Stocks Open Sharply Lower As Investors Assess Economic Growth: Markets Wrap

Investor angst and concern over tapering may have contributed to the downturn in indices, leaving traders weary of riskier assets.

Source: Shutterstock

- Circle announced plans to go public, merging with SPAC Concord Acquisition in a $4.5 billion deal

- Wells Fargo told customers that the bank would no longer offer personal lines of credit, CNBC reported

Stocks toppled then pared losses amid rising delta variant cases, signals of choppy labor market recovery, and as a bank nixes one of its consumer lending products.

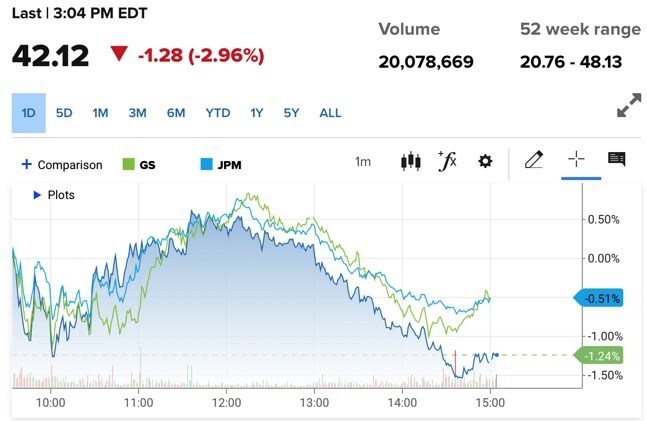

Banks declined after receiving a clean bill of health from the Federal Reserve’s stress test last month. Wells Fargo told customers that it would no longer offer personal lines of credit. It will shut down the consumer lending product in the coming weeks, CNBC reported on Thursday. Falling on the news, Wells Fargo fell -3.8% with an intraday low of $42.07. Goldman Sachs and JPMorgan Chase followed suit, shedding -2.3% and -1.73%, respectively.

Investors assessed recovery in the labor market. There was a slight uptick in initial jobless claims data, rising from 350,000 to 373,000 this week. Meanwhile, investor angst and concern over Fed tapering may have also contributed to the downturn in indices, leaving traders wary of riskier assets. All major Wall Street gauges closed lower than they opened.

Equities

- The Dow fell to 34,421, shedding -0.75%

- S&P 500 tumbled -0.86% to 4,320

- Nasdaq was down -0.72% to 14,559

Insight

“There is a bit of a recognition that things aren’t looking as economically positive as they were in mid-June when everything seemed to be hitting that Goldilocks middle ground,” said Edward Park, chief investment officer at Brooks Macdonald in an interview with the Wall Street Journal. “

Bank stocks like Wells Fargo, JPMorgan, and Goldman Sachs all drop intraday. Chart: CNBC

Bank stocks like Wells Fargo, JPMorgan, and Goldman Sachs all drop intraday. Chart: CNBC Bonds slid too. The US 10-year treasury yield fell to 1.25% intraday, benchmarking its lowest point since February. Tapering talks and looming inflationary pressures could be causing capital to reallocate toward less inflation-sensitive sectors of the market and away from fixed incomes.

Fixed Income

- The US 10-year yields 1.293% as of 4:00 pm ET

Insight

“This decline in bond yields could be signaling that the inflation burst is transitory, and/or that the Delta variant will slow growth, although at 1.25% this morning that seems extreme,” Chairman of Evercore ISI Ed Hyman said to CNBC in a note.

Crypto

- Bitcoin is trading around $32,903.10, down -4.06% in 24 hours at 4:00 pm ET

- Ether is trading around $2,149.92, shedding -9.07% in 24 hours at 4:00 pm ET

- ETH:BTC is at 0.0653, down -4.48% at 4:00 pm ET

- VIX shot up 17.28% to 19.03 at 4:00 pm ET

Commodities

- Brent crude is up to $74.29 a barrel, advancing 1.17%

- Gold is up 0.02% to $1,802.30

Currencies

- The US dollar fell -0.29%, according to the Bloomberg Dollar Spot Index

In other news…

Circle announced plans to go public, merging with SPAC Concord Acquisition in a $4.5 billion deal, the crypto company announced Thursday. Circle raised $440 million just last month in a funding round, Coindesk reported.

We’re watching out for …

- Twenty central bankers and finance ministers will meet on Friday

- China PPI data will be published on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.