Troubled Exchange CoinFLEX Confirms Bitcoin.com’s Executive Chairman Owes It $47M

“The debt is 100% related to his account,” CoinFLEX CEO Mark Lamb says

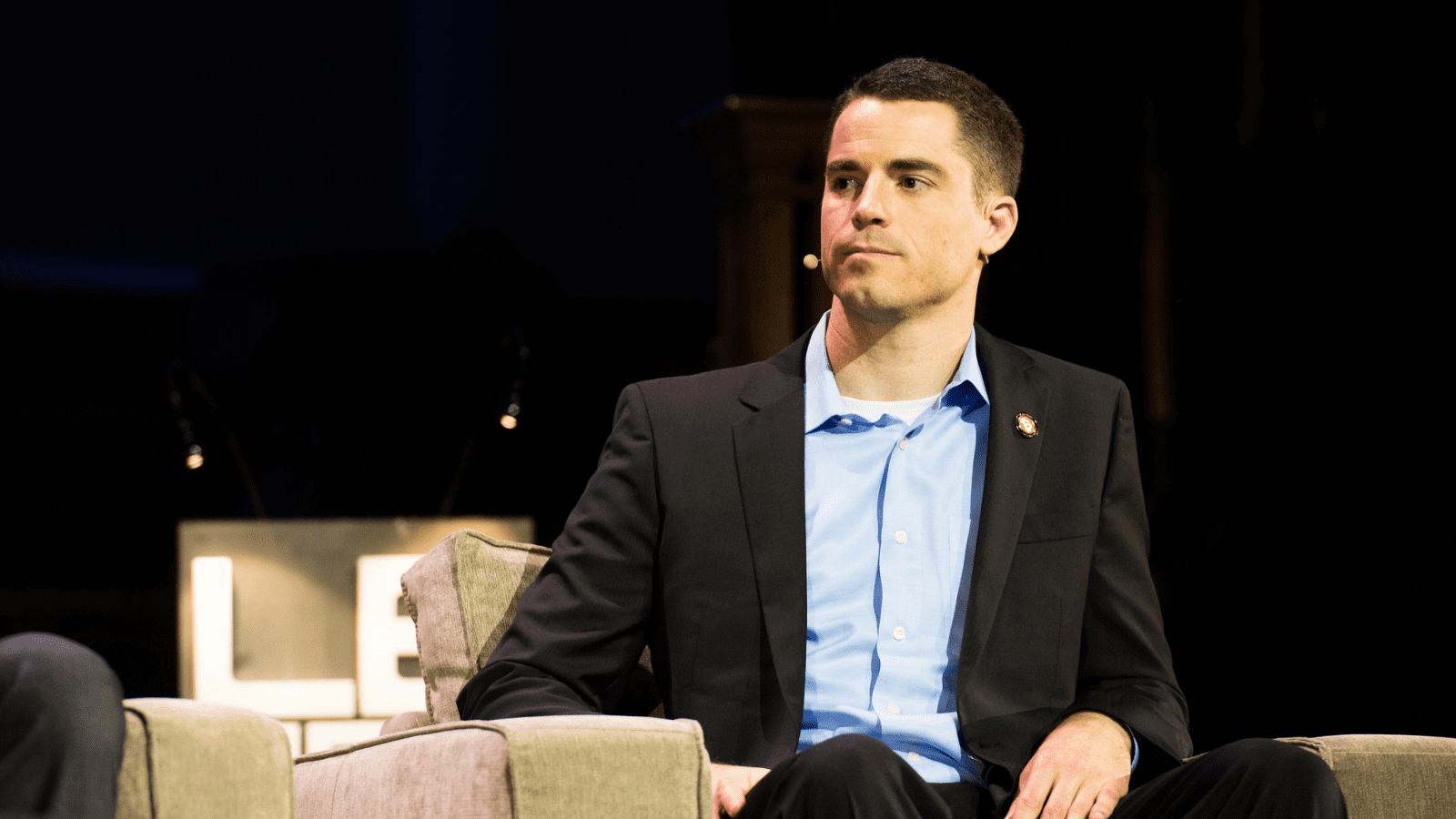

Bitcoin.com CEO Roger Ver | Source: LeWeb/"Roger Ver" (CC license)

- After halting withdrawals last week, CoinFLEX announced it would launch a new token to raise $47 million

- Ver denies that he is the debtor and says CoinFLEX owes him a substantial amount of money

The chief executive of CoinFLEX alleged Tuesday that the former CEO of crypto trading platform and wallet provider Bitcoin.com owes the cryptocurrency exchange $47 million.

CoinFLEX CEO Mark Lamb tweeted that Roger Ver, current executive chairman of Bitcoin.com, is a longtime customer and the counterparty whose outstanding debt forced the derivatives-focused exchange to halt withdrawals last week. The company on Monday moved to issue a new token, rvUSD, to stabilize its balance sheet, with the goal of raising at least $47 million.

Lamb told Bloomberg rvUSD will have a 20% yield, and — if $47 million is raised — users would be able to withdraw their funds in full.

After being suspected as the debtor by the anonymous crypto market participant FatManTerra, Ver initially denied.

“Not only do I not have a debt to this counter party, but this counter party owes me a substantial amount of money,” Ver said at the time.

In defense of CoinFLEX, Lamb tweeted that “[Ver] is denying that the debt pertains to him and so we felt the need to clarify to the public that yes — the debt is 100% related to his account.”

He added that his company does not owe any debts to Ver, and that “his statement is blatantly false.”

Ver has been a proponent of a 2017 bitcoin fork, Bitcoin Cash (BCH), which was later split again into Bitcoin Cash ABC (remaining known as BCH) and Bitcoin Cash Satoshi’s Vision (BSV) the brainchild of Craig Wright. Despite neither fork being embraced by the market as the canonical bitcoin, they currently rank at number 32 and 49 by market cap, with the cryptoassets together worth about $3 billion, or about 0.7% the value of BTC.

As a bitcoin evangelist, Ver became known as “Bitcoin Jesus.” He renounced his US citizenship in 2014, motivated in part by his experience serving 10 months in federal prison for illegally selling explosives on eBay.

CoinFLEX and Ver did not immediately return requests for comment.

Correction: Roger Ver has served as the executive chairman of Bitcoin.com since Aug. 1, 2022. Dennis Jarvis is the current CEO. Updated June 29, 2022 at 9:00 am ET.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.