Pi Squared raises $12.5 million to build universal ZK Circuit powered by Proof of Proof

Pi Squared’s seed round and innovative Proof of Proof technology position it at the forefront of verifiable computing

Pi Squared and Adobe stock modified by Blockworks

Pi Squared, the visionary team on a mission to enable the next generation of verifiable computing, has announced the completion of its seed round, raising $12.5 million. Led by Polychain Capital, the syndicate comprises ABCDE, Bloccelerate, Generative Ventures, Robot Ventures, and Samsung Next, and a cohort of angel investors including Shumo Chu, Harish Devarajan, Justin Drake, Sreeram Kanaan, Csongor Kiss, George Lambeth, Yilong Li, Calvin Liu, Lucian Mincu, Karthik Raju, and Common Prefix.

With its seed round complete the Pi Squared team is ready to deliver on the power and promise of its breakthrough “Proof of Proof” (PoP) concept.

PoP sets the foundation

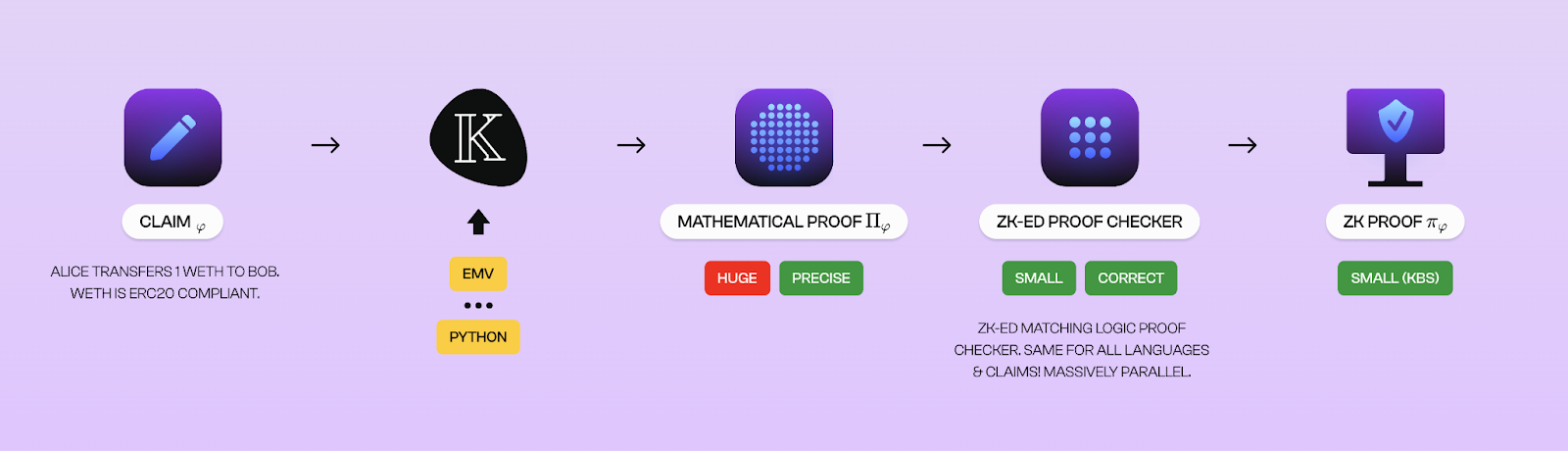

Pi Squared denotes zero-knowledge (ZK) proofs of mathematical proofs: the mathematical proofs are verified by a small, universal proof checker that yields ZK proofs. In other words, the generated results are ZK proofs of mathematical proofs—hence “Proof of Proof.”

Pi Squared applies to all executions and DA systems across platforms. | Source: Pi Squared

Pi Squared applies to all executions and DA systems across platforms. | Source: Pi Squared

Just as TCP/IP underpins the Internet, Pi Squared’s universal mathematical proof checker heralds Verifiable Computing 2.0.

