NFTs, down to $73M in weekly volumes, embrace ‘ownership model’

Use cases for NFT projects can range from setting up a football team in Mars to supporting local communities in Mexico

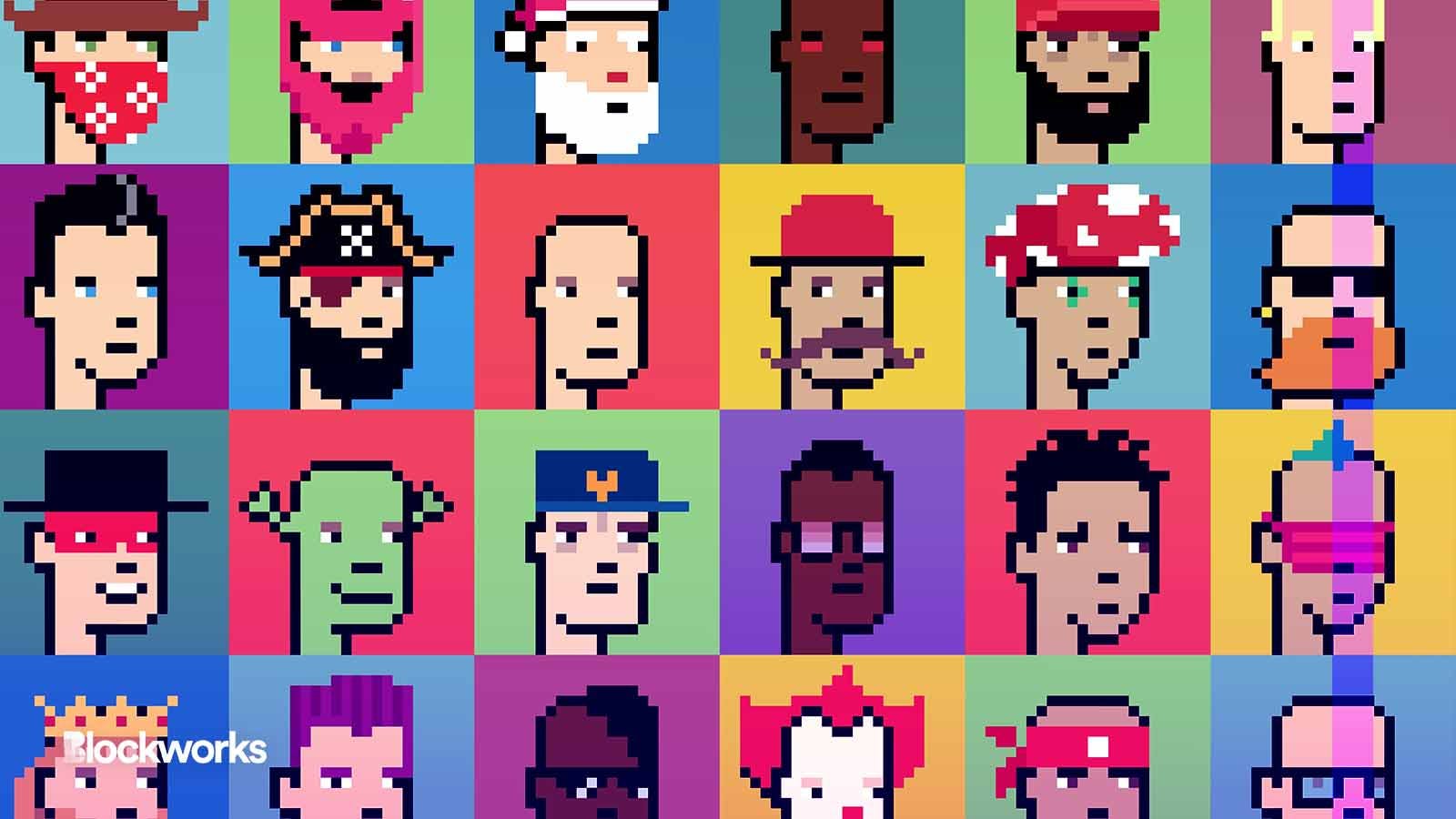

derter/Shutterstock modified by Blockworks

NFTs were one of the biggest buzzwords in early 2021.

Digital artwork by up-and-coming creators sold for millions of dollars. Beeple boomed. And “The Merge” attracted over 30,000 collectors, who paid a total of $91.8 million to mint the collection.

The floor price of “The Merge” has since dipped from roughly 25 ether (ETH) to 1.1 ETH today.

Its demise is part of a much larger trend: Trading volume for all NFTs has dropped significantly, from a weekly volume of $1.8 billion in August 2021 to roughly $73 million today.

One could argue that the NFT boom is over and that a comeback would be difficult, but a handful of projects remain faithful to their potential.

In an X, formerly Twitter spaces held by World of Women — an NFT collection that features female artists from around the world — NFT creators on Monday came together to share insights into what they are building.

Mints to play football matches on Mars, become a Mayan Jungle guardian

Gaming remains a big NFT narrative, receiving roughly $297 million in funding in July.

One team building in the NFT gaming space is Martian Premier League (MPL). To participate in MPL, users can mint an MPL NFT and enter the gaming world, where they must build their own football team on a virtual Mars.

“Without that sense of ownership model that NFTs have allowed us to take, we wouldn’t have a good enough ‘why’ to come to market,” Eleanor Nugent, the founder of MPL, said in an X space.

The floor price for an MPL NFT is currently sitting at 0.011 ETH (~$19).

Read more: NFT collectors focus on generative art and historical significance amid market rout

Gaming is not the only area in which NFTs are being used. The team at Maya Spirits is hoping to use their NFT mints to champion gender equality and environmental protection in Mexico through donations.

Maya Spirits NFTs are inspired by the children in the local community. Roughly 70% of proceeds minted through NFTs are donated, 20% is spent on development initiatives, and 10% covers travel expenses, Liam Scully, co-founder of Maya Spirits, said on the X space.

The team will be partnering with Art Blocks, a platform that connects artists to blockchain technology, to launch its next NFT mint.

“These drops will be very limited in supply, and to get access you must hold a Maya Spirits NFT,” Scully said.

Maya Spirits NFTs are currently trading at a floor price of 0.015ETH (~$26).

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.