When the easy trades disappear

As flows consolidate and volatility fades, finding edge now means knowing which games are still worth playing

Picture-Xpress/TJmedia/Shutterstock Adobe modified y Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Markets are recalibrating after the Fed’s second rate cut of the year, with Powell’s comments sparking a sharp shift in expectations. Flows are once again driving returns, as Solana’s new staking ETFs steal the spotlight and put TradFi’s appetite for yield on display. We also explore what it means to stay competitive when the edge in crypto keeps shrinking, and why understanding where to play may matter more than what to trade.

Indices

The Fed delivered its second rate cut of the year yesterday, but it was Jerome Powell’s remarks that rattled markets. He noted that the Fed has not yet made a decision about December and that officials hold strongly differing views on the pace of future cuts. Following his comments, the odds of a December cut dropped from 90% to 66%, sparking a risk-off reaction.

BTC fell -2.5% and Gold slipped -0.6%, while equities held up relatively well. The S&P 500 dipped -0.02%, and the Nasdaq gained 0.27%, helped by Nvidia, which became the first $5 trillion company amid continued strength in the AI trade and reports that OpenAI is targeting a $1 trillion IPO.

Looking at crypto-specific sectors, the AI sector mirrored its equity counterparts, rising 1.67% on the day. The other standout was RWA, which gained nearly 1%. The AI index was once again supported by TAO, up 1.8%, while LINK gave a boost to the RWA sector, climbing 1.3%.

Surprisingly, BTC was the weakest performer overall, weighed down by sharp ETF outflows of -$470.7 million and continued profit-taking from early whales. These factors are adding short-term pressure in what remains an already fragile market environment.

Market Update

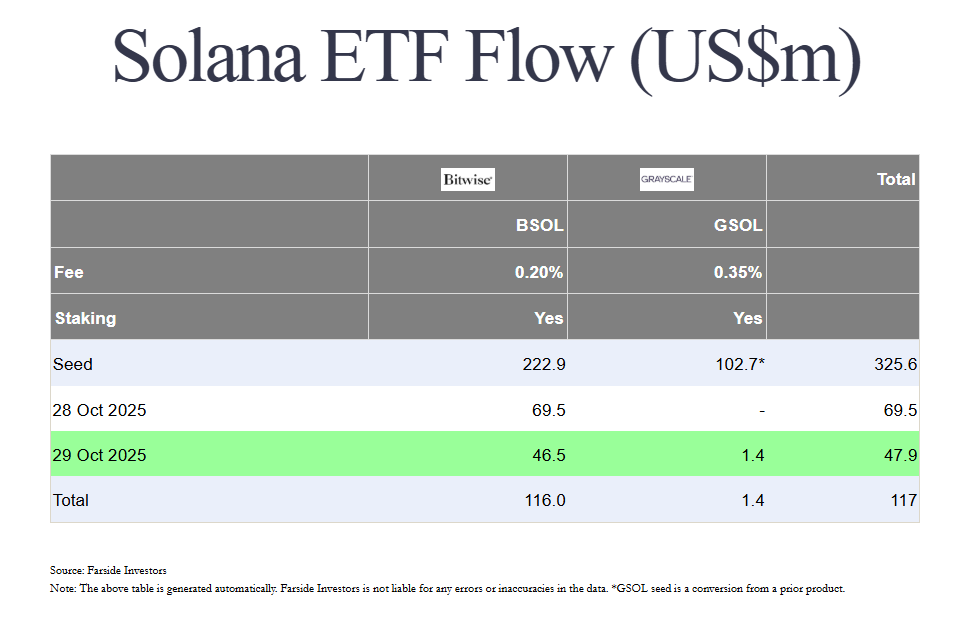

Returns follow where flows go, and this week all eyes are on Solana. The launch of the Bitwise BSOL ETF has given SOL a major tailwind, pulling in $116 million in inflows within just two days and generating $128 million in trading volume. That makes it one of the strongest ETF debuts of the year. Grayscale’s SOL ETF also entered the market, though with a quieter start at $1.4 million in first-day inflows.

What makes these SOL ETFs stand out is that both include staking rewards, something Ethereum has yet to achieve despite anticipation around its own staked ETF. That could soon change as BlackRock’s ETH staking ETF deadline arrives today. Bitwise partnered with Helius, while Grayscale chose Figment to manage SOL staking. The contrast is clear when compared with the REX/Osprey SOL ETF, which saw just $4.4 million in inflows last week.

