MicroStrategy Beats Estimates for Earnings, Revenue, Buys 8,957 Bitcoins in Q3

Michael Saylor has no intention to stop purchasing bitcoin anytime soon.

Michael Saylor, CEO, MicroStrategy

- MicroStrategy reported a slight increase in year-over-year revenue in Q3

- The company purchased an additional 8,957 bitcoins during the third quarter and has intentions to continue this strategy

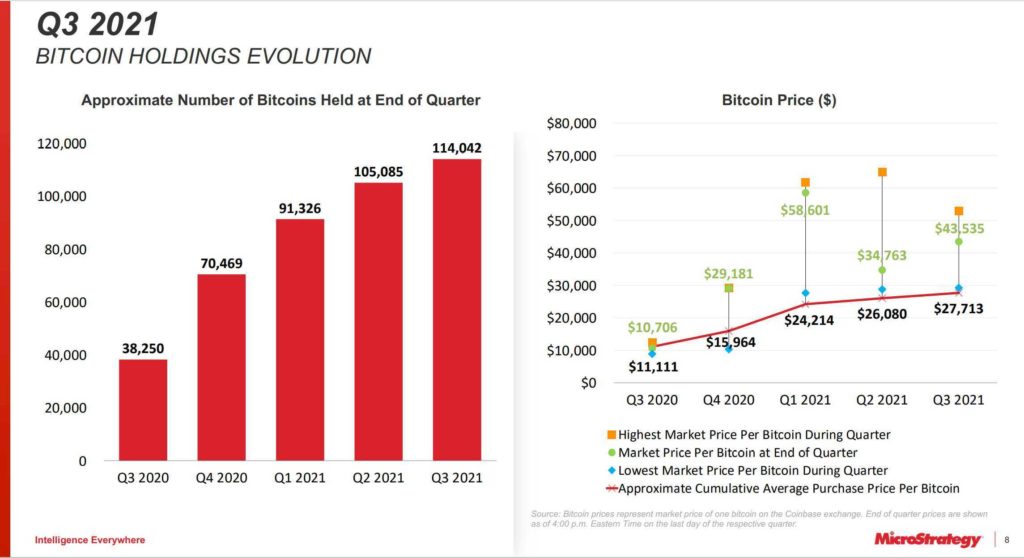

MicroStrategy reported a purchase of 8,957 bitcoins, bringing its total holdings to more than 114,000 bitcoins. The business intelligence company noted that its bitcoin purchasing strategy is expected to continue.

Based on current prices, MicroStrategy’s bitcoin holdings amount to about more than $7 billion.

MicroStrategy also reported a slight year-over-year increase in revenue, $128.0 million during the third quarter, and an earnings surprise of 66.07% for the third quarter of 2021. Analysts expected revenue of $127.5 million.

“We’re profitable, we’re generating a very healthy operating margin and and I’m very pleased with the stability and maturity of that business,” said Michael Saylor, chairman and CEO of MicroStrategy.

MicroStrategy reported a quarterly earnings of $1.86 per share, exceeding the Zacks Consensus Estimate of $1.12 per share. This marks the company’s third quarter surpassing earnings per share estimates over the last year.

The company announced an offering of $500 million of senior secured notes with an annual interest rate of 6.125% in a private offering to qualified institutional buyers to finance the purchasing of more bitcoin in June 2021.

“At times, we thought the most creative action was a convertible debt issuance, but back in the second quarter, we decided that a senior secured note was more creative,” Saylor said. “It’s impossible for us to know exactly what the right activity is going to be going forward because the market is constantly changing.”

The book value of MicroStrategy’s bitcoin was $2.406 billion, which is the value of the digital asset according to its balance sheet account balance and reflects the cumulative impairment loss of $754.7 million. Digital asset accounting regulations require companies that hold cryptocurrencies to report an impairment loss in cases where the asset price drops below the company’s purchase price at point during the quarter.

“Currently, companies that aren’t investment companies that report Bitcoin as intangible assets. This means Bitcoin gets initially reported on balance sheets at its historic cost, and then is deemed impaired at the market value ever depths,” said Phong Le, president and chief financial officer at MicroStrategy. “However, the carrying value can never conversely be revised upwards if the price of Bitcoin increases.”

Saylor mentioned the regulatory discussions that occurred during the past three months, but remained fairly optimistic about the future of a core business model for his company. The approval of an exchange-traded fund will allow institutions and financial advisors to access the market.

“There’s no intention to block institutions from owning this asset,” he said. “It’s been referred to as a scare, speculative digital asset, or store of value asset.”

MicroStrategy shares rose slightly on the news and were trading 0.42% higher at the close on Thursday.

This article was updated on October 28, 2021, at 6:07 pm ET to reflect the correct number of bitcoins held by MicroStrategy.