What Grayscale’s new flurry of trusts says about where we’re at

Plus, did airdrops ruin altcoin summer before it even started?

24K-Production/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

It’s Grayscale season

In the past few months, the OG crypto asset manager has launched five different single-token trusts — near and stacks in May, and bittensor, sui and maker in August.

Bittensor and sui popped after Grayscale announced the trusts earlier this month. TAO ran up to 25% in the following day while SUI almost doubled over the week. Both have since retraced slightly.

The trusts themselves have so far amassed $655,429 in the case of SUI and $1.55 million for TAO.

The MakerDAO product, disclosed on Tuesday but launched last Thursday, has otherwise collected $266,904 worth of MKR in private placements to date. MKR itself is up about 7.5% on the news.

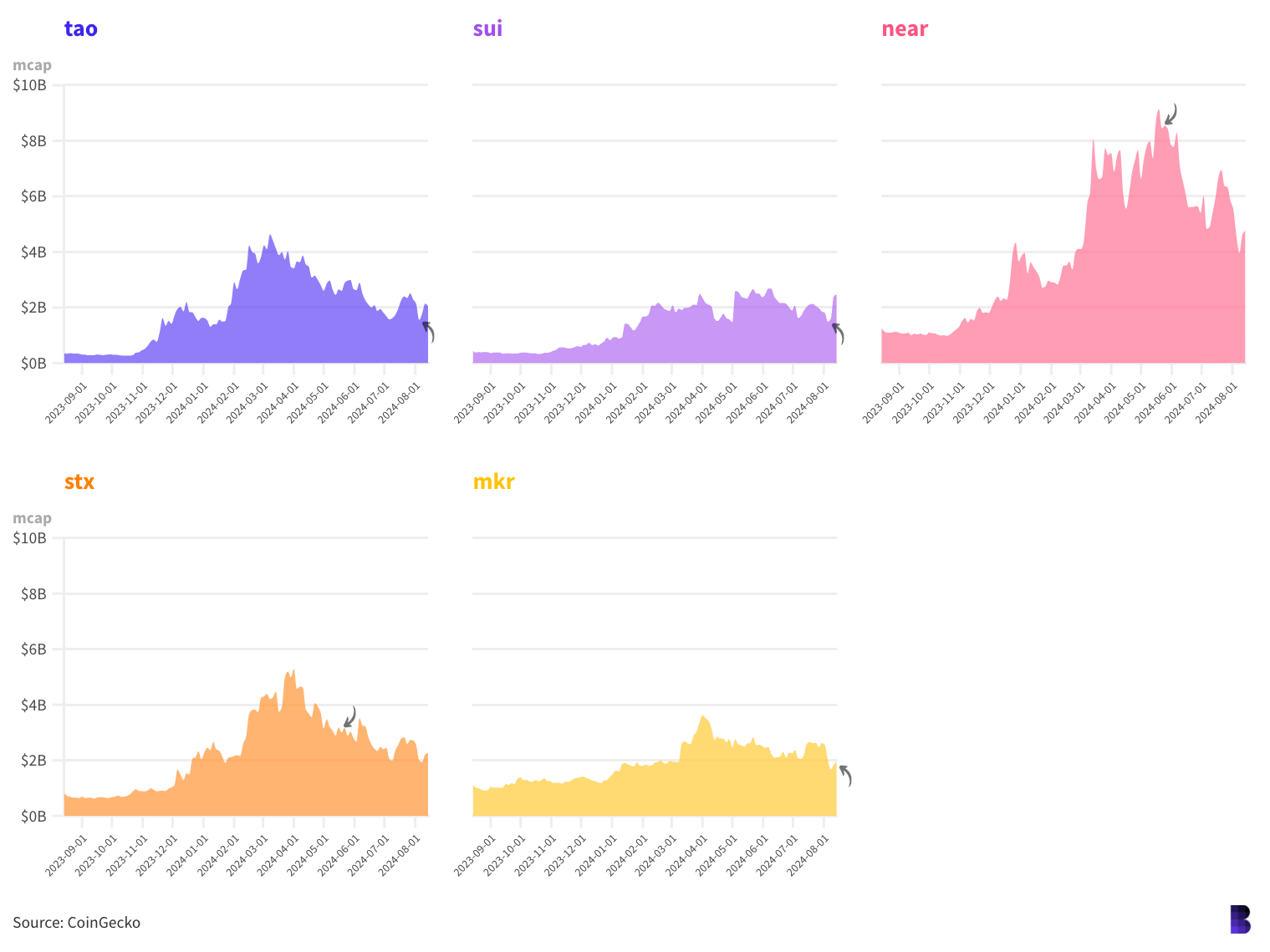

The chart below shows the market caps of cryptocurrencies with a recently-formed Grayscale trust.

