Not all about bitcoin production: Miners benefit by curtailing operations

More miners will participate in energy sales or demand response programs as the bitcoin halving draws nearer, a mining consulting firm founder says

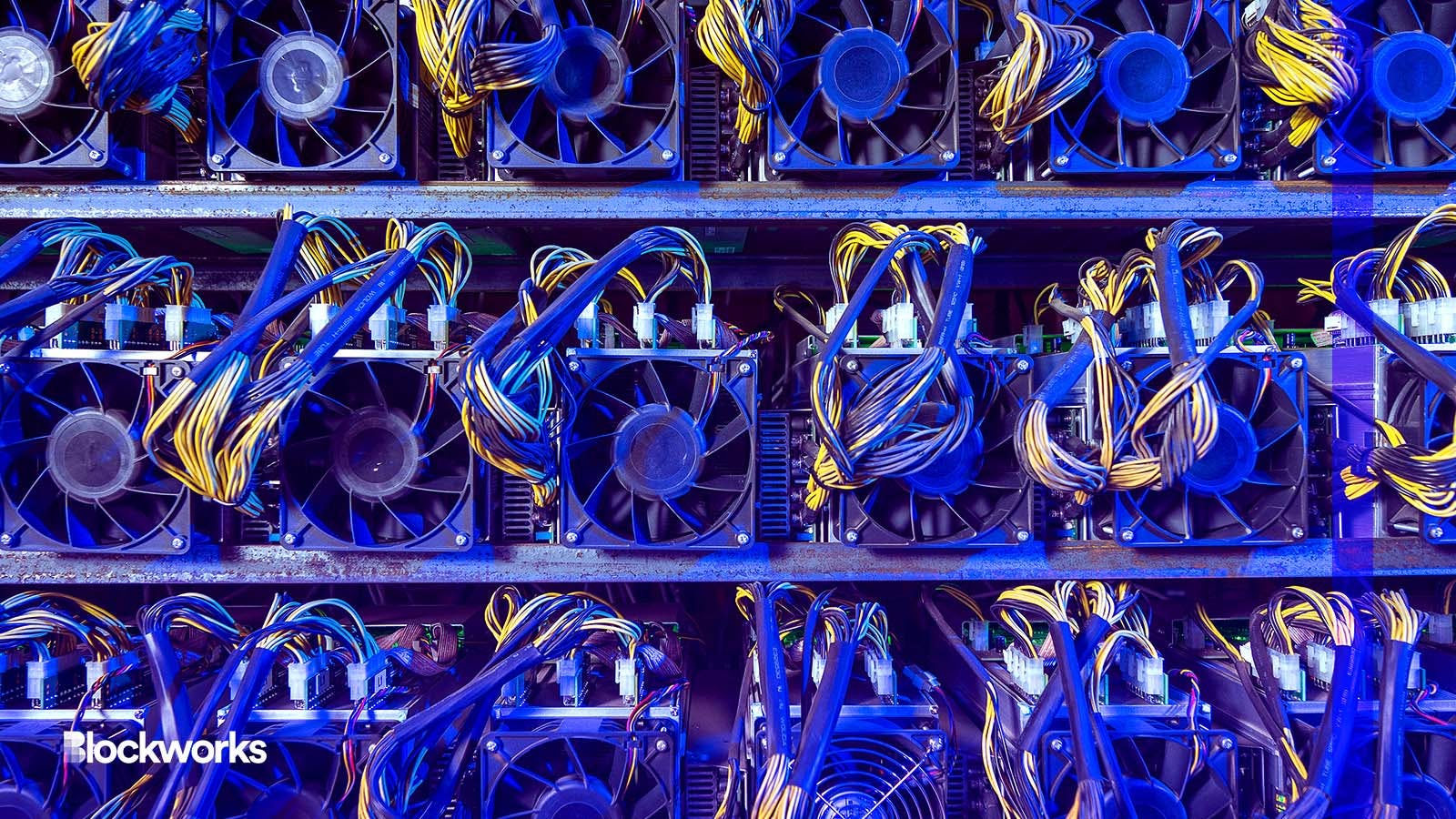

Mark Agnor/Shutterstock modified by Blockworks

Certain companies that mined more bitcoin than competitors last month did not necessarily beat out their counterparts on the “realized hash rate” front.

Some firms operating in Texas used demand response programs to generate additional revenue — a strategy expected to continue as the mining space grows more competitive.

Marathon Digital, Core Scientific and CleanSpark mined the most bitcoin in July, respectively, according to data from TheMinerMag. Those companies also led all others in realized hash rate — a metric based on production of bitcoin and bitcoin equivalent from proprietary hash rate.

But down the list, certain miners that mined less bitcoin made up for it by curtailing their mining operations.

Chart by TheMinerMag

Chart by TheMinerMag

Chart by TheMinerMag

Chart by TheMinerMag

Iris Energy, for example, mined 423 bitcoin (BTC) in July, compared to Cipher Mining’s 418 BTC. But the latter company brought in an equivalent of 28 BTC in power sales during the month by curtailing some of its proprietary hash rate.

Cipher Mining said in an Aug. 1 statement that an important feature of its power purchase agreement in Odessa, Texas is the ability “to sell power back to the grid.”

Miners have the option to sell their grid-balancing rights to the Electric Reliability Council of Texas (ERCOT) to balance the grid by reducing their energy consumption. The company began reporting those power sales monthly as a bitcoin equivalent figure.

Riot Platforms mined even less than Iris Energy and Cipher Mining — producing 410 BTC in July, an 11% decline from the prior month. But Riot received $8.2 million in power and demand response credits, equal to roughly 280 bitcoins based on the average BTC price in July.

Temperatures in Texas have soared this summer, creating “some of the most challenging operating months of the year,” Riot CEO Jason Les said in a statement.

The credits came as Riot curtailed more than 90% of its power usage on certain dates of peak demand as a way to help ERCOT continue offering power to consumers without interruptions.

Read more: Bitcoin mining load flexibility can ‘significantly mitigate power shortages’ in Texas

According to Nishant Sharma, founder of mining consulting firm BlocksBridge, the parent company of TheMinerMag, miners began reaping the benefits of curtailing their mining operations back in 2020. This development followed the entry of the first large-scale mining operations into Texas, a state renowned for its demand response programs.

“However, the trend has increased now as mining has become more competitive than ever before,” Sharma told Blockworks.

Last year was tough for crypto miners as declining crypto prices hurt firms that took on debt to accelerate growth operations during the bull market. Data center operator Compute North filed for bankruptcy in September, while Core Scientific did the same a few months later.

More firms in the space have begun selling a portion of their bitcoin to cover certain operational costs. Marathon Digital, for example, which produced 1,176 BTC last month, opted to sell 750 bitcoins in July.

Miners are looking at various technologies and operational strategies to remain leaner and stay ahead in the race, Sharma said.

Hive Blockchain Technologies changed its name to Hive Digital Technologies as part of a shift in focus to supporting the growth of artificial intelligence.

“As halving draws nearer, miners will find more innovative ways to generate returns for their investors,” Sharma said. “We will see more miners participating in energy sales or different demand response programs.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.