“Our mission is to revolutionize verifiable computing, making it universal for all languages and virtual machines, inherently correct-by-construction, and lightning-fast,” says Grigore Roșu, CEO of Pi Squared and CS Professor at University of Illinois Urbana-Champaign. “This will have many applications, including a universal settlement layer (USL) so all Blockchains, L1s and L2s, can be universal, correct, inter-operable and efficient. It does not end there, our long-term mission is to settle all science and knowledge on USL.”

This innovation fosters a universal computing space with seamless interoperability for languages and VMs, reduces the trust base for correctness certificates, eliminates the need for error-prone traditional language tools such as compilers and interpreters, and makes language updates as straightforward as plug-and-play.

Pi Squared’s compelling initial product

Pi Squared is using ZK technology in a correct-by-construction and fundamentally unique way to ensure their products are fundamentally reliable and precise from the moment of implementation, ensuring verifiable-computing correctness across all languages and virtual machines.

The first product being built on Pi Squared is the Universal Settlement Layer (USL), a modular blockchain architecture defined by several core characteristics:

Universality

Computations can be expressed in any language or virtual machine without the need for compilers.

Provable correctness

Computations verified by the USL are mathematically proven to be correct, and any external entity can independently verify the correctness of the state of the USL.

Trust Base Minimality

USL exposes any trust assumptions in upper-layer computations for increased transparency, end-user awareness, and eventually minimize the trust base through correctness proofs.

App Interoperability

The USL will support validating interoperability between different application modules and networks (e.g. appchains).

Determinism and reproducibility

The validation is reproducible and independently verifiable by any external entity.

The tangible impact of USL

The Pi Squared team envisions USL to be the language and virtual machine-agnostic layer that enables new apps and improves existing services with its settlement layer.

For the Web3 industry, USL will enable the rise of more cross-chain applications and use cases while improving liquidity access across appchains. It’s a noteworthy development set to make the historically difficult lives of Web3 participants easier—builders and end users alike.

Specific applications enabled by USL include:

Rollup-in-a-box

This service facilitates the creation of L2/L3 rollups and appchains, offering support for multiple programming languages and virtual machines for both off-chain code and on-chain smart contracts.

Users can customize rollups by choosing from a menu of system features. Every rollup created with this service has its transactions settled transparently and uniformly by USL.

Multi-chain bridging

Multi-chain bridging enables rollups and applications on USL to effortlessly bridge tokens on-chain across various chains without the need for off-chain code.

Each side of a bridge operation can utilize a different language to create the minting or freezing transactions, while the on-chain code can be defined using yet another language. USL manages this diversity seamlessly, making it invisible to the upper layers.

Cross-chain financial applications

To provide better staking and borrowing rates, USL enables DeFi applications to transition smoothly between different rollups and appchains by settling transactions on USL, even when involved chains may use different VMs and platforms for execution.

In practice, an example of this occurring is a cross-chain DeFi application staking Ether on Cosmos and using the received liquid staking token (LST) as collateral to borrow USDC on Solana.

Heterogeneous ZK verification

Users can leverage USL, via support of various ZK rollups and applications, to use the ZK platform of their choosing. USL validates through a ZK proof verification process when transactions occur using the appropriate ZK backend.

“Pi Squared’s proof of proof technology will have a transformative impact across Web3 and beyond,” said Karthik Raju, GP at Polychain Capital. “Pi Squared’s universal ZK circuit will significantly increase the reach and applicability of Web3 for everyone, from builders to end users.”

Ready to trailblaze

Pi Squared’s seed round and innovative Proof of Proof technology position it at the forefront of verifiable computing.

Pi Squared will be presenting and exhibiting at events around EthCC in Brussels next week. Readers can listen to Pi Squared’s CEO, Grigore Roșu, speak at Restaking & Infra Day as well as L2con on July 8th & 9th.

To learn more about Pi Squared, visit the Pi Squared website and follow their X (Twitter) account.

This content is sponsored by Pi Squared and does not serve as an endorsement by Blockworks. The veracity of this content has not been verified and should not serve as financial advice. We encourage readers to conduct their own research before making financial decisions.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.