Latest in Crypto Hiring: Yuga Labs, Offchain Labs Add Execs

Genesis restructures leadership as CEO set to step down; Citi taps crypto leaders

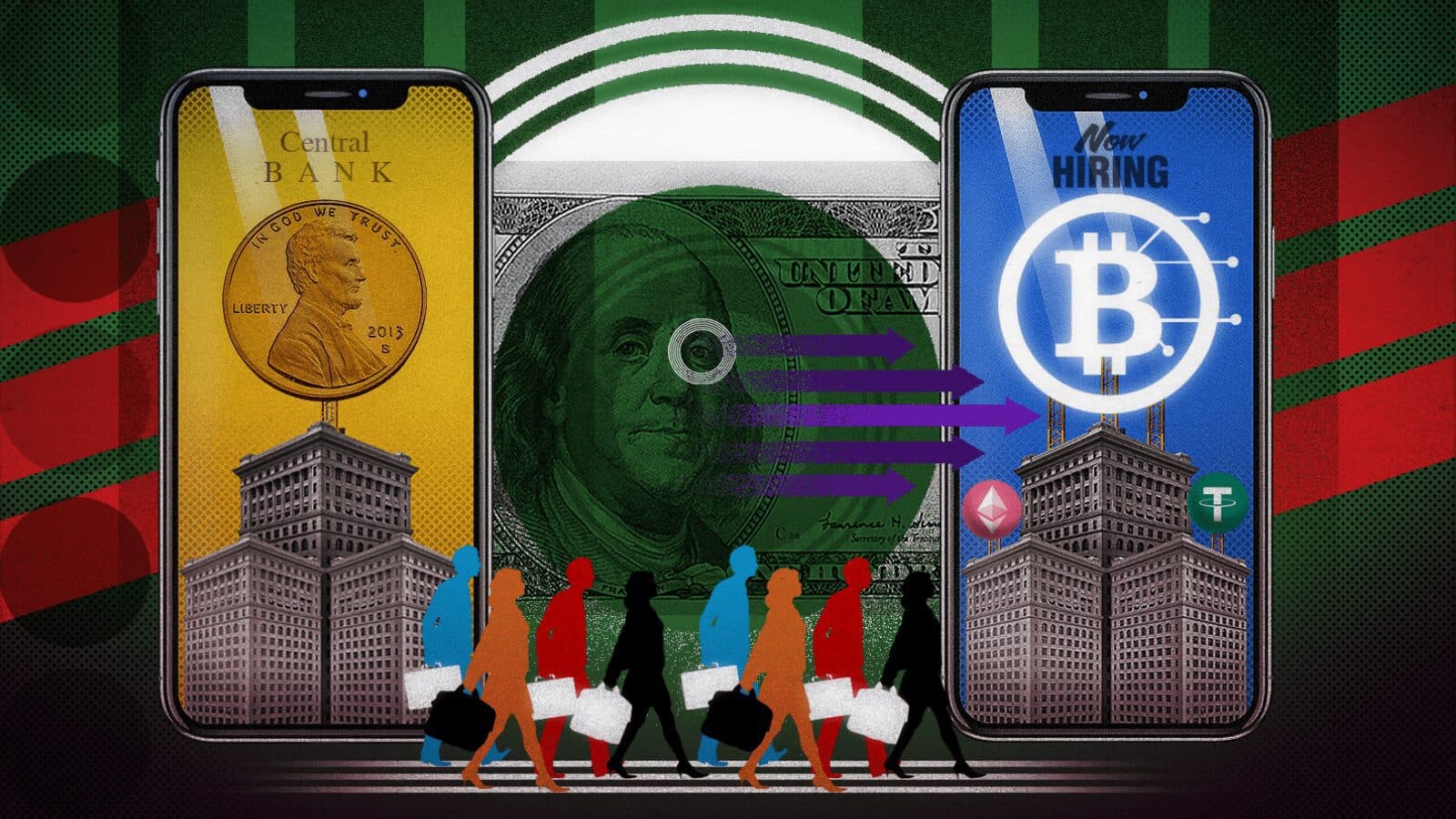

blockworks exclusive art by axel rangel

- A former Bakkt and Coinbase executive leaves for alternative asset manager

- Ex-Bank of America electronic foreign exchange sales head joins B2C2

Yuga Labs named Chris Fortier its new vice president of product and will support the team broadly across Web3, metaverse, NFT and product initiatives.

Fortier previously worked at Rally.io where he oversaw its social token and NFT (non-fungible token) capabilities while also leading its strategic direction and user experience. Fortier also led the development of creator-centric products for Twitch.

“In my new role I’ll be helping build the next wave of digital experiences — not just for our Apes, Punks, Meebits, Voyagers, and Mutants, but for the entire web3 industry, which is an incredible opportunity,” Fortier said in a statement.

