Friday charts: Elements of a bubble

The AI bubble could pop even if demand for AI is unlimited

jamesonwu1972/Shutterstock modified by Blockworks

This is a segment from The Breakdown newsletter. To read more editions, subscribe

“There has been a lot of talk about an AI bubble. From our vantage point, we see something very different.”

— Jensen Huang

Alphabet CEO Sundar Pichai said this week there are “elements of irrationality” in the current boom in AI infrastructure.

But his announcement of a new version of Google’s Gemini LLM gave us reason to think we may not be irrational enough.

Gemini 3 was received as a surprisingly massive improvement over Gemini 2.5, as measured by the arcane metrics that language models are judged on. (As a regular user, I can’t really tell the difference.)

Tomasz Tunguz says this disproves the “scaling wall thesis” that LLMs had hit a plateau where simply adding more compute no longer resulted in better performance.

Google, however, added better compute — smarter algorithms, better training, newer chips — and Gemini 3 got a lot better.

This seems like a green light for everyone to keep investing like mad in everything.

Also this week, Jensen Huang said everyone is still investing like mad in GPUs: “Blackwell sales are off the charts, and cloud GPUs are sold out.”

Better yet, Nvidia CFO Colette Kress added that “the A100 GPUs we shipped six years ago are still running at full utilization today.”

The comment from Kress appeared to be a direct response to Michael Burry’s accusation that Nvidia’s customers have been deceptively inflating their reported earnings with unrealistically long depreciation schedules.

But GPUs appear to be benefiting from a “cascading use model”: The newest chips are used for training for a year or so and then run inference tasks for a while longer before eventually being put out to pasture to serve up YouTube videos and things.

That should be excellent news for investors: If the models are still getting better, demand for new chips is increasing and old chips are still useful…we should maybe be wondering whether AI companies are understating their earnings.

And yet, stocks were lower this week.

This might be a sign that the market has stopped worrying about the demand for chips and started worrying about the supply of energy.

Demand seems to be something close to insatiable: A Google Cloud executive recently estimated it would have to double its compute capacity every six months for the next four or five years to meet it.

But where the power will come from to provide it is a mystery.

It takes five to seven years to build the gas turbines that power most data centers and the companies that make them are fully booked until at least 2030.

If additional power isn’t available, there’s no point in buying a new-generation GPU that draws more of it — an older generation of chip, judiciously drawing less of it, would do just fine (or better).

Nor is there any point in building a new data center if there are no new turbines to pair them with.

All of which is to say, the AI bubble could pop even if the demand for AI is effectively unlimited.

Also this week, Pichai warned that if the AI bubble does pop, “no company is going to be immune, including us.”

He meant no AI company, but “no company” is not far from the truth, either.

Without the boom in data centers, the US economy would likely be in recession: Amazingly, data centers, which account for 4% of GDP, accounted for 93% of GDP growth in the first half of the year.

So, whatever part of the economy or financial markets you care about, you probably have to care about the scaling wall thesis, data center depreciation schedules and cascading use cases, too.

I’ll keep you posted.

“One chart to rule them all”:

Michael Burry thinks this is the only chart you need to see: As measured by capex as a percentage of GDP, the AI boom is already similar in scale to the investing booms that preceded the dotcom, housing and shale bubbles.

Depreciating, yes, but slowly:

Contra Burry from a16z notes that demand for older, less-powerful A100 GPUs has held up surprisingly well.

Going all in:

At Microsoft, capex has surged to nearly 50% of sales. Benedict Evans says this shows that Microsoft’s business model has changed “from competing on network effects to competing on access to capital.” The latter is much more bubble-prone.

Startups are all in, too:

Again from Benedict Evans, nearly all Y Combinator startups are now AI-related.

It could get bigger:

The starting dates for Emre Akcakmak’s overlaid charting are probably a little arbitrary, but his graphic makes a good point: If AI is a bubble, history would suggest it could get a lot bigger.

The scariest chart in the world?

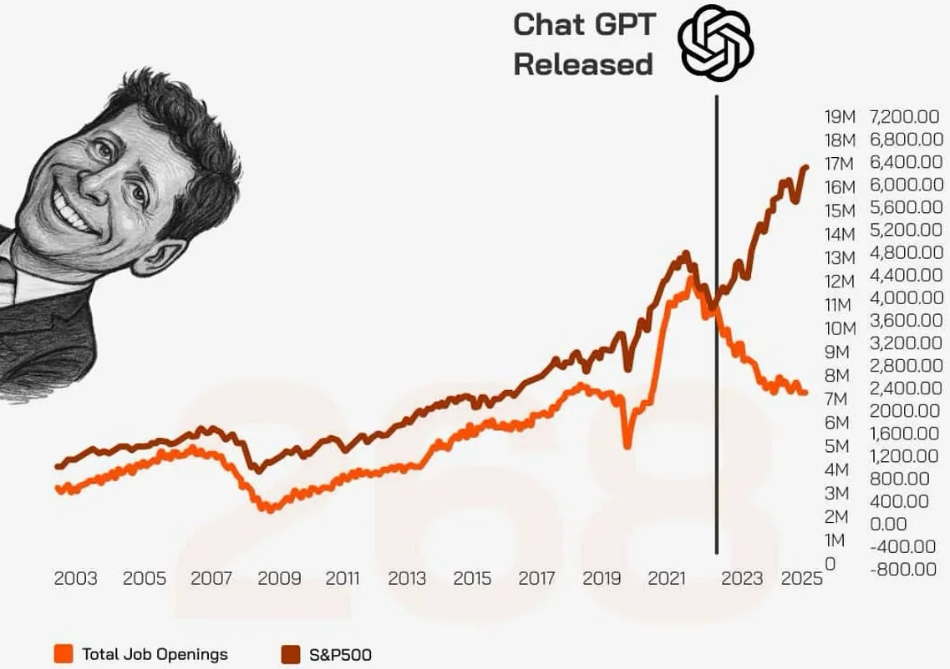

Derek Thompson notes that from the starting point of ChatGPT, the S&P500 has shot higher and the number of job openings in the US has shot lower. I’m not sure how much causality there is here, but it does make for an excellent chart.

