Pump acquires Padre trading terminal, promises token compensation

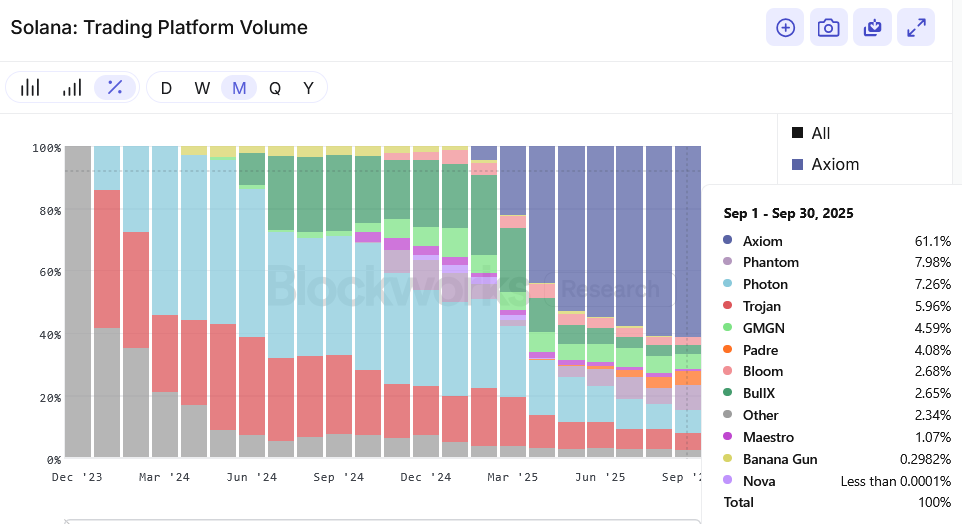

Padre has 4% market share of trading platforms on Solana.

claudenakagawa/Shutterstock and Adobe modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

One recurring theme in crypto is that token holders keep discovering that they don’t have the same protection rights as shareholders.

Legal protections make M&A a smooth process. For instance, if BigCo acquires LittleCo for $1 per share, the people who own LittleCo’s shares should get $1 per share. The acquirer is buying the company, and the shares are the company, so the shareholders get bought out. No investor is left behind. There are exceptions, but that is generally “supposed” to be the way it works under traditional financial laws.

Cryptoland, however, has its own rules.

Various efforts exist to mitigate this problem, like MetaDAO’s futarchy markets or the Blockworks Token Transparency reports. But the default for now is mostly to just vibe it out on Twitter.

Pump acquires Padre

Pump announced its acquisition of Padre last Friday. Padre is a trading terminal with about 4% market share on Solana (it’s also on BNB Chain, Base and Ethereum).

Padre also has a PADRE token of its own. Why does a trading terminal have a token? I don’t know. The token confers things like fee discounts and access to features, which is nice, but not the same as “owning Padre,” which is a different thing.

Unfortunately for the PADRE investors who raised ~$1.7 million on Fjord Foundry 19 months ago, that token will “no longer have utility on the platform with no further plans for the future,” as per Pump’s acquisition announcement.

Source: X

Source: X

PADRE token holders got upset and complaints of classic rugging ensued, with some alleging the team was banning Discord users for speaking the unspeakable thing about ownership rights.

You can see below that PADRE’s price tanked 80% moments after the acquisition was made public.

This wouldn’t happen in an alternate universe where crypto tokens are governed by the same laws as TradFi.

But in cryptoland, if the token you own is adjacent to the company that gets bought, and that token doesn’t give you cash consideration, then the rational thing to do for the PADRE holder, upon learning their adjacency, is to be extremely adjacent and sell.

In any case, the ruckus on Twitter seems to have prompted teams to take action.

Just this morning, Padre announced that PADRE token holders will be compensated with PUMP tokens, based on a snapshot from Friday, Oct. 24, 2025.

Nice! This is the part where crypto governance is sometimes benevolent.

Still, there’s a valuation problem. If Pump bought Padre for, say, $40 million, and PADRE’s value at the snapshot was ~$5 million, then compensating token holders at market is merely ~13% of what they would’ve gotten as per the deal’s implied equity value.

Shareholders would’ve gotten the $40 million pro rata, as StrategicHash points out.

Making PADRE holders “whole” at the pre-announcement price is better than nothing, I suppose, but it is also not the same as paying them as if they owned the company, because they do not.

You can think of Pump’s swap as a goodwill gesture, or even a (Padre) customer retention strategy, kind of like if United Airlines gives you 1,000 miles for canceling your flight. But it’s not a legal payout.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.