Stocks whipsaw, BTC holds onto $78K as investors trade on ‘fake news’

The S&P 500 quickly erased gains spurred by optimism that President Trump may push back the start date for his new tariff policies

White House National Economic Council Director Kevin Hassett | usbotschaftberlin/"A conversation between Kevin Hassett, and Roman Pletter, Deputy Head of Economics, DIE ZEIT." (public domain/government work license)

US equities whipsawed Monday morning, with the S&P 500 surging as much as 8% before falling 3.5% in a matter of seconds based on what the White House is calling “fake news” regarding upcoming tariffs.

Meanwhile, bitcoin traded sideways, hovering around $78,000 after falling below $80,000 Sunday evening.

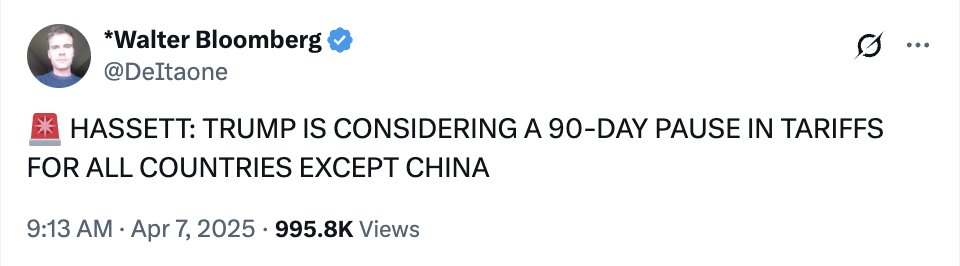

Investors appeared to be reacting to popular social media accounts that claimed the White House would be considering a three-month pause on implementing tariffs. The White House quickly told CNBC the report was “fake news.”

The rumor was apparently spurred by a comment from President Trump’s top economic advisor. When asked during a Fox News interview if Trump would consider a 90-day pause on tariffs, White House National Economic Council Director Kevin Hassett said, “I think the president is going to do what the president is going to do.”

Trump on Monday threatened a new 50% levy against China if the country does not back down from its retaliatory tariffs by Tuesday. Beijing last week said it would impose a 34% tariff on US imports starting April 10.

At the time of publication, the S&P 500 was trading 0.6% lower while the Nasdaq Composite lost 0.1% on the session. The Dow Jones Industrial Average, after briefly moving into the green, was down 1,000 points. The VIX hovered around 45 after breaching 50 earlier in the day.

The chaos comes after Trump’s team spent the weekend assuring the world that tariffs will go into effect on time this Wednesday. Commerce Secretary Howard Lutnick on Sunday said that “there’s no postponing” the policies, adding that the higher levies will “stay in place for days and weeks.”

Markets are now calling for five interest rate cuts from the Federal Reserve this year. Odds of an interest rate cut in May jumped from 14% to 33% in one week, according to data from CME Group.

The Fed’s Board of Governors will hold its typical biweekly meeting Monday, an event also making the rounds on social media and being falsely characterized as an “emergency meeting.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.