The bear case for human employment:

Benedict Evans notes that Otis introduced the “Autotronic” elevator in 1950 — the exact peak of employment for elevator attendants. It’s possible that AI will turn out to be Autotronic everything, but we should remember that most elevator attendants found better jobs in the 1960s.

So far, so good:

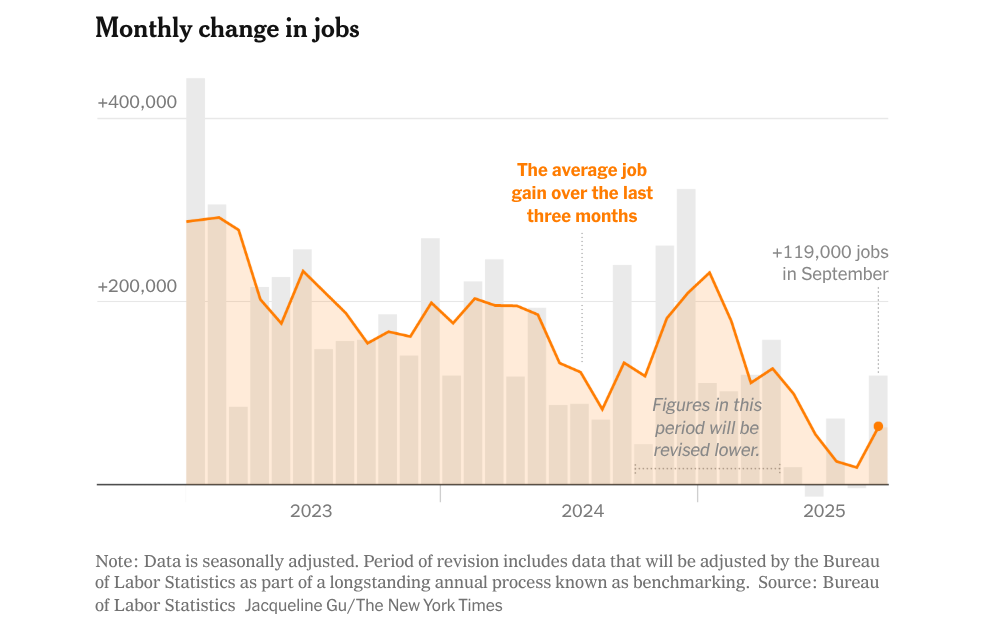

The delayed jobs data showed the US with a surprise gain of 119,000 jobs in September.

We need some Autotronic housebuilders:

Torsten Slok notes that the median age of US house buyers is all the way up to 59 — excellent news because it makes me feel ahead of the curve for a change. On the other hand, as a younger-than-average home buyer, I can tell you that homeownership is overrated and renting is underrated.

At least houses aren’t imported:

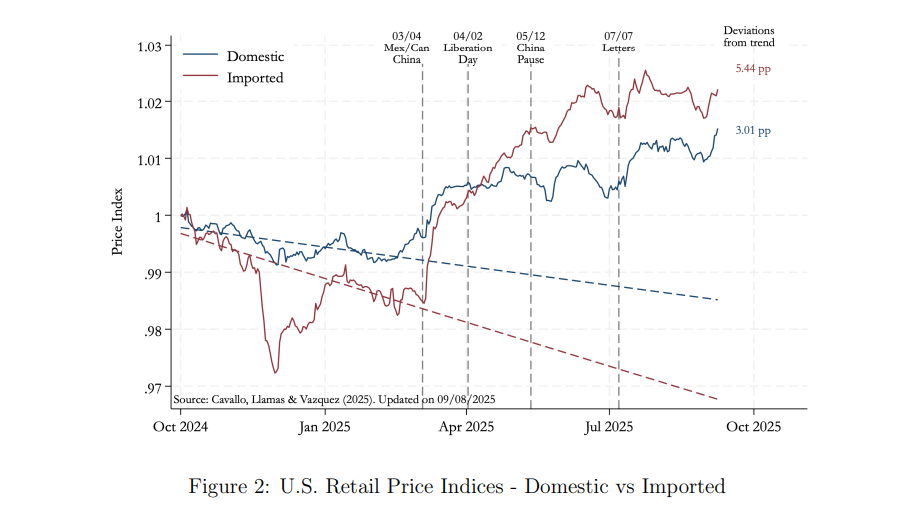

A new study of US prices finds that tariffs have made imported goods 5.44% more expensive than they otherwise would have been.

Other fun inflation facts: The average price of a car in the US is now above $50,000, and in some places, gasoline is cheaper than water.

Have a great weekend, non-depreciating readers.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.