indeed be a very significant TWAP given the current state of Hyperliquid ecosystem projects: PURR (~$65 million) and HFUN (~$35 million) sit at very low market caps. Even Kinetiq, arguably one of the most hyped LST projects on Hyperliquid, is projected by Polymarket to launch between $250 million and $500 million. It seems obvious that a $55 million stimulus package would greatly re-rate these tokens. However, the argument against is also very strong:

- Hyperliquid should support strong projects. While buybacks would attract more projects, these are unlikely to be the high quality projects needed.

- Forces projects to launch tokens (e.g., Unit, Liminal).

- Asymmetrically benefits investors and team members. For example, Kinetiq’s core contributor supply (23%) is equivalent to the supply distributed to Kpoints holders (24%). While this is fair for projects that capture the value they create, it is unfair when HYPE buybacks are redirected to these tokens.

- Hyperliquid differentiated itself from pure value capture and revenue generation; subsidizing other projects could dilute the quality of projects building on the HyperEVM (similar to projects on other chains propped up with incentives).

Along with this, I would argue that directing revenue in the form of buybacks does little to bootstrap projects beyond a short-term price boost. Finally, this would do little to incentivize projects to buy and stake HYPE, as the notional amount of HYPE needed to materially influence a vote is far too high.

- “Enhance HYPE Resilience: Diversify value accrual beyond pure exchange revenue”

This is a point I am inclined to disagree with completely. The thesis is that Convex-style vote aggregators could provide alternative revenue streams. First, the idea is strange: projects bribing the AF-2 fund for buy-pressure on their token. If this were the case, AF-2 would likely adversely select projects to buy, as the projects most likely to give out tokens aggressively are unlikely to do well long-term.

As noted in the original proposal, “Traditional bribes pay LPs to deepen pools, which often leads recipients to sell the rewards to realize profit, creating sell pressure.” We would likely see projects bribe AF-2 to buy their token, and users then dump on AF-2 with the tokens they received as a bribe.

- “Preserve Competitiveness: A 5% diversion is negligible (~$150K daily reduction in HYPE buys) compared to the ~$3 million baseline.”

Strictly speaking, this is true: The notional value of HYPE is unlikely to materially affect HYPE’s price. However, I believe this does affect HYPE negatively, as it undermines HYPE as a pristine asset that buys back with all its revenues, a value proposition that is easy to understand in a market with complex Ve tokens and lockup periods. It also raises questions about conflicts of interest from voters.

Overall, while HIP-5 would materially improve the price of Hyperliquid ecosystem projects, it creates a negative dynamic where Hyperliquid uses HYPE revenues to support potentially unaligned projects (asymmetrically benefiting founders and private investors). These flows are unlikely to have positive ROI and could allow for manipulation (e.g. voter manipulation, frontrunning, conflicts of interest) and, while not material in notional terms, could dilute HYPE’s role as a pristine asset.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.