OpenSea Co-founder: ‘Gaming to be the Next Frontier for NFTs’

OpenSea co-founder Devin Finzer predicts that despite the surging popularity in art and collectibles on the marketplace, gaming could be the “next frontier” for non-fungible tokens.

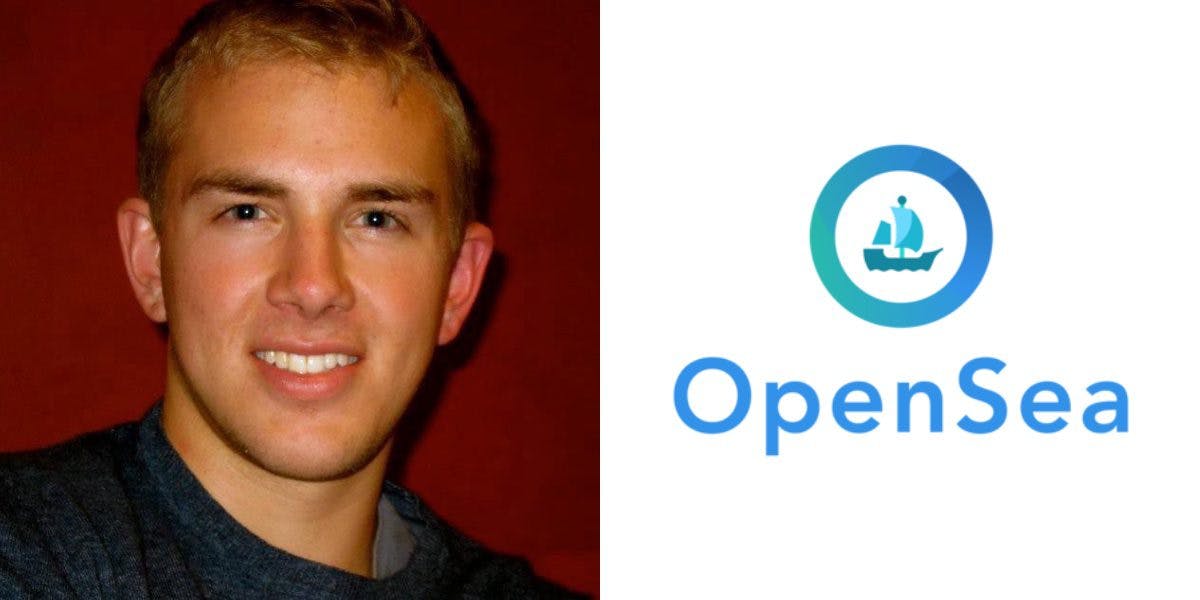

Devin Finzer, co-founder and CEO, OpenSea

- Finzer cited Axie Infinity as one of the booming use cases for gaming in the industry, which has recorded over $1.6 billion in total sales as of late-August

- “There’s so many people in my generation, and in Gen Z, where we love to play [games], but now we want to get rewarded for [it],” founder of Jenny DAO said

Mainnet 2021, New York City — When OpenSea launched in December 2017, its monthly trading volumes were less than $1 million. The marketplace has since become the largest in the world for the asset class, with volumes breaching $3.5 billion in the past 30 days. However, from the platform’s early days, co-founder Devin Finzer predicted that despite the popularity in art and collectibles on the marketplace, gaming would be the “next frontier” for non-fungible tokens (NFTs).

“I didn’t expect art and collectibles to have such [enormous] value over time. I really thought it would be primarily from legitimate games using NFTs,” he said during a fireside chat at Messari’s Mainnet conference on Monday.

Four years later and Finzer still stands by his initial prediction.

“I actually still believe this. A lot of games have been incredibly successful. I really do think gaming is the next frontier for NFTs.”

Finzer cited Axie Infinity as one of the booming use cases for gaming in the NFT space. The platform, which has recorded over $1.6 billion in total sales, is a blockchain-based video game that gives users the ability to trade and raise creatures using NFTs. (Think of it like a Pokémon-style investment opportunity.)

“I think [NFTs] are this really exciting cultural phenomenon where people want to hold a piece of internet history,” he said.

Other panelists at the two-day event were bullish on gaming as well, including founder of Jenny DAO, Jae Chung.

“I think it opens up so many doors. There’s so many people in my generation, and in Gen Z, who love to play [games], but now we want to get rewarded for [it].” Chung added. “I just don’t see that going away.”

Currently the top three NFT projects by market capitalization: CryptoPunks, Bored Ape Yacht Club and Art Blocks have a total cap of $5.7 billion, according to AssetDash.

“NFTs will become a trillion dollar asset class by the end of the year” once they are heavily “integrated into yield-carrying assets,” Chung said.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.