Aside from NEAR, the recent Grayscale choices all carry a market cap of about $2 billion.

Aside from NEAR, the recent Grayscale choices all carry a market cap of about $2 billion.

Arrows point to when each trust was revealed publicly — NEAR and STX have both lost ground since May. Grayscale’s dedicated trusts hold $2.05 million in NEAR and $2.37 million STX, so it’s not as though either one has ever bought enough of either token to really move prices.

Still, Grayscale hasn’t been on a spree like this since the crypto market was at its bubbliest, in 2021.

During the peak bull market from February to November 2021 Grayscale launched trusts for solana, filecoin, livepeer, basic attention token, decentraland and chainlink.

That spree also came about three years after its previous run of new product launches, also when markets were super hot.

Across April 2017 and June 2018, there were new trusts for ethereum, ethereum classic, stellar, litecoin and bitcoin cash, as well as privacy coins zcash and horizen (with the the latter later dropping that moniker). The firm’s bitcoin trust was conceived much earlier, in 2013.

If we consider the bitcoin and ether trusts (now ETFs) as outliers with $24.3 billion and $5.2 billion in crypto under management, the remaining 17 single-token trusts currently hold on average $35.3 million in their respective coins.

But in terms of timing, Grayscale doesn’t really have the best track record.

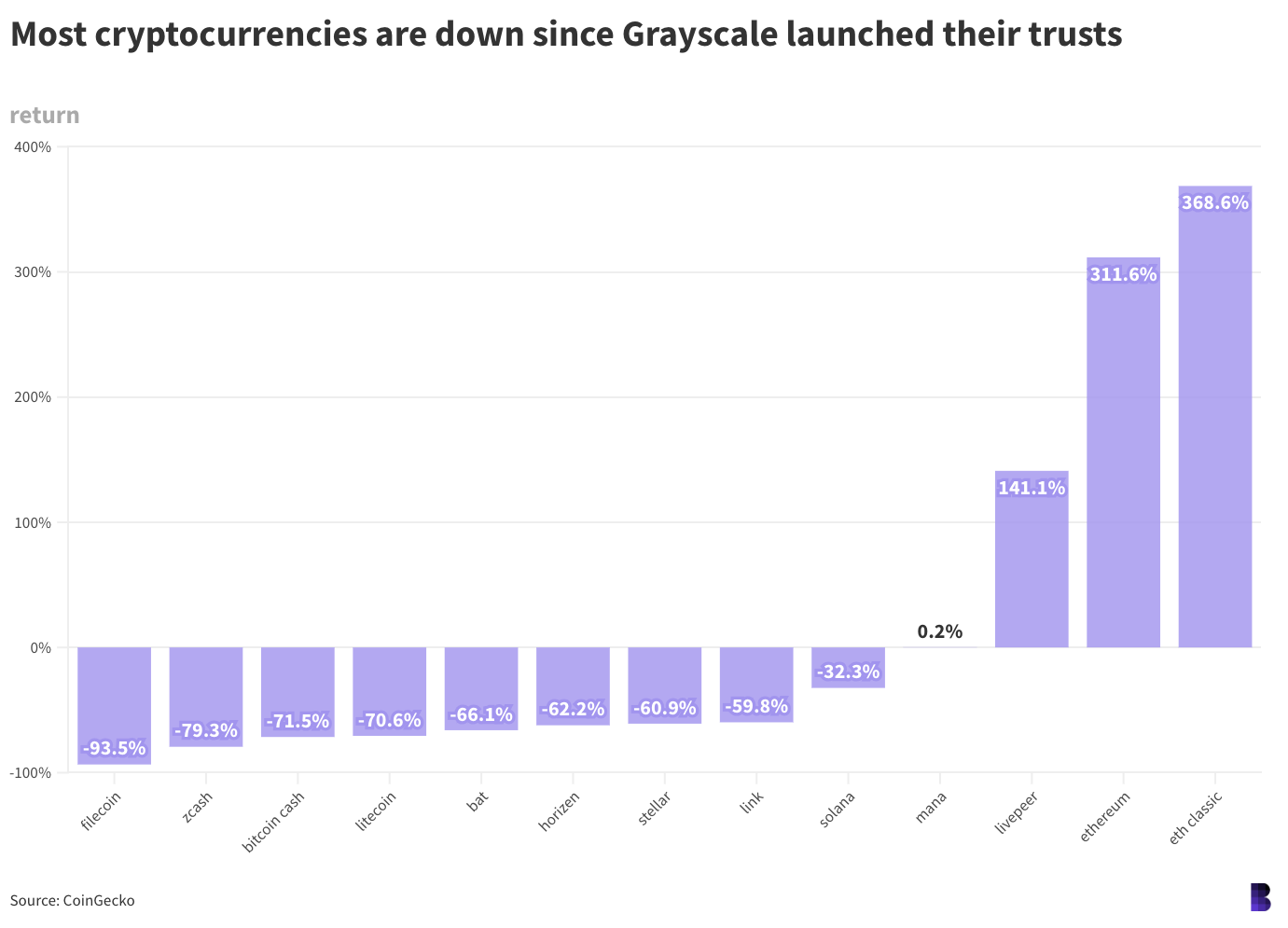

Bitcoin isn’t shown as it would completely dwarf the others, with 47,500% gains since Grayscale launched its trust.

Bitcoin isn’t shown as it would completely dwarf the others, with 47,500% gains since Grayscale launched its trust.

Of the 13 tokens with single-asset trusts launched since 2017 (there are also a few that hold multiple coins), only three have risen in price since Grayscale created their respective vehicles: ethereum, ethereum classic and livepeer.

Most of the individual cryptocurrencies are still up over their full trading histories, it’s just that Grayscale tends to launch trusts when prices are relatively high.

(There has historically been a lag between trust inception dates and their OTC Markets listings. The chart above shows returns since inception, and returns would look a little different if it measured since the trusts reached OTC Markets).

All this should convert to losses for most day-one contributors to individual Grayscale trusts, and even shareholders, although there has obviously been opportunity to time their markets for profit. But there’s another factor at play, which I’ll call “The Grayscale NAV conundrum.”

