Ether Flirts with All-Time High as Asia-Based Traders Look More to DEX Markets

While bitcoin and ether stalled on inflation, regulatory comments from US officials, investors in Asia continue to make moves as interest in DeFi grows.

Blockworks Exclusive Art by axel rangel

- Ether stalled during the US trading day, but took off during the Asian trading hours as investors double-down on DEXs, which gained 8% in the last 24 hours

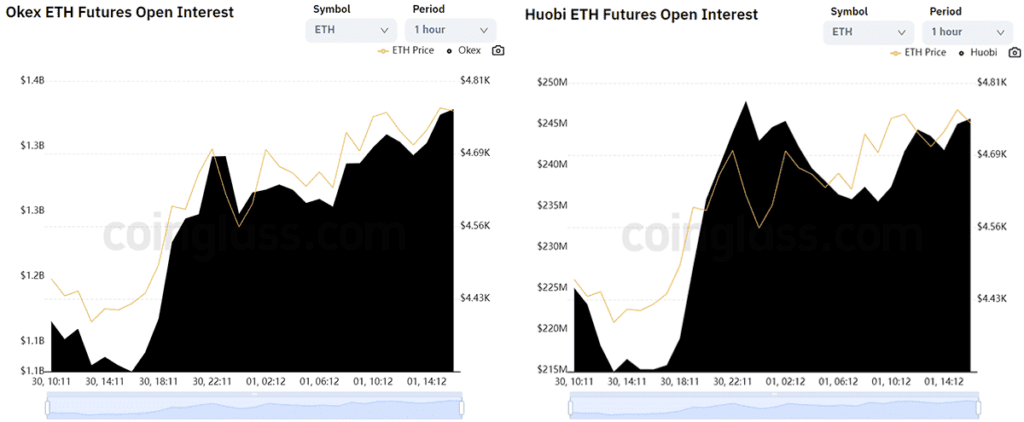

- Open interest contracts for ether continue to inch up on Huobi and OKEX during the Asia trading day

While bitcoin and ether retreated during the US trading day after remarks from US Federal Reserve Chairman Jerome Powell about inflation and continued regulatory uncertainty, price movement for ether picked back up during the Asian trading day pushing it past the $4,700 mark and in striking distance of its previous all-time high of $4,800.

On OKEX and Huobi, two exchanges primarily serving traders in China and East Asia, open interest for ether continued to tick up, heading towards $1.4 billion on OKEX and $245 million on Huobi.

Ether futures open interest on major Asian exchanges

Ether futures open interest on major Asian exchanges

March Zheng, a partner at China-based Bizantine Capital, believes that ether will leave the market behind because traders in China are interested in getting more exposure to DeFi and decentralized exchanges given the regulatory challenges these exchanges are having in China.

“One potential factor for this uprise during Asian market hours is Ethereum’s bridge to DeFi. As China begins to close down access to Huobi for China-based traders by the end of December, retail traders may be looking to increase their ether positions to better position themselves in decentralized exchanges such as Uniswap or Sushiswap,” Zheng told Blockworks.

Zheng also noted that he’s seeing increased interest in Solana for similar reasons, as well as Arbitrum — an Ethereum layer-2 using optimistic roll-up technology to dramatically decrease gas fees for transactions. Arbitrum has attracted $2.74 billion in capital since launching over the summer, according to L2beat.com.

Sushiswap’s SUSHI token virtually mirrored the rise of ether during the Asia trading day, climbing 7% on-day while Uniswap’s UNI increased by 8% according to CoinGecko.

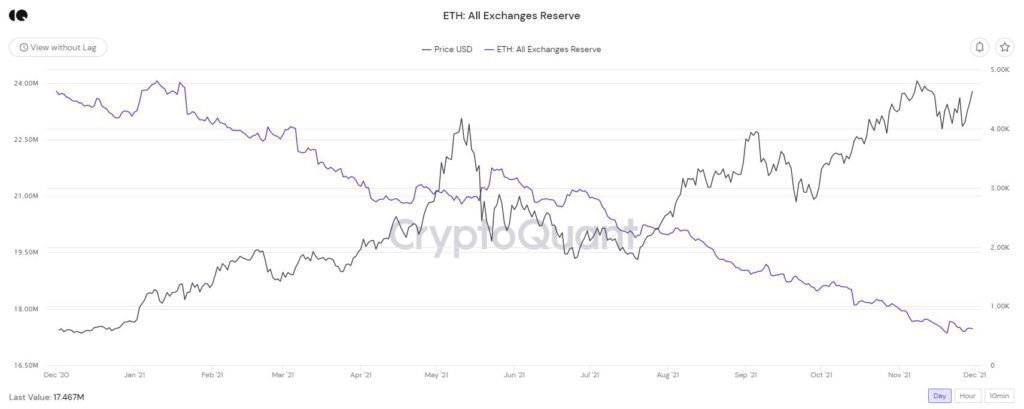

Meanwhile, the amount of ether being stored on exchanges, according to Cryptoquant, continues to decline. The data provider says that as of Nov. 23 there were approximately 17.6 million ether stored on exchanges. A month prior, there were approximately 18.2 million.

The amount of ETH held in all exchange wallets

The amount of ETH held in all exchange wallets

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.