SOL ETFs begin trading: Can Jito drive a network rebound?

As Solana ETFs launch but network REV trends lower, Jito sits at the intersection of new capital inflows and microstructure improvements

Artwork by Crystal Le

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Crypto markets had a modest start to a headline-heavy week. BTC closed Monday at ~$114K, down -0.2% on the day, outperforming gold but underperforming US equities. Gold is finally cooling off, closing below $4,000 (-1.6%), while the three major stock indexes (S&P 500, Nasdaq 100 and Dow Jones) hit new all-time highs, with tech stocks leading gains.

The positive momentum in US equities was partly driven by constructive US-China trade talks ahead of Thursday’s meeting between the leaders of both countries. While on macro, investors are also anticipating the Fed will cut rates by 25 bps on Wednesday, with the CME projecting a 98% probability of a rate cut. Additionally, this week will also be dominated by Q3 earnings announcements, including Big Tech names like Apple and Meta, as well as Coinbase on the crypto side.

Regarding cross-index performance, the only sectors that outperformed the Nasdaq on Monday were AI (+2.4%) and Crypto Miners (+1.5%). On the miners index, RIOT was the best performing stock, rising ~7% yesterday ahead of its Q3 earnings report on Thursday. All other crypto-related sectors were negative on the day, except crypto equities, which closed slightly higher (+0.2%).

As mentioned, Coinbase will announce Q3 earnings on Thursday (Oct. 30), after market close. The US crypto exchange announced a partnership with Citi yesterday to develop a payments solution for institutional clients. The solution will focus on improving on- and off-ramps and other infrastructure initiatives. COIN traded up as high as 5.3% intraday, before closing up 2%.

While investors were constructive on Coinbase’s collaboration with Citi, they had preliminary negative views on Galaxy’s announcement of a $1 billion private offering of exchangeable senior notes due 2031. Although the company mentioned it intends to use the net proceeds “to support growth across its core operating businesses and for general corporate purposes,” GLXY fell almost 9% after hours yesterday. To note, Galaxy surprised to the upside on its Q3 earnings call last week, with its reported EPS of $1.13 beating the $0.38 expectations by a wide margin.