Crypto ETFs are fast becoming profit engines for their issuers, and the new staked SOL ETFs are no different. Take BSOL for instance: On top of a 0.20% management fee, Bitwise keeps 6% of staking rewards. Assuming a $500 million AUM and a 7% yield, that translates to roughly $2.4 million in annual revenue, pushing the effective fee close to 0.48%.

Now, the race is on. Canary Capital, Franklin Templeton, VanEck, 21Shares and Fidelity have all filed for their own staked SOL ETFs. If inflows and volumes hold up, it’s only a matter of time before BlackRock joins the chase. Whether TradFi has truly bought into the “Solana as a payments chain” story remains to be seen, but with enough momentum, November could be the start of a flow-driven SOL season.

Finding edge

Equities keep ripping higher. Giants like Nvidia are up around 60% YTD, the S&P 500 has gained 16%, and even gold is up 52.5% — on track for its best year since 1979, when US inflation was stuck in double-digits.

Meanwhile, of the 17 crypto indices we track, only four are positive YTD, and two of those are equity-related (miners and crypto equities).

This has gotten me, and many other traders, asking why are we still trading coins that:

- underperform most equities both in absolute and risk-adjusted terms,

- lack transparency, and

- offer little to no investor protection (see the case of Padre).

The truth might be uncomfortable. Being a good trader is not only about picking the right tokens or having the right thesis, but also about choosing the right market to compete in.

This reminds me of an article by Robot James that influenced a lot of trading philosophy: “Stop Trying to Beat Djokovic at Tennis.” The idea behind this centers on markets being an extremely competitive zero-sum game. A retail trader competing is similar to stepping into the ring with Mohammed Ali:

“You don’t want to be trying to outsmart and out-gun other traders in a highly competitive zero-sum game.

You can’t win like that. So don’t just consume a bunch of economic data and expect you’ll figure out macro scenarios better than the market. That ain’t gonna happen. You’re trying to beat Djokovic at macro tennis.”

Rather than trading the S&P 500 against Jane Street and HRT, you want to find an uncompetitive arena. From 2020 to 2022, crypto was exactly that: a massive, unstructured, retail-dominated market that allowed you to compete directly against other individuals in a grand PVP battle. It was probably the most +EV market for anyone to trade in. However, as YTD altcoin performance shows, the landscape has shifted. The arena has become much more competitive, with retail now picked off by extractionary fee structures, deep information asymmetries and constant sell pressure.

That does not mean there are no opportunities left. It means that finding true edge in altcoin picking has become increasingly difficult. More than ever, traders need to be intentional about where they compete, understand the structure of the market they are operating in and consider its advantages and drawbacks. I believe that consistently identifying outperforming altcoins is one of the hardest games to play. It requires

- catching short-lived narratives that often fade within weeks,

- forecasting sector rotations and flow dynamics, and

- extracting alpha from fundamentals, all while operating in markets where most tokens primarily exist to fund project expenses and team allocations.

From that perspective, equities may actually offer a less competitive and more favorable environment.

The one major advantage crypto still has is its community distribution structure and incentives. While traditional finance has mature shareholder rights, crypto has a cultural and often implicit obligation to distribute tokens to early participants. For example, Plasma deposits at a $500 million FDV were up 32x, MegaETH’s raising at $1 billion while being valued around $5 billion pre-market, and Monad is currently distributing to its community. These types of markets are uncompetitive by design, as their incentive mechanisms reward early participation. There have been many similar examples, from Lighter to Plasma to Kinetiq, where being early was the right move, and the downside was limited to opportunity cost.

Looking ahead, one potential opportunity is Polymarket, which raised at a $10 billion valuation and has confirmed both a token and an airdrop. In 2024, Polymarket processed $8.6 billion in volume, and in 2025 YTD volumes have already reached $12.3 billion.

There is no known airdrop methodology, which is exactly where the edge lies. But if you assume that retroactive volume will be rewarded, you can make a strong argument for a highly lucrative airdrop, depending on the total distribution percentage and the final snapshot date.

The point here is not to say that the Polymarket airdrop will be the best one to farm. Rather, it is to highlight there are still many ways to gain exposure to new, promising projects while limiting directional risk. Instead of positioning in an altcoin with a 200% bull case and a -70% bear case, you can position for Polymarket upside through delta-neutral strategies where the potential reward is higher and the downside is limited to your time and effort. Whether that means farming HIP-3 markets, leveraged looping tokens like USDai, or participating in liquidity programs depends on how you want to express your view of the market. However, types of opportunities continue to offer asymmetrical returns, even as the broader altcoin market becomes increasingly competitive.

Updated November 3, 2025 at 12:15 am ET: Clarified Bitwise staking fees.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.