As Crypto Markets Tank, Metaverse Tokens Buck the Trend

Kraken research indicates metaverse and exchange tokens were only sectors that saw year-over-year growth

Source: Shutterstock

- Crypto metaverses empower individuals through decentralization, according to Kraken

- Metaverse token performance is up a collective 395%

The digital currencies that power the metaverse are up a collective 395% in the past year, an outlier in a broader dismal crypto downturn, according to a new report.

Popular metaverse projects The Sandbox, Decentraland, Sommium Space and Voxels are among the leaders in user activity, according to the report by Kraken Intelligence and CoinGecko.

Decentraland’s MANA is up 41%; The Sandbox’s SAND 470%; Axie Infinity’s Axie Infinity Shards (AXS) 511%; and Stepn’s GMT 746%.

Though May brought negative price moves across the crypto board, including for bitcoin (BTC) and ether (ETH), metaverse tokens registered the highest level of volatility out of all sectors.

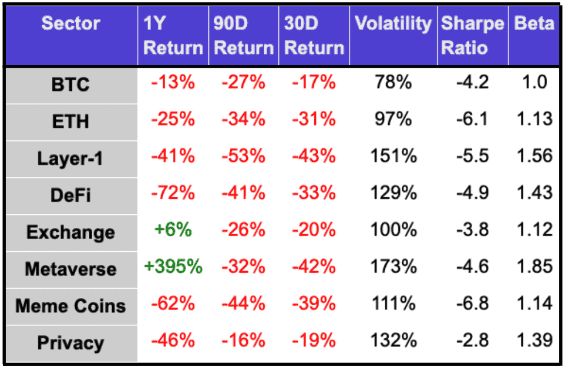

Sector Breakdown; Source: Kraken

Sector Breakdown; Source: KrakenAnd NFTs, which play a significant role in blockchain-based gaming and the metaverse writ large, also saw flat daily usage amid a large decline in May — with daily volume dropping 87.1%, according to the report.

The year-over-year performance of metaverse tokens, which can be used to buy digital land, NFTs (non-fungible tokens) and participate in governance, is largely attributed to the NFT resurgence.

The Sandbox’s digital economy reported cumulative NFT sales volume at $473,665,766 and three million registered wallet users.

Sebastien Borget, chief operating officer of the Animoca-owned platform, told Blockworks the metaverse is “an unstoppable digital nation in the making that already brings entertainment, fashion, gaming music and art all together, offering long-term perspectives through clear utility for NFTs.”

He added the reason the metaverse and tokens such as SAND has outperformed crypto more broadly over the past year is due to continued demand for land from global brands from Hong Kong, Dubai and Korea that are acquiring NFT avatars and engaging in play-and-earn events.

Ethereum-based metaverse Decentraland, registered the second-largest cumulative NFT sales volume at $216,471,162, through the first quarter, behind The Sandbox.

Giovanna Graziosi Casimiro, events producer at the Decentraland Foundation and head of Metaverse Fashion Week, told Blockworks that amped up trading of virtual land plots is driving growth in Decentraland.

“Wearables represent a medium of self-expression and identification, propelling a unique creator’s economy and ecosystem,” Casimiro said.

Referring to Metaverse Fashion Week, which Decentraland hosted in March, she said it “inspired the entrance of legacy, world-renowned fashion brands into our marketplace and expanded the discussion on NFTs as bridges between the physical and digital.”

Another NFT-based and gamified metaverse, Treeverse, is challenging the terminology behind crypto-native worlds in a bid to attract more mainstream gamers. A developer for parent company Endless Cloud tweeted on Thursday it plans to stop using the term NFTs.

Kraken is planning to launch its crypto exchange in the United Arab Emirates capital Abu Dhabi, as well as its own NFT marketplace.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.