Treasury opens comment period on GENIUS Act stablecoin rules

Advance notice seeks input on consumer protections, illicit finance risks, and market oversight in new stablecoin framework

Lux Blue/Shutterstock and Adobe modified by Blockworks

The US Department of the Treasury has issued an advance notice of proposed rulemaking (ANPRM) to begin implementing the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

The measure invites public comments for 30 days following publication in the Federal Register, with submissions viewable on Regulations.gov. The Treasury is seeking input on consumer protection, illicit finance, financial stability, and compliance obligations for stablecoin issuers, as it develops the first formal regulations under the new law.

The GENIUS Act, passed earlier this year, marked the first major US legislation focused specifically on payment stablecoins. It directs the Treasury to create a regulatory framework that balances innovation with oversight.

This effort follows the Treasury’s August 18 request for comment on detecting illicit activity involving digital assets, which remains open until October 17. While the current notice does not impose new obligations, it signals a pivotal stage in translating the GENIUS Act into enforceable policy.

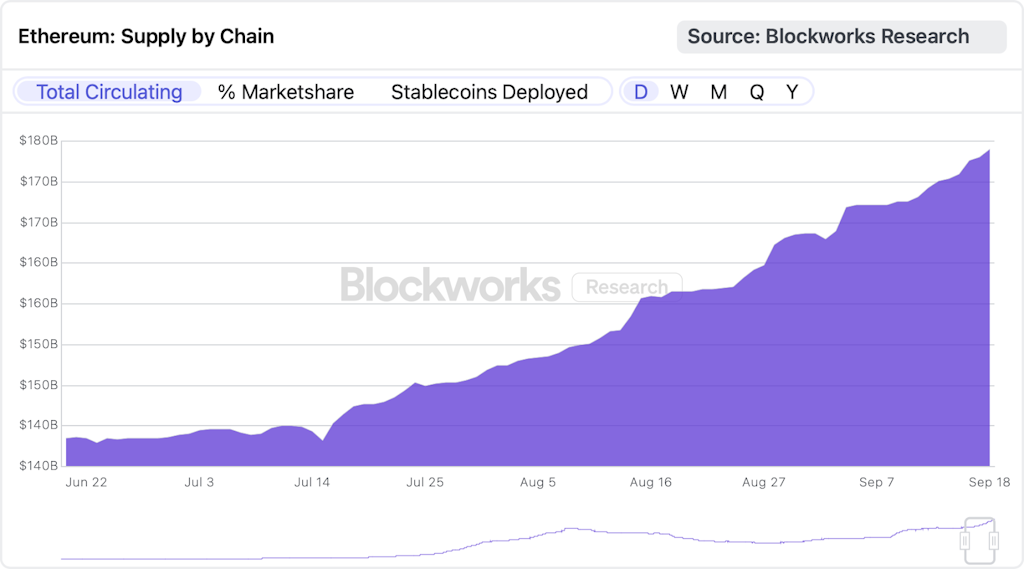

Ethereum stablecoin supply | Blockworks Research

Ethereum stablecoin supply | Blockworks Research

Ethereum remains the dominant hub for stablecoins, with a circulating supply of $174 billion on its network, representing 60.7% market share across all chains, according to Blockworks Research data. USDT leads with more than $84 billion deployed on Ethereum, followed by USDC at $47 billion.

Emerging stablecoins such as USDe and USDf have shown sharp growth, expanding their supply by over $141 million and $38 million respectively in recent reporting periods.

This is a developing story.

This article was generated with the assistance of AI and reviewed by editor Jeffrey Albus before publication.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.