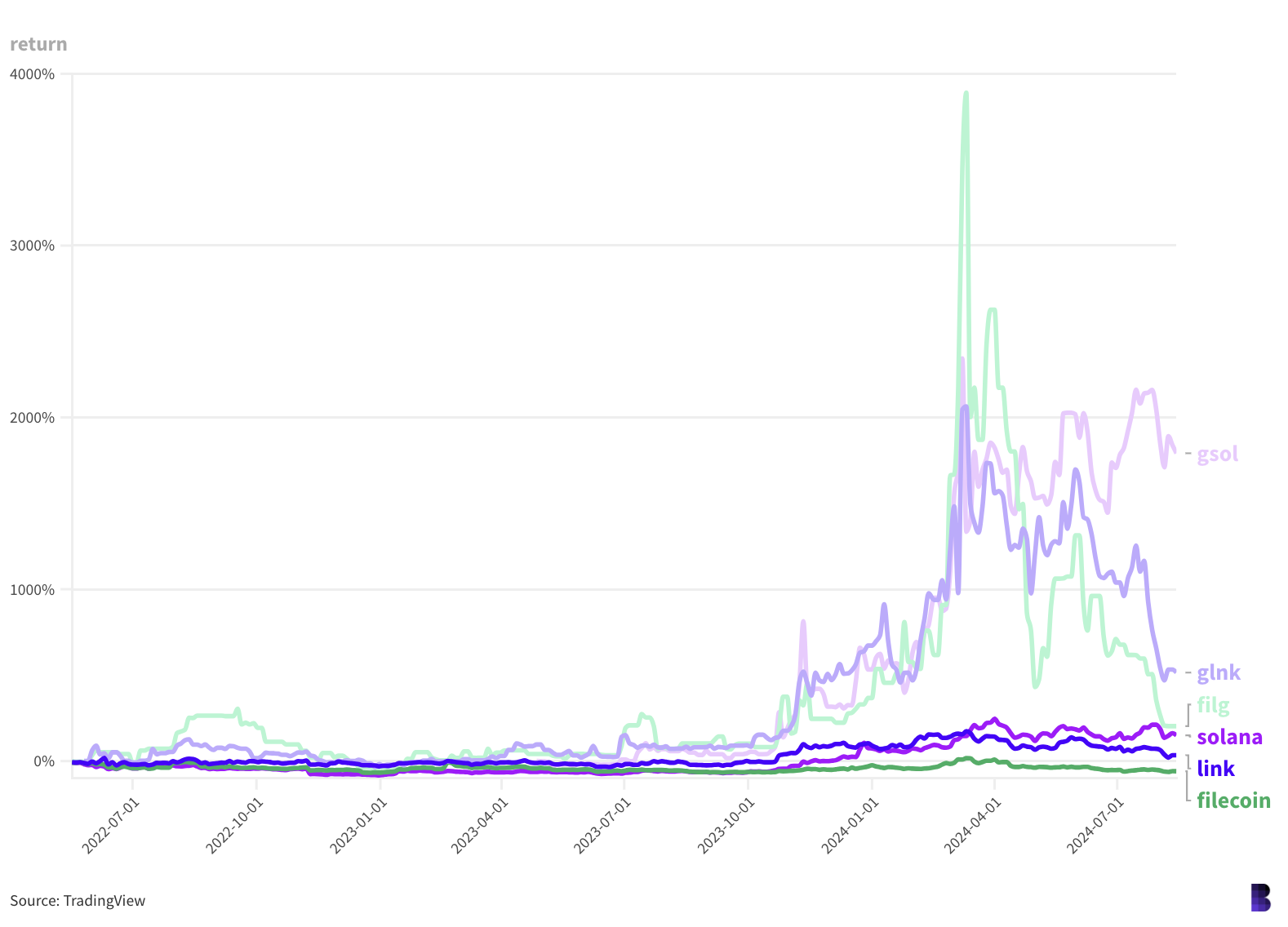

The underlying cryptocurrencies are in the darker colors, while the Grayscale trusts are faded in the background.

The underlying cryptocurrencies are in the darker colors, while the Grayscale trusts are faded in the background.

Shares in Grayscale trusts tend to pump much harder than the underlying cryptocurrencies. GSOL, the solana trust, for instance is up 1,800% since May 2022 while SOL, the cryptocurrency, has gained 150%.

The Grayscale NAV conundrum effectively misprices the shares to be far more expensive than the cryptocurrency held by the trusts (also known as the Grayscale discount/premium that had plagued GBTC and ETHE leading up to their ETF conversions) — which makes them much less attractive for regular investors. GSOL for instance is trading at a 660% premium.

But why? It’s a mixture of low share count, the closed-ended nature of the trusts, and speculation that more Grayscale vehicles will eventually be converted into ETFs, which could close the NAV gap. Or at least, present an opportunity to sell the news.

It’s not so clear whether Grayscale trusts push up prices of their underlying cryptocurrencies. Probably not, at least outside of bitcoin and ether. The headlines are likely more powerful.

It does say something about where Grayscale is at in terms of market outlook: still buzzy enough to launch a few more trusts.

— David Canellis

Data Center

- BTC and ETH are halfway to recovering from their selloffs at the start of August — today up 4% apiece to $61,200 and $2,750.

- SUI is the only top-100 token to lose significant ground, dropping 6.2%. It’s still up 47% over the past week on the back of the Grayscale trust news.

- SUI has meanwhile seen some of its biggest days for stablecoin inflows to date, with total supplies up 47% to $371 million.

- $256 million has flowed out of Ethereum bridges in the past seven days, while less than $35 million has flowed into other chains.

- Optimism and Gnosis bridges have seen the most, with $16.39 million and $5.95 million, respectively.

Make Crypto Great Again (MCGA 2024)

