Ray Dalio: Crypto Should Be Part of a Diversified Portfolio

Billionaire hedge fund executive calls cash “the worst investment” amid rising inflation

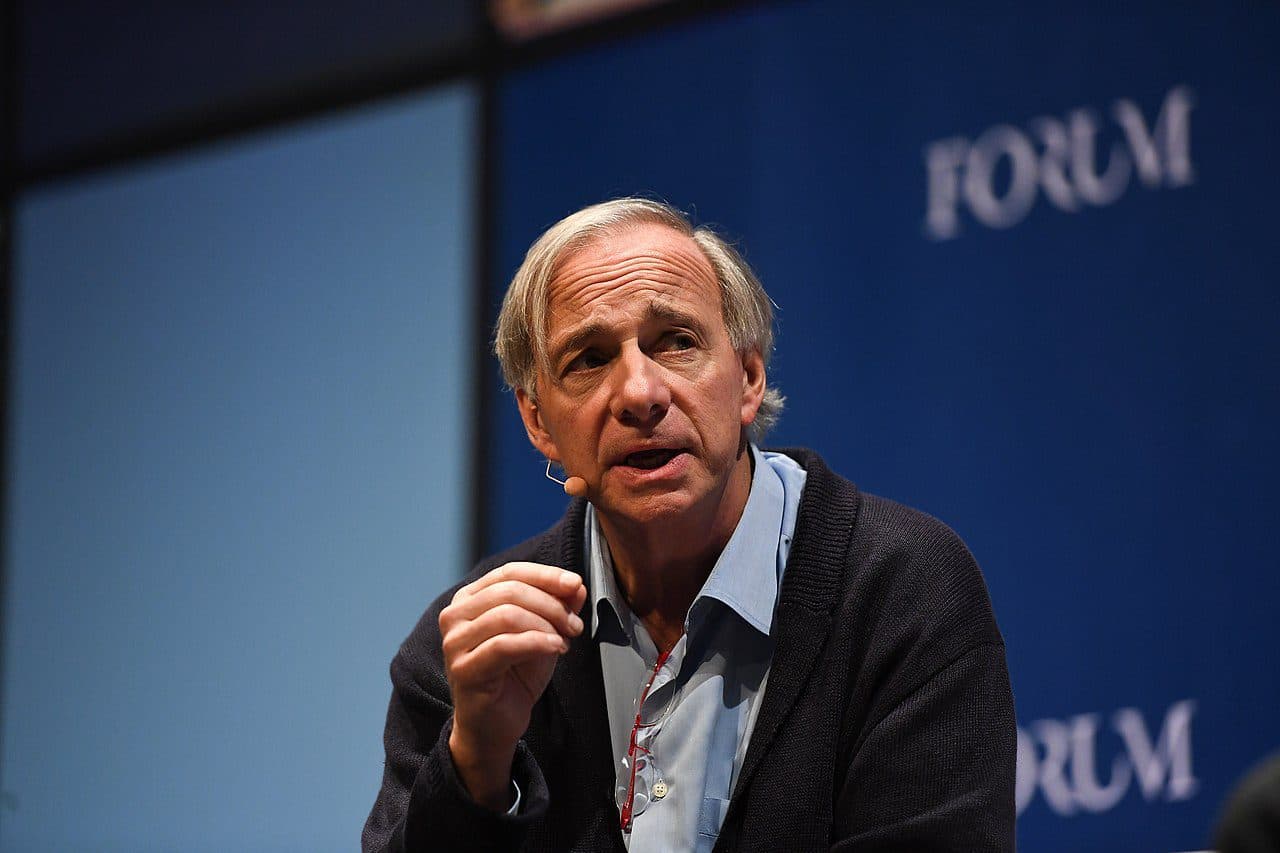

Bridgewater Associate’s Ray Dalio; Source: Wikipedia

- Dalio said crypto is an alternative money in an environment in which the value of the dollar is depreciating in real terms

- Assets such as bitcoin and ether should be a relatively small part of investor portfolios, he added

Billionaire Ray Dalio owns bitcoin and ethereum, he said during an interview with Yahoo Finance, and believes that crypto has a place in portfolios.

The founder of hedge fund manager Bridgewater Associates — and the firm’s CIO since 1985 — declined to specify how much bitcoin and ether he owns.

Though he indicated he doesn’t own a lot, he said he views it as an alternative money in an environment in which the value of the dollar is depreciating in real terms.

“I think it’s very impressive that for the last 10 or 11 years that programming has still held up,” Dalio explained. “It hasn’t been hacked … and it has an adoption rate.”

The hedge fund executive said he encourages diversification during the Yahoo Finance interview, noting that crypto is “a relatively small part of the portfolio.” He called cash the worst investment, noting its loss of buying power.

The Consumer Price Index (CPI) rose 0.8% in the month of November — the fastest pace since 1982 — putting inflation at a 6.8% increase over the year.

The Federal Reserve said in a statement Wednesday that it would speed up its asset purchase tapering timeline in response to high inflation and an improved labor market. Economic projections released with the statement show that Fed officials anticipate three increases of a quarter-point each to the benchmark federal funds rate in 2022.

“The one thing I would say to investors [is] don’t judge anything in your returns or your assets in nominal terms, in terms of how many dollars you have; view it in terms of inflation-adjusted dollars,” Dalio said. “Cash this year you’ll lose 4% or 5% to inflation, and so pay attention to those.”

These are not Dalio’s first comments on cryptocurrency.

The billionaire told CNBC in September that regulators would try to “kill it” if crypto becomes successful. He added at the time that many things that don’t have intrinsic value, such as cryptocurrencies, “became hot and then became cold.”

10T Holdings Founder and CEO Dan Taperio and Mark Yusko, founder and chief investment officer of Morgan Creek Capital Management, criticized Dalio’s September comments during a panel at Blockworks’ Digital Asset Summit.

“[Crypto] … will displace all of the bad, crappy money, and that is inevitable and there’s no way to stop it,” Yusko said. “Ray Dalio is crazy to say they can shut it down. No, you can’t.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.