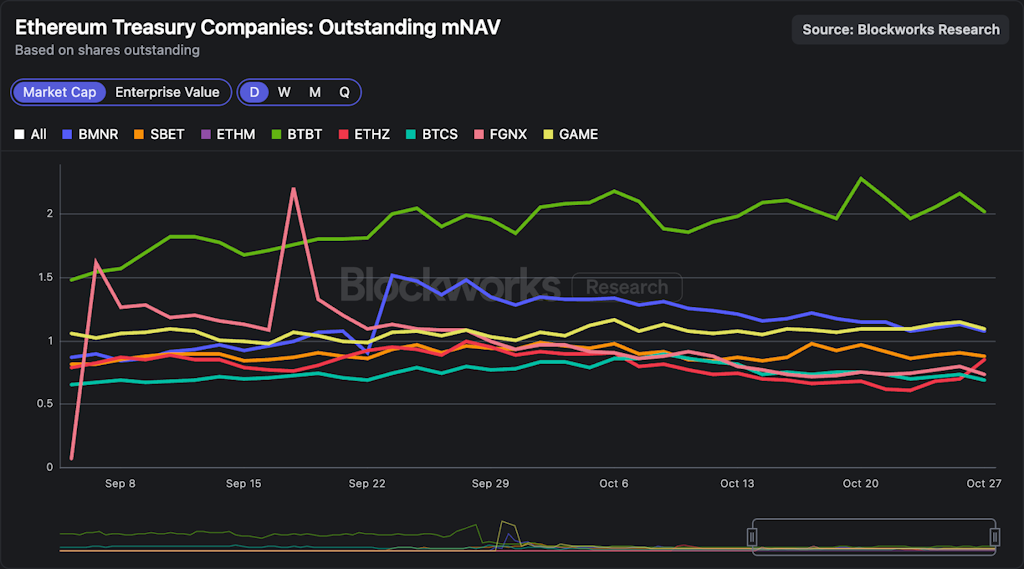

On the DATCO front, things aren’t looking particularly good. ETHZilla (Nasdaq: ETHZ) announced that it sold approximately $40 million of its ETH treasury holdings and plans to use the proceeds to repurchase shares. Since Friday (Oct. 24), ETHZ has repurchased ~600K shares for roughly $12 million and plans to continue repurchasing its shares until the discount to NAV is normalized. To note, ETHZ was unable to use cash on hand to buy back its stock, even though the company’s statement that it had $569 million in cash as of Sep. 26 suggests it had enough to do so. As seen below, ETHZ traded at a market NAV (mNAV) of 0.6x on Oct. 22, the lowest amongst all its peers. After yesterday’s announcement, ETHZ closed at an mNAV of 0.86x, suggesting the company will repurchase additional shares under its $250 million buyback authorization.

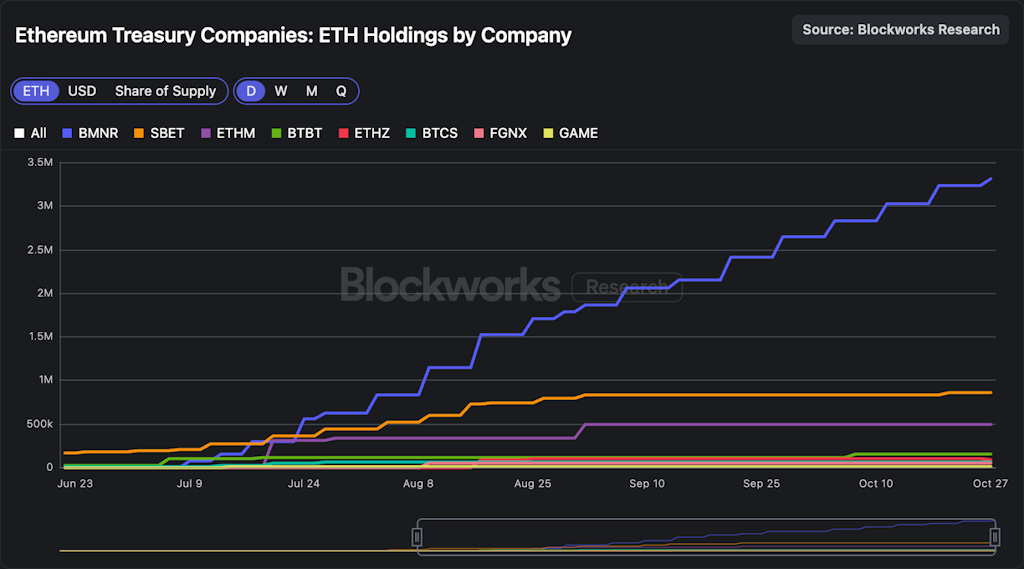

The “magic” of DATCOs is their ability to keep cranking the machine by selling equity to buy more of the underlying token, which relies on mNAV premium. The problem is that this is essentially a marketing game, and DATCOs like ETHZ trading at a discount to NAV have tightened financing conditions. Among Ethereum DATCOs, BitMine (BMNR) is notably still trading at a slight premium to mNAV (1.08x), though the ratio has been declining in recent weeks. BMNR announced yesterday that its holdings have now surpassed 3.3 million ETH, worth around $13.7 billion, following last week’s acquisitions. BMNR now holds almost 4x as much ETH as its next closest competitor, SBET.

On a more positive note, the Bitwise SOL staking ETF (BSOL) starts trading today, joining SSK as the only two Solana spot ETFs in the US. Notably, Bitwise said it will aim to maximize staking rewards by targeting a 100% stake ratio, resulting in a staking reward rate of 7.34%. It will be interesting to see if it’s actually able to stake 100% of SOL holdings. SSK and SOL ETPs in Europe, which have been live for over four years, intentionally have staking ratios well below 100%. The reason is entirely operational: These issuers need to ensure there is sufficient liquidity to meet daily redemptions.