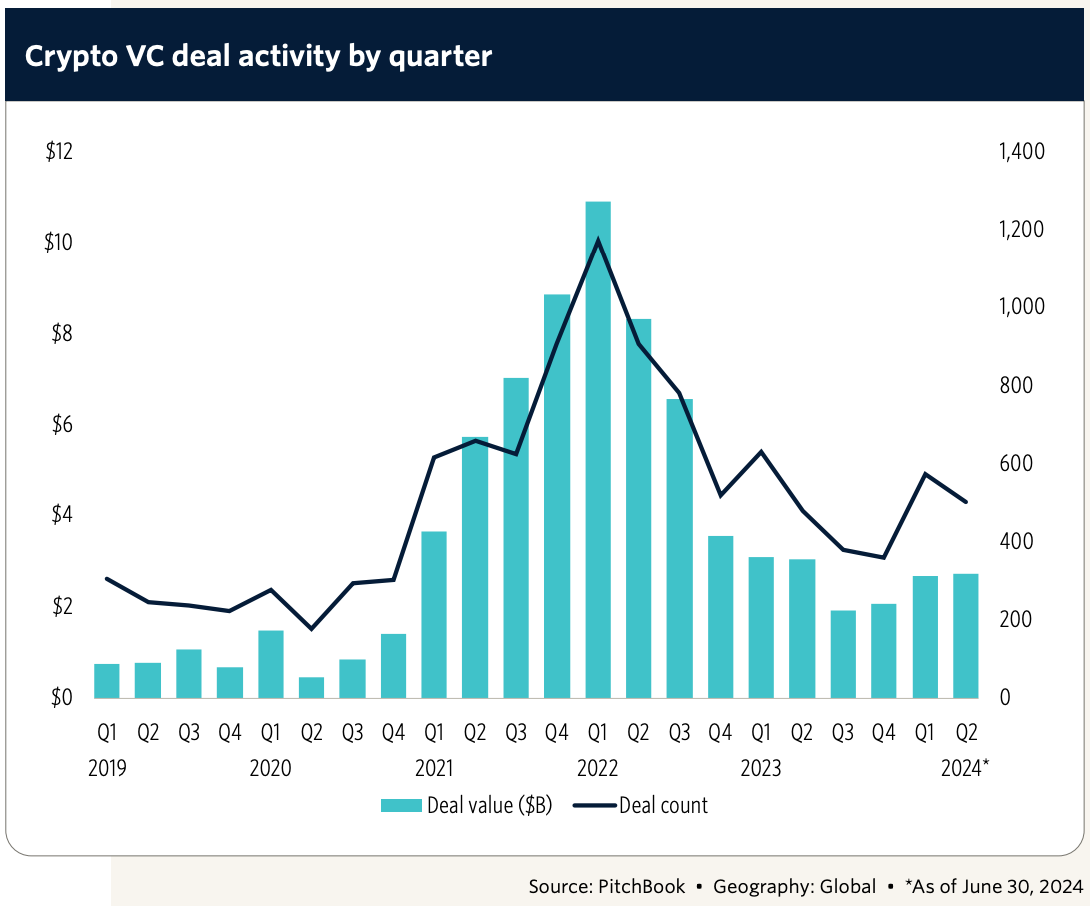

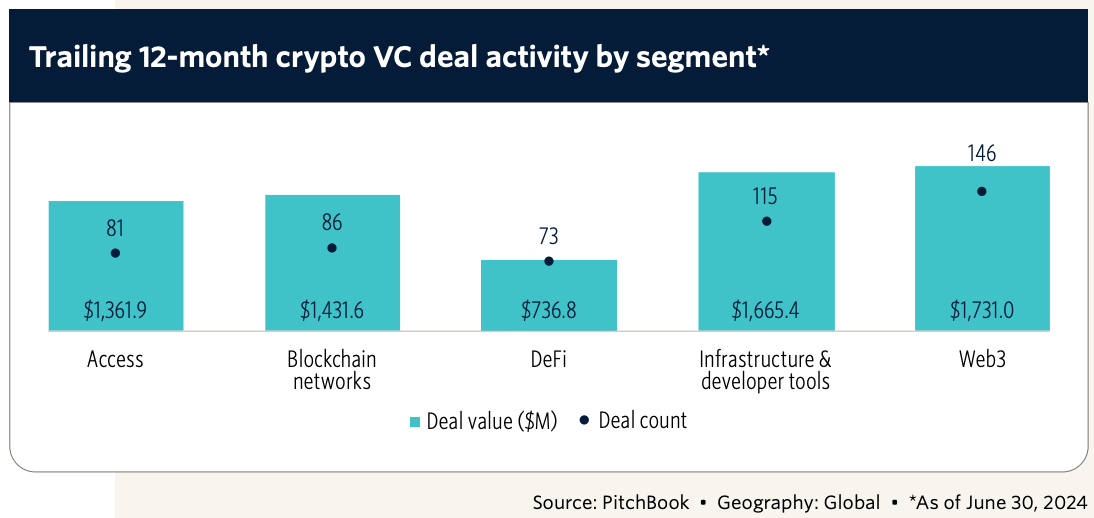

Last quarter, crypto and blockchain startups raised $2.7 billion across 500 deals, according to PitchBook’s latest venture capital report.

