Naver acquires Upbit in Korea

Korea’s “Google” just bought the country’s “Coinbase” in a bold bid to build a super app spanning payments, stocks and crypto

SUNG YOON JO/Shutterstock modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Markets caught a brief relief rally yesterday, with BTC finishing +1.2% after a tough week of trading. Relief rallies like this often reveal which sectors are best positioned to outperform when risk appetite returns. Gaming led the rebound with a +3.07% gain, extending its strong momentum from last week, while Memes also stood out with a +1.53% rise. On the other end, L2s slipped -1.17% and L1s edged lower at -0.37%, making them the weakest sectors in an otherwise positive session.

While large liquidations that clear out leverage are often followed by a sharp V-shaped recovery, this time the rebound hasn’t materialized. Since Monday’s wipeout, markets have continued to drift lower. ETH and SOL, which had surged on the back of DAT flows, have retraced to the $4,000 and $200 levels, respectively, both down about 20% from recent highs.

ETF flows paint a mixed picture. The start of the week saw heavy outflows from BTC and ETH ETFs, though yesterday BTC ETFs flipped back to positive territory. Sustained inflows here could signal capital rotating back to the relative safety of BTC, which historically holds up better during risk-off stretches.

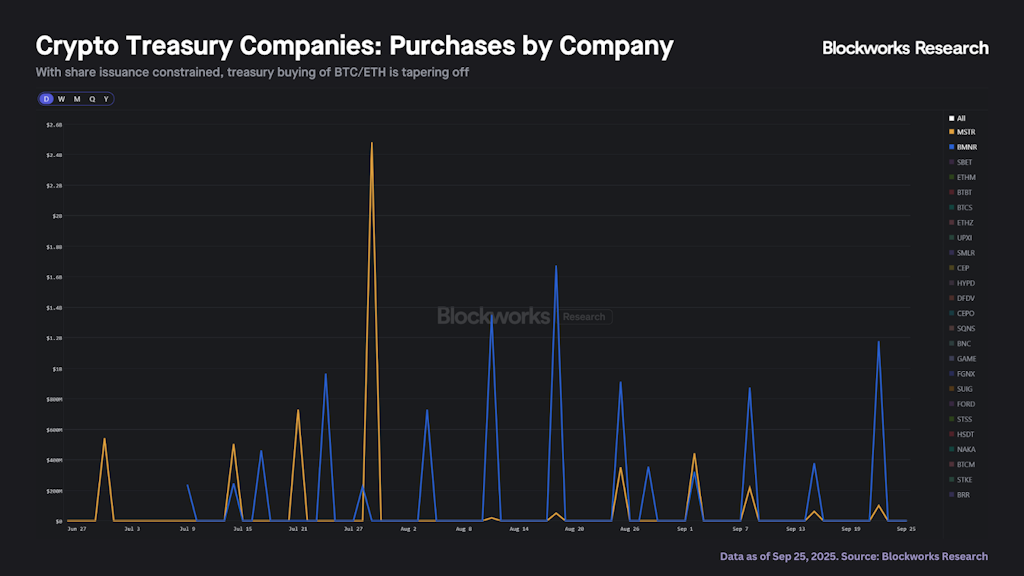

The picture isn’t much brighter among treasury companies. Premiums to NAV for the top treasury companies, MSTR and BMNR, have continued to compress.

That makes it harder for them to issue shares and accumulate BTC/ETH at the same pace. Their steady bid was a key driver of the recent rally, but as those purchases taper off, the market is losing a major source of demand.

Overlaying all this is the macro backdrop. The Fed has formally entered an easing cycle with two more cuts expected this year. Yet, Powell’s comments this week noted that equity valuations remain fairly high, underscoring lingering caution. In short, crypto markets are searching for their next catalyst, and until it arrives, investors should brace for more chop ahead.

Naver buys

Naver, South Korea’s largest internet portal, has completed a comprehensive stock swap to acquire Upbit through its fintech arm, NAVER Financial. Dunamu, the operator of Upbit, confirmed the deal. Naver shares jumped 11.4% on the news.

For context, NAVER is South Korea’s dominant digital platform, with ~25 million daily active users across search, shopping, payments, messaging and content. The addition of Upbit broadens this ecosystem by bringing in cryptocurrency trading. As of February 2025, Upbit controlled about 69% of Korea’s crypto exchange market share (down from 86% in 2021), and an estimated 16 million Koreans actively trade crypto.

The move is part of NAVER’s broader push to become a comprehensive super app. Earlier this year, NAVER Pay acquired a 70% stake in Dunamu’s Securities Plus Unlisted (Korea’s largest platform for unlisted stocks) and secured an OTC license. NAVER and Dunamu have also been developing a KRW stablecoin initiative. With crypto, equities, private equity and NAVER Pay, which processed KRW 20.8 trillion in Q2 2025, NAVER is positioning itself under one roof as a financial and digital hub similar to the “everything app” vision Elon Musk has described (but failed to achieve) for X.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.