In contrast to these players, Bitwise will stake in-house via Helius, which may improve BSOL’s operational efficiency. For three months, Bitwise will waive management fees on the first $1 billion of AUM. BSOL will open the floodgates for many more SOL ETFs, which can realistically attract multiples more than the $415 million SKK has seen in cumulative flows since July.

Finally, on the crypto front, MegaETH’s public sale went live yesterday and is already ~9x oversubscribed as of writing, with commitments nearing $450 million. By now, it’s clear the auction will clear at $0.0999, implying an FDV of $999 million. With the sale ending in two days, we will likely see the oversubscribed multiple rise even further (around 20x would be my uneducated guess), with allocation criteria decided on social information (Twitter profile, onchain history, etc.). MEGA has traded between $4 and $5 billion FDV on Hyperliquid’s pre-market over the past few days, suggesting that committing capital to the sale will likely pay off, though most users probably won’t get their desired allocation.

Inside Jito’s weakness and the forces that could reverse it

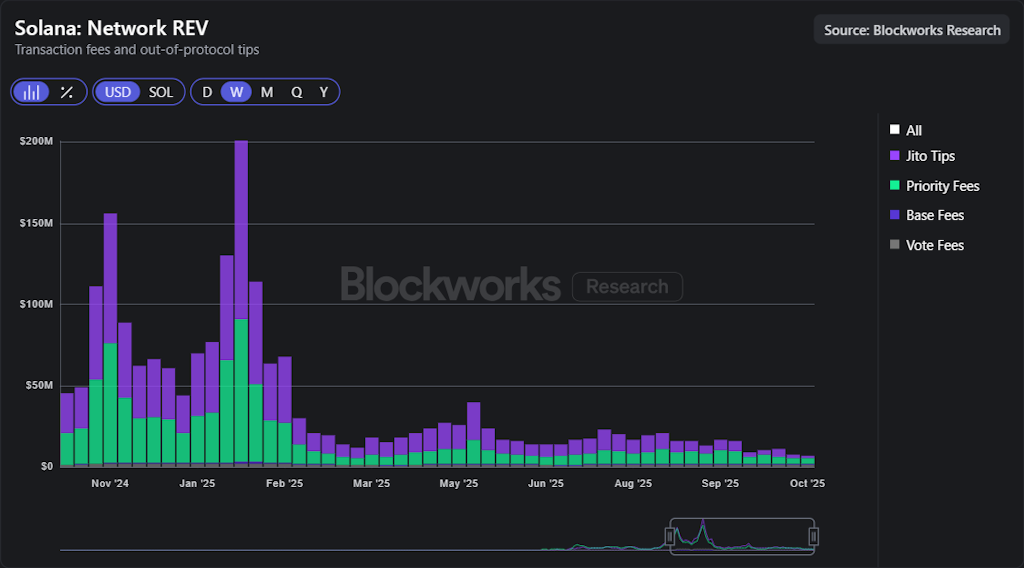

The Jito token ($JTO) has been having a weak run in price performance and has significantly underperformed Solana itself. Jito tips’ share of network REV has fallen sharply, from over half of Solana’s REV base to now below 30%, compounded by a broader decline in Solana’s overall REV. The question now is whether Jito possesses the reflexivity to benefit from a rebound in Solana’s network activity, the very activity it is designed to enhance.

Solana’s architecture design was once praised, yet recently has raised questions as many apps and DeFi activity underperformed the broader crypto market. It raises the question — why hasn’t a competitive perps exchange emerged on Solana to rival Hyperliquid’s execution quality? Why have teams like Elipisis Labs moved to building Atlas? The architecture delivers speed but not always predictable ordering, fair fee routing or strong spam resistance.