Remember how last week I mentioned that bitcoin’s maintaining a correlation with the stock market right now? Well, there’s another correlation — or lack of correlation — I want to highlight, and that’s the historical link between prices taking off and capital rising in private markets.

PitchBook senior analyst Robert Le noted that the correlation is nonexistent this time around. In March, there was a bump in funding as the market responded to bitcoin carving out all-time highs (and, of course, the bitcoin ETFs).

Source: PitchBook’s Q2 Crypto Report

Source: PitchBook’s Q2 Crypto Report

But in order to be anywhere near where we were in 2022, we’d have to see funding hit roughly $23 or $24 billion and Le says he just doesn’t “see that amount of capital going back into crypto this year or next year.”

In fact, those figures could be 3-5 years out, he told me, adding that it’s going to be a longer-term thing.

Jacob Martin, general partner at seed stage venture firm 2 Punks, said he’s not sure we’ll ever get back to the 2022 levels. Part of the reason is that the general environment back then — from the stock market, to the economy to, well, the way crypto was perceived (RIP) — was very different to our current situation.

“Crypto has a branding problem,” Martin added. When looking for potential startups to invest in, he’s noted that some projects look great on paper but can’t fully flesh out where the userbase could come from. This isn’t an issue across the board, but it’s one that VCs continue to run into.

Take Farcaster, for example. A lot of VC money (roughly $150 million) piled into the potential social media darling last quarter.

But, as Le noted, Farcaster has only really brought on crypto-native users and hasn’t yet shown signs of bucking that trend.

Right now, VC money is going into startups and protocols working on blockchain infrastructure. While the building blocks need to be laid down, these aren’t necessarily the deals that are going to get your heart racing.

Source: PitchBook’s Q2 Crypto Report

Source: PitchBook’s Q2 Crypto Report

For Le, that means we need to see more money go into apps. Once that starts to happen, then we might see the metaphorical boulder tumble down the hill as the momentum heats up.

To put it simply, Le said that right now it’s like folks investing in Amazon Web Services over the potential to invest in the firms built on AWS. Think Uber, Airbnb and Meta (formerly Facebook). Makes sense, right?

“We’re gonna expect to see that parabolic amount of investments when applications are serving end users, whether retail end users, or like, businesses or enterprises,” he said.

It’s not the end of the world that VC activity hasn’t quite returned to 2022 levels, despite the bullish environment. I’ve said “wait and see” so many times lately, but I can’t help it. It’s just reality.

We’re kind of in an odd moment. At least it’s nothing to fret over.

— Katherine Ross

The Works

- Coinbase teased an apparent alternative to wrapped bitcoin, dubbing it ‘cbBTC.’

- Goldman Sachs disclosed over $400 million in spot bitcoin ETF holdings in a 13F filing with the SEC.

- MetaMask is releasing a blockchain-based debit card developed with MasterCard.

- Arkham Intelligence data shows that $2 billion from Mt. Gox was moved to a wallet seemingly belonging to BitGo.

- The Fairshake PAC is targeting Sen. Sherrod Brown’s campaign, dedicating $12 million to support the Republican running against him.

The Riff

Q: Did airdrops ruin altcoin summer before it even started?

They certainly diluted it.

In talking to Martin (GP at 2 Punks Capital), he noted how even the rich folks are feeling poor right now.

I think the current environment, paired with the fact that it’s feasible to assume a lot of people don’t have the same kind of disposable income as they did two years ago, is perhaps somewhat behind the altcoin slowness we’ve seen. We could even call it burnout from memecoin mania.

And maybe that’s a fair way to siphon some blame away from airdrops, because it’s not just Americans who are feeling the effects of their tight wallets.

Or, everyone is just placing bets on Polymarket instead of scooping up altcoins. Who knows.

— Katherine Ross

It’s true that “crypto” hasn’t really perfected the art of token launches.

The past year or so has seen its fair share of airdrops: celestia, arkham, notcoin, pyth, optimism, sei, jito, dymension, starknet, ethena, manta, zk and blast, among others.

There are exceptions, but generally, this cycle’s batch of airdropped coins have indeed underperformed against bitcoin.

So, it’s tempting to label the recent rush of low-float-high-FDV airdrops one big top signal.

I’m more inclined to call them a creative way of staying on the right side of the SEC, which has all but made straight initial coin offerings a crypto relic.

If airdrops return en masse without significant retooling, however, I might have a different response.

— David Canellis

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.