Ether Follows Bitcoin to All-time High but Meets Extreme Volatility

One day after the king crypto unambiguously surged passed its April peak, Ethereum’s native fuel is knocking at the ATH door. But will it be let in?

Blockworks exclusive art by Axel Rangel

- Ether touched $4374.95 on CoinBase at 7:29 am ET

- Bitcoin dominance has been on the rise for the past three weeks

On May 12, Ethereum’s ether currency spiked to an intraday peak of roughly $4,385. Last hour, ether came with within a hair’s breadth of that all-time high mark before dipping back under $4,200.

The second-largest digital asset briefly exceeded $513 billion in market capitalization, surpassing its May 12 record of $481 billion, according to data from CoinGecko.

One factor fueling ether’s rise has been the change in the protocol implemented in early August which burns ether with every transaction the network processes. That offsets a significant portion of the natural growth in circulating supply of ether due to issuance from mining rewards. Some 588,000 ETH (or nearly $2.5 billion at current valuation) have been burned since the change was made.

Ether has also been known to follow bitcoin’s lead in both up and downtrends and, relative to its larger peer, has been ranging between about 0.06 and 0.08 BTC, with the most recent peak (in bitcoin terms) coming on September 3.

As bitcoin’s price has responded favorably to the wildly successful introduction of $BITO, the new bitcoin futures-linked ETF from ProShares, many traders were expecting ether to quickly follow suit. The question on all market-watchers’ minds now is, what happens next?

At first glance, the price of ETH rejected the all-time high fairly strongly, as it fell 5.35% within the space of a few minutes, but ETH has been in a healthy pattern of consolidation since then.

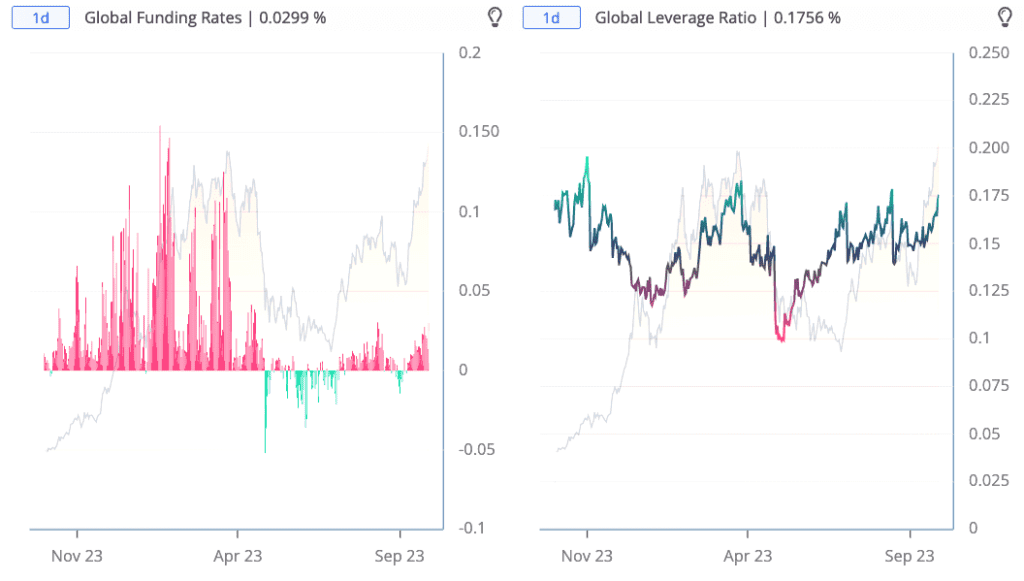

The overall market has seen leverage ratios creep up this week, along with open interest, which increases the likelihood of volatility, although there’s no clear indication from those metrics alone as to the direction of price moves. Funding rates on perpetual futures markets for both bitcoin and ether are elevated, which often marks local market tops, as leveraged traders must pay to hold onto their long positions, but they have not yet reached the extreme levels preceding the market crash in the Spring.

Bitcoin global funding rates and leverage ratio; Source: krowntrading.net

Bitcoin global funding rates and leverage ratio; Source: krowntrading.net

Rapid swings can have strange effects on isolated markets, and several large digital assets, including ether, witnessed considerable, albeit short-lived volatility at approximately 7:35 am ET.

US futures markets point to a slightly down open, with the S&P and Nasdaq futures both registering around -0.2% ahead of the start of Thursday trading in New York.