The Fortier appointment comes about a week after Yuga Labs hired Danny Greene to fill its newly created role of brand lead for Meebits after Greene spent the last eight months as general manager of the MeebitsDAO.

Offchain Labs hired Andrew Saunders as its first chief marketing officer as the company seeks to expand its reach with Ethereum scaling solutions.

Saunders joins from Amazon’s global brand marketing team, where he helped build its first entertainment and culture marketing practice. Before that, he was global head of brand strategy and marketing for media company Tastemade.

Offchain Labs is developing Arbitrum, a so-called optimistic rollup scaling solution for Ethereum. The hire comes after the company launched Arbitrum Nova, a blockchain for games and social applications development.

“Arbitrum has become a premier destination for Web3 builders around the world and we’re looking forward to bringing Andrew into the fold to expand on that global reach and rapid adoption to date,” Offchain Labs CEO Steven Goldfeder said in a statement.

Marc Boiron, the former chief legal officer at dYdX, has left the company to take the same role with Ethereum scaling platforms developer Polygon.

In addition to his experience at dYdX, Boiron worked at law firm Manatt, Phelps & Phillips, where he advised companies on blockchain technology-related issues and developing approaches to addressing regulatory issues adopted across the Web3 ecosystem.

“With regulatory pressure increasing worldwide, it’s integral to have an in-house legal counsel to help navigate and embrace web3’s ever-evolving regulatory landscape,” Polygon co-founder Sandeep Nailwal said in a statement.

UK-based crypto firm B2C2 lured Zeke Vince from the traditional finance world to lead its US sales efforts.

Vince was formerly the global head of electronic foreign exchange sales at Bank of America Securities. He joined Bank of America in 2017 from JPMorgan, where he spent six years as a part of the electronic foreign exchange sales team. Prior to JPMorgan, Zeke worked in the same unit at Credit Suisse.

Crypto exchange Unizen appointed Michael Healy, a co-founder of the Unit Network, as chief strategy officer.

Healy worked for Wikileaks and helped build its Android application in 2010. After donations via Visa and Mastercard were disabled, he brought bitcoin payments to the organization.

He has also previously worked at London-based venture capital firm Wellington Partners, investing in companies such as Spotify during his tenure.

The hire comes after Unizen received $200 million from Global Emerging Markets in June to accelerate the development of its trade aggregation system.

Alternative asset manager Blackstone hired Adam White, a former Bakkt and Coinbase executive, as a senior adviser.

He will focus on advising within the company’s growth equity investing platform as Blackstone seeks to invest in services and infrastructure supporting the digital asset ecosystem. Blackstone participated in a $100 million funding round last year for Chainalysis, which provides blockchain data and compliance software.

White joins Blackstone after working as president and chief operating officer at Bakkt since 2018. Before that, he was a vice president and general manager at Coinbase.

Crypto.com named Chin Tah Ang as general manager for Singapore after the company received in-principle approval from the Monetary Authority of Singapore for its Major Payment Institution License.

Ang most recently served as the executive director of Digital Industry Singapore. Before that, he worked for the Singapore Economic Development Board.

The hire comes after sources told Decrypt that Crypto.com is set to lay off more employees after cutting 260 staff members in June.

A spokesperson for the company declined to comment.

Meanwhile, crypto social trading network BingX revealed Friday that it is looking to fill about 200 positions globally, including public relations managers, as well as product development and customer service professionals.

“This so-called crypto winter presents a rare chance for us to tap on some of the industry’s best talents and we will leverage on that,” BingX Communications Director Elvisco Carrington said in a statement.

In case you missed it

Singapore-based cryptocurrency lender Hodlnaut decided to slash its headcount by 80%, or about 40 employees. The retained team is required to carry out key functions, it said.

The firm said in an update on Friday that it is handling inquiries from the Singapore attorney general and the police force but did not offer further details.

Crypto broker Genesis named a swath of new leaders as CEO Michael Moro is set to step down. The Digital Currency Group subsidiary appointed Chief Operating Officer Derar Islim, who joined Genesis in 2020, to be its interim CEO while the company searches for a full-time chief executive.

The crypto brokerage also revealed to Bloomberg that it is cutting 20% of its 260-person workforce.

Citi added two crypto-focused leaders to its Treasury and Trade Solutions unit.

Ryan Rugg, who has experience at Lehman Brothers, Morgan Stanley, JPMorgan and IBM, joined as the division’s global head of digital assets. David Cunningham, previously the chief commercial officer at LexTego, is now Citi’s director of strategic partnerships for digital assets.

21Shares hired Sherif El-Haddad, previously the head of asset management at Al Mal Capital, to lead the firm’s expansion in the Middle East.

The world’s largest crypto exchange-traded product (ETP) issuer also revealed Wednesday that former Barclays executive Marina Baudéan joined the company as its head of France, Belgium and Luxembourg. Additionally, Oliver Schäfer, who previously worked at JPMorgan Asset Management for 15 years, is the company’s new head of Germany.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.