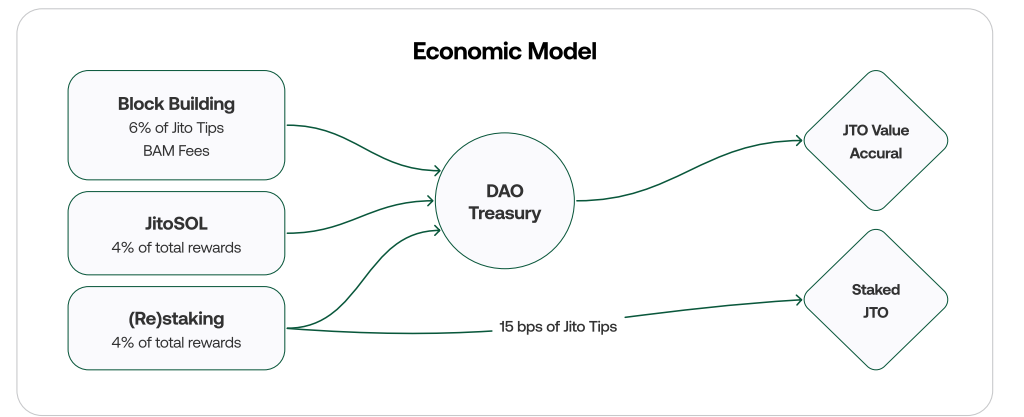

Jito’s Block Assembly Marketplace (BAM) aims to fix this by preserving Solana’s monolithic design while giving apps app-chain style control over sequencing and fees. One potential example is a taker speed bump that slows toxic flow and tightens spreads, similar to what Hyperliquid has deployed. The goal is cleaner queues, less latency games and higher quality fills that can catalyze better apps and strengthen DeFi activity, possibly supporting a rebound in Solana REV. All BAM fees will route to the DAO, providing a new source of fees with BAM mainnet recently crossing 10 million+ in SOL stake.

The recent $50 million strategic investment (private token sale) led by Andreessen Horowitz signals strong backer confidence. It highlights BAM as core Solana infrastructure that improves market quality by giving apps control over sequencing while reducing harmful MEV. The end result is that BAM is a network that extends Solana and unlocks onchain primitives such as central limit order books and dark pools that have historically been impractical because of MEV.

Solana staking ETFs are incoming. VanEck has filed an S-1 for a JitoSOL ETF that would hold Jito’s liquid staking token directly. As more funds launch and scale, there is higher potential of LST penetration and a tighter link between TradFi inflows and Jito’s value loop. Note that liquid staking on Solana has been increasing steadily to now nearly 15% of stake.

Since SIMD-0096, validators receive all priority fees instead of splitting them with the burn mechanism, giving them a disproportionately large share of network revenue. Once SIMD-0123 is activated, it will reintroduce balance by requiring validators to share a portion of those fees with stakers, boosting staking yields and making rewards more evenly distributed across the network. Both dynamics — more ecosystem activity being shared with stakers and the expansion of liquid staking — directly feed into Jito’s fee generation from liquid staking management fees.

However, competition in Solana’s liquid staking market has intensified. JitoSOL once held nearly half of all staked liquidity, but its share has fallen to around 25% as new entrants fragment the space. Sanctum, in particular, has gained momentum through its branded LST model and partnerships, offering protocols the ability to launch customized staking products that compete directly with Jito’s offering.

Against this backdrop, Jito is aligning protocol incentives with token holder value. After JIP 24, all Block Engine and BAM fees flow into the DAO treasury. The DAO allocates all revenue to continuous JTO buybacks, with about $2.5 million already executed since August 2025. The SubDAO is shipping the Vault, the JTO Auction and a TWAP buyback system to automate this flow. Monthly buybacks are set to match the prior month’s revenue, creating a direct and recurring link between network activity and token value.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.